It has only taken about a year and a half since a Canadian asset manager entered the U.S. wealth management industry to transform its business.

For the first time ever, CI Financial posted more assets in its wealth management arm than in its traditional fund business at the end of the second quarter, the Toronto-based firm’s CEO, Kurt MacAlpine, said in a call with analysts after the firm

In large part, that was due to the firm’s

Note: The company discloses its quarterly returns in Canadian dollars. Unless otherwise mentioned, all figures are in Canadian rather than U.S. dollars and relate to its U.S. wealth management business.

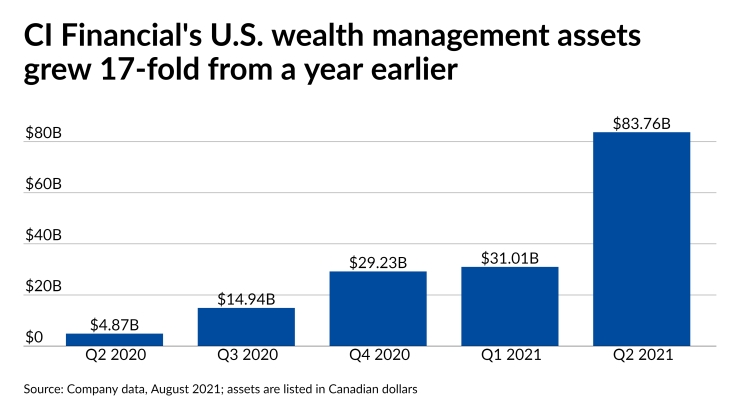

- Client assets: CI’s U.S. wealth management assets grew by a factor of more than 17 year-over-year in the second quarter to $83.76 billion — the eye-popping multiple a reflection of the size of RIAs it’s buying. The firm isn’t slowing down: besides a quarterly crop of $50 billion from its completed acquisitions, CI has two more agreements slated to push the overall number above $90 billion. “RIA owners are attracted to our deep expertise in asset and wealth management, our client-first approach, long-term commitment to the sector and our strategic vision to build the leading private wealth platform in the U.S.,” MacAlpine said,

according to a transcript by Seeking Alpha. “Additionally potential tax changes have further increased the number of quality entrepreneurs exploring strategic alternatives for their businesses.” - Deals: The deals completed in the second quarter more than doubled CI’s footprint in the U.S. in terms of client assets. Just before the firm unveiled its earnings, it announced an

agreement to buy Budros, Ruhlin & Roe, a Columbus, Ohio-based RIA with more than 800 clients and U.S. $3.4 billion in client assets. The deal for an undisclosed amount is expected to close in the fourth quarter. In a June move that will add additional capital for future acquisitions and go to repay outstanding debt, CIissued $900 million in notes. - CRM: Representatives for the firm declined to answer follow-up questions about what software vendor its wealth management arm has been using for its CRM ahead of the Salesforce transition, or the exact timing of the migration. The work on the CRM is “still very early days,” MacAlpine said on the call. In response to a question from an analyst, he described the work on the software as “integrating and unifying a CRM system” for the RIAs. Going to Salesforce, he said, “will allow us to do the digital marketing lead generation, that predictive analytics at scale across all of our different RIAs.” Besides those simultaneous changes, the firm is also examining how to deliver “an industry-leading client experience, not only in person but also digitally,” MacAlpine added.

- Outlook: The CEO told analysts he expected the volume of deals to fall off a bit in the third and fourth quarters because sellers often aim to ensure their deals close by the end of the calendar year. Instead, the pipeline is maintaining the same level of momentum, though there might be “a little bit of lumpiness” in the short term, MacAlpine predicted. “We're having a lot of incredibly high-quality conversations, obviously as evidenced by the transaction we just announced this morning, which is the leading RIA in the Columbus, Ohio market,” he said. “I would anticipate as people are trying to better understand and process whatever potential tax changes are coming, that may cause a little bit of a slowdown as people look for clarity. I don't think it changes the overall story, though. There is a flight to scale, people are looking at what used to constitute scale on the RIA marketplace is no longer the case and that number keeps going up. So firms are either looking to figure out how they best access that scale or looking, whether it's building it on their own and making those strategic investments, to partner and collaborate with a broader platform.”