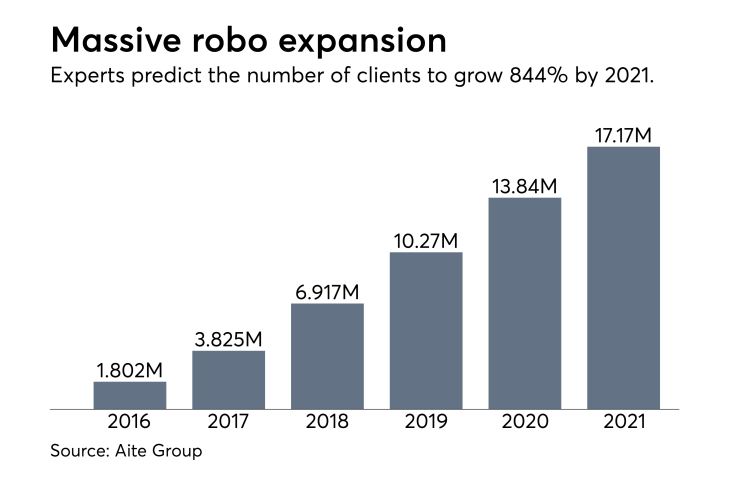

Vanguard, Charles Schwab and Fidelity will press their advantages in digital advice, but Acorns is driving the sector’s massive expansion, a new study says.

So-called incumbent firms’ share of the robo advice market will jump to 93% by 2021 from 78% last year, according to

More than half of that growth will come from Acorns. The firm

The more traditional firms like Vanguard, Schwab and Fidelity, however, boast their own ETFs and other funds to create robo-portfolios, Aite Group points out. Vanguard’s hybrid platform, Personal Advisor Services, already

“Digital advisor firms have a compelling case to start lessening reliance on Vanguard ETFs and stop subsidizing a competitor’s bottom line, but the alternatives are few,” according to the report’s author, Aite Group senior wealth management analyst Javier Paz. The study includes a warning for startups.

“For robo-startups, it is do-or-die time now that incumbents are in the race. Incumbents face a decision to grow their robo-business complacently or to do so with a greater sense of urgency, and we suspect most will pick the latter approach.”

-

Personal Advisor Services closes in on the $100 billion AUM mark.

August 9 -

The IBD spent $77 million on technology upgrades in 2016.

August 2 -

The microinvesting site, which now has over 2 million accounts, allied itself with Clarity Money.

July 28

"The numbers are all in a positive direction" as advisers shrug off threats to growth.

TRADITIONAL FIRMS INVADE STARTUP SPACE

Therefore, the study concludes, selling the business to serve as the digital advice arm of one of the industry giants represents a “very sensible approach” for startups. Their share of digital client assets will shrink to 7% in 2021 from 22% last year, if Paz’s predictions hold true.

Brokerages and other incumbents boast established brands and client bases, along with capacity to absorb lower returns stemming from robo fees. With Acorns’ average account balance amounting to $177 and smaller client assets at all startups, such factors boost incumbents’ prospects, the study says.

Paz projects Vanguard PAS to surge over 500,000 clients and $100 billion in assets under management this year. By the end of next year, the digital platforms of Vanguard, Schwab, Fidelity and Merrill Lynch will manage more than $400 billion, according to Aite Group’s forecast.

ETF SHAKEUP COMING SOON?

Vanguard and Schwab, along with Personal Capital, Scalable and FutureAdvisor investor BlackRock, receive inflows into their mutual funds and ETFs through their digital platforms. Vanguard and BlackRock’s iShares also get fund flows from 16 of 18 digital firms surveyed by Aite Group.

Around a third of the firms also include Schwab ETFs in their portfolio mix. Competitors may soon find ways to cut into Vanguard’s share of the market, but they face a difficult fight, Paz writes.

“The giant vacuum-like sound coming from Vanguard funds as they draw increasing client assets demonstrates this brand’s strong pull and makes it very difficult for advisory firms to break away completely from Vanguard dependency,” according to the report.