Financial planners’ movement to independence is picking up steam, with new RIA registrations growing 75% over five years as increasingly large teams break away, according to the nation’s top custodian.

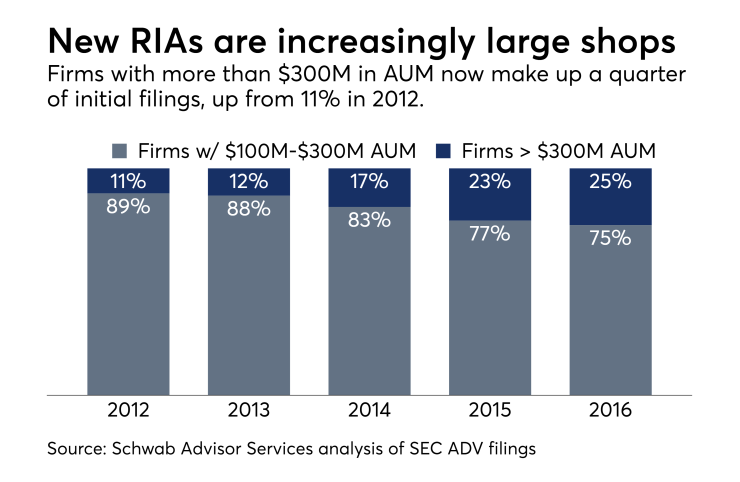

All told, at least 199 RIAs with an aggregate $55 billion in assets under management submitted initial Form ADV filings to the SEC last year, according to a study released this week by Charles Schwab Advisor Services. The share of new firms with $300 million or more in AUM has jumped by 14 percentage points since 2012 to 25%.

Consolidators and platform providers are

“Momentum begets momentum as advisors see others have success and enjoy new business in working with their clients in the independent channel,” Beatty says. “The ecosystem is rallying to this opportunity.”

-

The firms dominate the space, but they face headwinds in a changing industry, Cerulli says.

October 31 -

As RIAs and regulations reshape the industry, the concern is real, a new Cerulli report says.

October 10 -

The number of annual new SEC registrations has jumped by 150% since 2000.

August 29 -

Our exclusive interactive infographic reveals some interesting trends on the top 10 new firms and their locations.

August 22

Regional brokerages and firms that assist breakaway advisors have been picking off top talent at the wirehouses.

ROOM FOR MORE GROWTH?

The number of new breakaway advisors placing their assets with Schwab has risen by nearly a third this year. More than 170 advisors have affiliated with Schwab this year after leaving wirehouses, IBDs, regional firms or other companies, compared to 128 after the third quarter of 2016.

The average AUM of the breakaways has also surged 59% to $151 million year-over-year, according to Schwab Advisor Services. New RIAs with over $300 million in AUM brought a total of $35 billion in managed assets to the independent channel in 2016, an increase of 15% from the previous year.

Advisors from IBDs remain the biggest source of breakaways to Schwab, followed by wirehouses, regional brokerages, banks, institutional BDs, trusts and insurance companies. Schwab Advisor Services didn’t include advisors from IBDs’ hybrid RIA platforms in its study.

The recent acquisition of the assets of major IBD network National Planning Holdings by LPL Financial, the largest IBD, has touched off

Beatty declines to discuss any possible moves to launch indie RIAs by advisors from National Planning Holdings’ four BDs. However, he says he doesn’t expect changes in the Broker Protocol to stem the movement of advisors toward RIAs.

“We have a deep understanding of what’s appropriate in transitions,” Beatty says. “Where there’s opportunity, where there’s a will, there will be a way.”