The largest independent broker-dealer network, Cetera Financial Group, will organize its six firms into two separate channels after exits by three executives and a slew of appointments.

The new structure marks the latest change at Cetera following its

Cetera Advisor Networks CEO Tom Taylor leads the new specialty channel, which also includes Cetera Financial Institutions and Cetera Financial Specialists, while Cetera Advisors CEO Brett Harrison manages the traditional channel, which also has First Allied Securities and Summit Brokerage Services.

Large groups such as

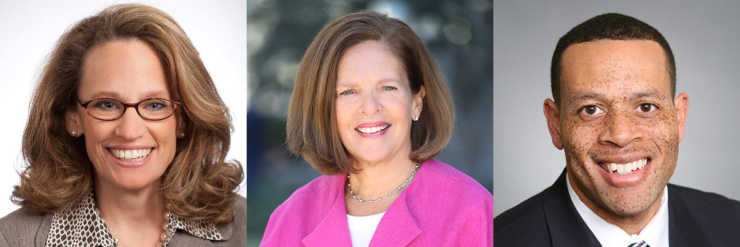

First Allied President Kevin Keefe, Cetera Advisors President Erinn Ford and Cetera Financial Group COO David Ballard are leaving the firm. Cetera CEO Robert Moore confirmed their departures this week, thanking each of them in statements for their time with the firm.

To fill the roles, Cetera hired Mimi Bock, a former executive vice president for national sales and consulting with LPL Financial, as president of First Allied and Cetera Advisors. Cetera also promoted Catherine Bonneau, former CEO of Cetera Financial Institutions, to COO of the network.

Cetera has

“The launch of our traditional and specialty channels is a logical outgrowth of our recruiting and retention success last year, which was driven by enhanced advisor support from increased collaboration among our network firms,” Moore said in a statement this week announcing the moves.

The changes, he added, will help the network accommodate advisors under customized business and affiliation structures and “formalize an organizational approach we’ve already been evolving towards.”

Representatives for the El Segundo, California-based Cetera say the new organizational strategy and appointments are effective immediately, with the exception of Bock, who will move into her position over the next few weeks under guidance from Keefe and Ford.

-

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7 -

The firms had the same parent, but Girard Securities’ CEO says the move will help its 200 advisors.

August 16 -

Cetera, Advisor Group and Securities America are unveiling upgrades they hope will help advisors save time while growing their businesses.

February 12

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

Cetera also promoted Tim Stinson, the national sales manager for wealth management, to the newly created role of head of wealth management. Cetera Financial Institutions President LeAnn Rummel remains in her post, and Cetera Financial Specialists President Gregg Ruvoli is staying at the firm as well.

Summit Brokerage CEO Marshall Leeds is still atop Summit, too. The heads of Cetera’s IBDs report to Taylor and Harrison, respectively, under the new structure. The six firm’s brands and services will remain distinct even as the channels allows for increased collaboration, according to Cetera.

Cetera Financial Institutions largely consists of bank and credit union advisors, while Cetera Financial Specialists caters to tax-focused planners. The third member of the specialty channel and the No. 9 IBD, Cetera Advisor Networks,

The specialty channel will focus on the two niches, as well as large teams known as offices of supervisory jurisdiction at other firms but referred to by Cetera as regional director-led firms. The traditional side will handle smaller, ensemble practices.

Bock, the former LPL executive, will lead the two largest IBDs in the traditional channel. She spent five years at LPL managing advisor-facing services following nearly two decades with Morgan Stanley, according to FINRA BrokerCheck. Her new position places her atop the No. 21 and No. 28 IBDs.

“There has never been a more exciting time for independent advisors to help clients reach their life goals, and Cetera is clearly leading the charge as the new standard-setter for providing financial advice,” Bock said in a statement.

A spokesman for LPL declined to comment on her departure.

Cetera did not make Keefe, Ford or Ballard available for interviews, but Moore wished them success in the next stages of their careers. The affiliations listed on their BrokerCheck profiles had yet to change from their Cetera roles following the firm’s announcement.

The network, which has 7,772 producing advisors across its six IBDs, reported