Cetera Financial Group will pay refunds of $3.2 million to retirement plan and charitable organization clients under the firm’s latest settlements with FINRA over sales fees on mutual funds.

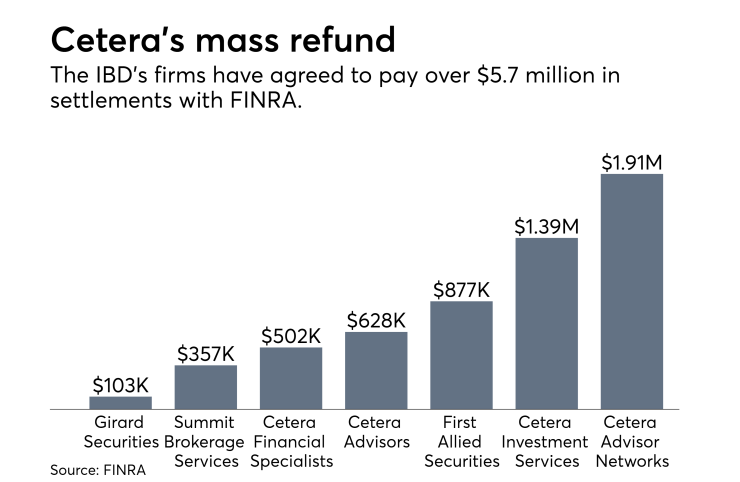

Five of Cetera’s member firms this week followed its two others in agreements with FINRA to provide restitution for accounts hit with charges the regulator says were avoidable through waivers. The seven settlements amount to more than $5.7 million in refunds across nearly 3,000 client accounts.

Wells Fargo, Raymond James and LPL Financial agreed to pay clients back

Securities America last year paid out $1.5 million in a waiver settlement, and National Planning Holdings firms

With sales waiver restitution nearing $80 million, regulators have made all aspects of

-

The firms had the same parent, but Girard Securities’ CEO says the move will help its 200 advisors.

August 16 -

Advisers face fewer choices for clients as both the rule and SEC enforcement roil the market.

June 20 -

Enforcement actions at the SEC and FINRA highlight emphasis regulators are placing on fees and reverse churning, anti-money laundering programs and variable annuities.

June 23

Regulators have revealed what kind of issues advisors must address if faced with a review.

LOWER CLASS SHARES

Cetera Advisors, Cetera Advisor Networks, Cetera Investment Services, Cetera Financial Specialists, First Allied Securities, Girard Securities and Summit Brokerage Serves saddled clients with unnecessary fees over the past eight years by not using the available waivers, according to FINRA. The regulator did not name the clients.

The overpayments assessed on retirement plans and charities included front-end sales charges on Class A shares and back-end sales charges, along with higher fees and expenses, on Class B and Class C shares, FINRA says.

Cetera “failed to adequately notify and train its financial advisors regarding the availability of mutual fund sales charge waivers,” according to the firms’ letters of acceptance, waiver and consent.

REFUNDS WITH INTEREST

Cetera Advisors and Cetera Advisor Networks had agreed to the terms in May, and the five other firms agreed to settlements this week. The firms pledged to provide refunds, including interest, to all affected clients and apply available retirement and charity waivers to all eligible accounts.

Cetera, whose firms represent

“We identified and reported this matter to FINRA, and voluntarily elected to refund sales charges to eligible clients prior to concluding the agreement with FINRA,” Kuo said.

“We are moving forward with the payments to clients, and are pleased to conclude a matter that has also affected many other FINRA member firms.”