Cetera Financial Group’s more than 7,700 advisors across six independent broker-dealers may soon face yet another big change: new ownership.

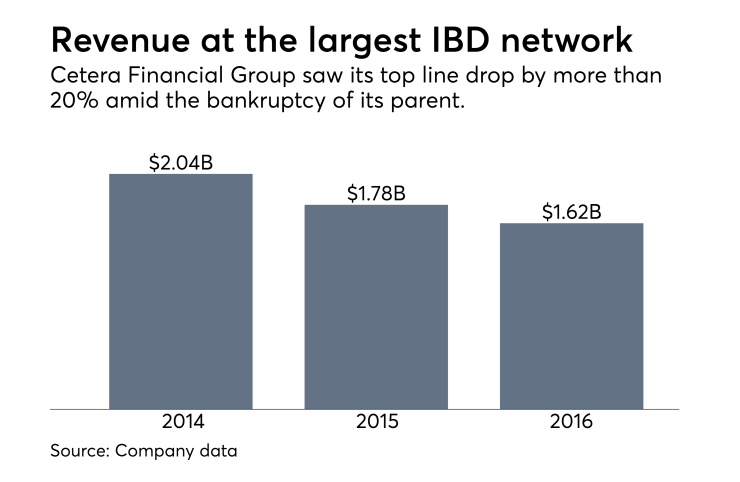

The IBD network is exploring a sale and the price tag could amount to $1.5 billion, or $350 million more than RCS Capital

Executives with Cetera and its current parent, Aretec, retained Goldman Sachs to help with what they called “a capital structure review process,” the firm announced this week. Representatives for the firm said it would be premature to speculate on the outcome of the review.

Private equity firms and other investors see opportunities in wealth management, Cetera CEO Robert Moore said during a panel in January. Fortress Investment Group, Eaton Vance Management and Carlyle Investment Management, three PE firms, currently have stakes in Cetera, along with other equityholders.

The possibility of a sale did not take industry experts by surprise as much as the quick timing after coming out of bankruptcy. Besides PE capital, the consensus prediction, other options include taking the firm public or selling to a bank, insurance firm or another wealth management company.

The search for a buyer is “overstressing for advisors” who could have to lead clients through repapering and the loss of some investment options under new ownership, says Alois Pirker, the research director for the wealth management practice at consulting firm Aite Group.

Still, he adds, “You have something of scale. You have something that probably still has inefficiencies that can be addressed. There’s possibly some upside there.”

-

An advisor who is a former ballplayer set ambitious goals for 2021 with an alternate take on the hybrid strategy.

February 22 -

Robert Moore divided the firm's six IBDs into two channels, promoted a new COO and hired from a rival.

February 13 -

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

Cetera earlier this month

The firm released a statement Monday confirming it is reviewing its structure, with Goldman to help identify the right strategies to continue its momentum.

"While the current debt structure was put in place in conjunction with our restructuring in 2016, we have materially outperformed the financial projections made at that time," a spokesman for the firm said in an email.

"Although our current loan terms are attractive, the leveraged finance markets continue to be constructive and at near-record lows in terms of pricing and spreads. Our strong financial performance (which has also led to a ratings upgrade at one of the credit rating agencies), puts us in a position to consider even lower cost financing options with longer terms and less restrictive covenants."

Cetera’s CEO had discussed the trend toward consolidation in the IBD space during a panel

“There is a lot of capital on the sidelines that wants in this space,” he said. “It's a high cash flow-generating, low capital-consuming structure for them, and PE firms have almost become more strategic investors than they were 10 years ago.”

He added, “Their investment horizons are longer, their ability to kind of invest in the business as opposed to just sort of, you know, strip it and sell it is much greater.”

IBD recruiter Jon Henschen says he disagrees with the view that PE firms are taking a longer-term approach. For example, he notes, Lightyear Capital

“They’re going to flip it, make their money and move on. And usually when they flip it, it goes from one private equity firm to another,” Henschen says. “The story they were telling me is that they were in there for the long haul and they wanted to bring it public.”

Representatives for Fortress, Eaton Vance and Carlyle didn’t respond to questions about the potential sale.

A spokeswoman for Lightyear,

Cetera has a complex ownership structure divided among PE firms, pension funds and other creditors after the bankruptcy, notes recruiter Louis Diamond. A new owner could result in retention packages and technology investments for advisors but also client consent forms and cost-cutting moves, he says.

“It was inevitable that there would be some sort of a change in ownership,” says Diamond, who adds that he expects a PE firm to be the buyer. “Any time there is change it’s an opportunity for an advisor, especially an independent one, to figure out if they’re in the best possible place for their clients.”

A risk of advisor attrition looms as a potential factor turning away some prospective buyers, Aite’s Pirker agrees. He sees another PE firm as more likely to buy into Cetera than the other potential suitors, he says.

“I would imagine that it’s something that keeps the advisors happy and makes sure that the ship remains steady until it runs into a new harbor,” Pirker says.