WASHINGTON — Compensation plans are getting a makeover thanks to the swelling ranks of millennial financial advisors.

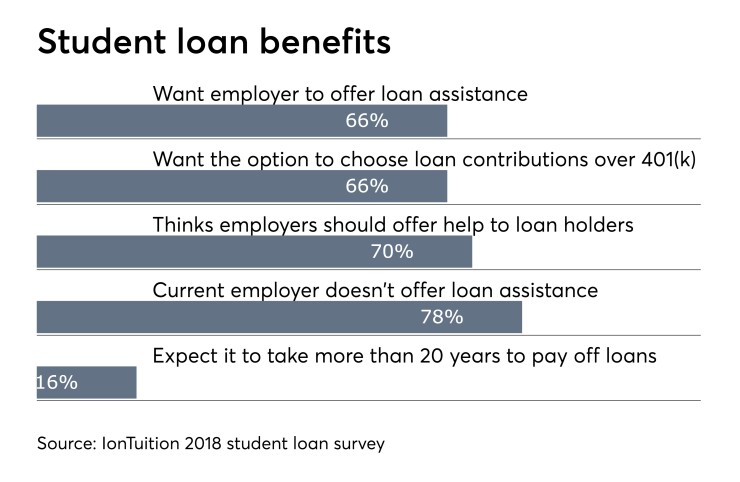

Firms wanting to attract and retain top talent are looking beyond cash rewards to benefits such as work-life balance and student debt repayment programs, said Kelli Cruz, founder of Cruz Consulting Group and a Financial Planning columnist.

“We all love complaining about millennials, but understanding the mindset becomes really important for compensation plans,” Cruz said at the Schwab Impact 2018 conference.

In addition to money, employees are looking for health insurance, a work-life balance, opportunities to advance and a sense of purpose, according to a Glassdoor survey. The latter has become a growing trend among young advisors, Cruz said.

“They’re really working for a purpose and our industry is a really wonderful match for them,” Cruz said, citing opportunities to receive certification and personal development. “It’s a very different situation. It’s not about having a boss, it’s about having a mentor.”

Millennials are also seeking real-time feedback. “You need to find people that can act in this capacity,” Cruz said, adding that mentor roles should be compensated accordingly.

Of course, it’s not just millennials looking for these kinds of benefits.

-

TD Ameritrade boosts next generation participation with $135,000 in scholarships and grants.

July 21 -

Hiring young planners is one thing but keeping them happy is another.

June 9

A handful of firms, such as

However, competition for top talent remains stiff especially in tight markets as more firms strive to expand. For instance,