Commonwealth Financial Network CEO Wayne Bloom believes financial advisor feedback is the firm’s “secret sauce.” He recalls a rival executive marveling at the notion when Bloom explained it to him at an FSI conference.

“He looked at me and said, ‘Wow, how does your team get any work done?’ Inside, I just smiled to myself,” Bloom said. “What he viewed as a disruption in our daily work and a hindrance, I look at it differently.”

He cites the firm’s handling of some 5,000 advisor comments per year — with 93% of them answered within a day — as a key factor in its sixth-straight year ranking

While Commonwealth took home the top score of 960 out of the market research firm’s 1,000-point scale, another firm also maintained a notable streak. Edward Jones received its 10th straight No. 1 score among employee BDs, at 926.

“Both these firms are top-ranked in every factor, and nearly every KPI,” Mike Foy, J.D. Power's senior director of wealth and lending intelligence, said in an email. “What they have in common is a very strong culture that is both advisor- and client-centric. Advisors describe the cultures as supportive partnership, even familial.”

Cambridge Investment Research and the employee and IBD channels of Raymond James rounded out the top 5. The survey focused on seven factors: client help, compensation, leadership, operations, problem resolution, professional development and technology support.

Edward Jones spans the largest number of affiliated representatives in the industry, with more than 17,500 advisors and

“We are privileged to serve clients in partnership with an exceptionally talented and caring team that strives to make a real, meaningful difference in people's lives,” Managing Partner Penny Pennington said in a statement. The award shows how the firm is “a place where talented financial advisors are proud to do the important work of serving our clients,” she added.

-

The husband-wife team left LPL after 11 years with an eye toward its rival’s tech and service offerings.

February 27 -

The new standalone firm’s first licensing agreement would bring MassMutual’s 9,000 reps on to the platform developed by the No. 4 IBD.

February 20 -

The five new advisors kicked off recruiting in 2019 for the No. 4 IBD after it set a record in the previous year.

January 16

Two perennial champions retained their top ranks in 2019 — but the aging demographic poses challenges for all firms, according to J.D. Power.

Commonwealth differs from Edward Jones in that it only recruits experienced advisors rather than deploying classes of trainees. The Boston-area firm is ramping up support for existing affiliated advisors who are interested in tapping successors, though, Bloom says.

In another contrast with most wealth management firms, Commonwealth has abstained from any acquisitions since 1992. M&A transactions have set record volumes in each of the past six years — and they’re on pace to climb to

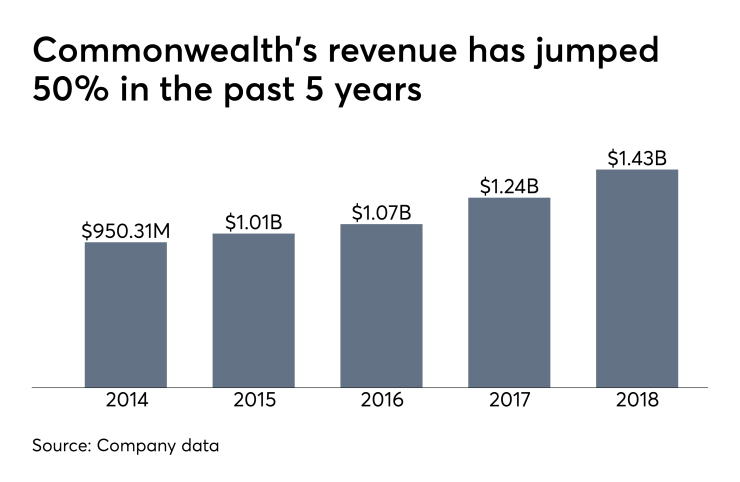

Bloom reads offering books frequently. While he calls them nice for learning purposes, he says the firm is usually only interested in about 10% to 15% of the selling firm’s advisors. Despite having the fourth-highest revenue among IBDs, the firm has only about 1,900 producing reps.

Commonwealth directly recruited 53 advisors producing $25.7 million in gross dealer concessions in the first half of the year, according to the firm. A standalone firm launched by Commonwealth’s partners will also provide

The firm opted to generate more revenue for further tech investments by offering its desktop on an outsourced basis rather than acquiring another firm, Bloom notes. While he declines to be specific, he says Commonwealth is having discussions with other BDs and RIAs about the tech platform.

The 128 staff members on Commonwealth’s help desk remain with the firm, exclusive to its affiliated advisors. Some 100 staff members — including top executives — receive daily summaries of the messages sent by advisors via a feedback link on top of every page of the firm's intranet platform, according to Bloom.

“It really comes down to engagement,” he says. “We have this ongoing and open dialogue with advisors that not only makes them feel empowered; they are empowered, and completely engaged in how we move the firm forward.”

Daily briefings include a listing of what the message was about, to whom it was routed and how they responded. Any message that has gone 24 hours without getting an answer shows up in red, Bloom says.

“There's also this very subtle peer pressure that's all part of it,” Bloom says. “You don’t want to be one of the people who should have claimed something and it's stuck in red.”