The waves of wealth management industry approval for the SEC’s Regulation Best Interest are receding back to a low tide of frustration over other enforcement matters.

Despite criticism of Reg BI and the regulator's enforcement approach,

The SEC

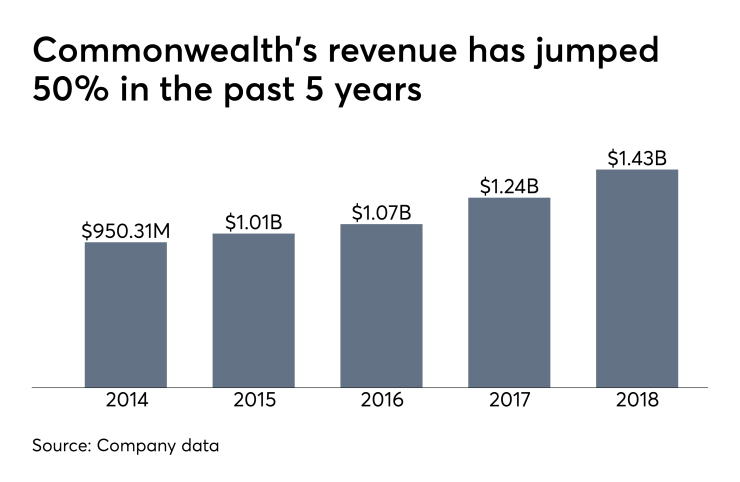

Commonwealth

The regulator may be trying to send a message, but Commonwealth’s lack of disclosure of its revenue sharing was “very, very bold,” according to Nicole Boyson, a Northeastern University professor and SEC critic who is

Boyson cites sections of the complaint stating that Fidelity Clearing & Custody Solutions’ National Financial Services informed Commonwealth of the conflicts in higher-priced share classes and the requirement to disclose them. Critics say that disclosure alone shouldn’t suffice.

“If a cheaper share class of the same fund is available, my interpretation of the fiduciary standard is that the RIA should be required to put the client in that share class,” Boyson said in an email. “It appears to me that RIAs no longer need to seek to avoid conflicts as long as they disclose them. This strikes me as a significant weakening of the fiduciary standard.”

-

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

The custodial bank says it has reimbursed the affected clients with interest.

July 3 -

Though the fees are controversial, there may not be an easy way for the industry to abandon them.

June 19

Two perennial champions retained their top ranks in 2019 — but the aging demographic poses challenges for all firms, according to J.D. Power.

Representatives for the SEC declined to comment on the case beyond the two-count

The firm received $100 million that NFS collected from fund companies then shared with Commonwealth over 4 and ½ years and failed to adequately disclose the conflict, the SEC says. One share-class example included in the complaint paid the firm 30 extra basis points out of clients’ investments.

Commonwealth spokeswoman Jacquelyn Marchand declined additional comment beyond the firm’s

Although the SEC complaint revealed key details of Commonwealth’s revenue-sharing arrangement with NFS, the regulator listed the clearing firm as a relevant entity rather than as a defendant. Representatives for the Fidelity affiliate didn’t respond to requests for comment.

Each of the firms have executives serving on the board of the IBD advocacy group FSI, which

Retrospective investigations by an administration that pledged to ease regulations irk the industry, despite critics’ dismissal of the SEC’s approach. Paul Atkins, an ex-commissioner who

“The SEC never cited a rule or regulation that had been violated,” Atkins

Firms participating in the RIA program

The revenue sharing with NFS dates to 2007, and the SEC has been focusing on disclosure of conflicts for the past few years, notes Jacob Frenkel, a Dickinson Wright attorney and former SEC enforcement official. Still, cases like Commonwealth’s usually end in settlements, he says.

Commonwealth is “prepared to litigate its position that its disclosures were appropriate, adequate and sufficiently transparent,” Frenkel says. “The industry will monitor the progress of this case very closely and will be cheering quietly for Commonwealth to prevail.”

The case raises the potential that “lots of these arrangements” will be investigated, according to Boyson. Commonwealth bulked up disclosure for its no-transaction-fee platform by last year but hadn’t reported any revenue-sharing in funds with transaction fees, the complaint states.

“My general thought about this case is that Commonwealth intentionally under-disclosed certain conflicts that were problematic,” Boyson says, noting the higher fees on clients. “This is the exact problem that the share-class disclosure initiative was trying to address.”

Frenkel views the case as a factual dispute on whether the Form ADV disclosures were adequate rather than a possible example of regulation by enforcement, he says. The case could have a wide impact across the industry, though.

“Here the commission is saying that it will follow up and it is prepared to allege fraud — not just books and records violations — if funds and advisors do not heed the commission's outcry for full and fair disclosure and proper discharge of fiduciary duties,” Frenkel says.