The largest custodians for registered investment advisory firms have collected the vast majority of the industry's assets, but smaller firms have a shining opportunity to catch up, according to a new study.

One out of four RIAs is considering adding another third-party vendor to safeguard their clients' assets and clear their trades, research firm

The sheer size of assets under custody at RIAs show the stakes of the competition. As of the end of 2021, Charles Schwab's Schwab Advisor Services ($3.7 trillion), Fidelity Institutional ($1.5 trillion), BNY Mellon's Pershing ($350 billion) and LPL Financial ($214 billion) spanned a combined $5.8 trillion, or 84% of advisory assets, according to Cerulli.

Alternative custodians such as

"We are looking to, and are, acting as a core custodian for these small RIAs," Moore said, defining "small" as less than $250 million in assets under management. "We really feel strongly that we are doing something different in that marketplace that can really help drive those specific RIAs to be more successful."

The ranks of competitors to the largest custodians include big self-clearing firms like LPL, Raymond James, Ameriprise, RBC and the wirehouses, as well as

Some giants are taking diverging paths with their custody businesses. Charles Schwab

Advisors "are more likely to add a new custodian to fill any perceived gaps in service or capabilities" than they are to make the rare decision to navigate "the logistical challenges of switching custodians," Marina Shtyrkov, the associate director of Cerulli's wealth management division, said in a statement. The most burdensome task comes from the infamous "repapering" process requiring clients to give their consent for the shift and fill out paperwork authorizing it.

"The transition process for breakaways is already a period of disruption for their clients and repapering is unavoidable, rendering those common objections irrelevant," Shtyrkov said. "Emerging custodians interested in the breakaway opportunity should build out experienced sales and support teams that can expertly navigate these advisors through the transition to independence."

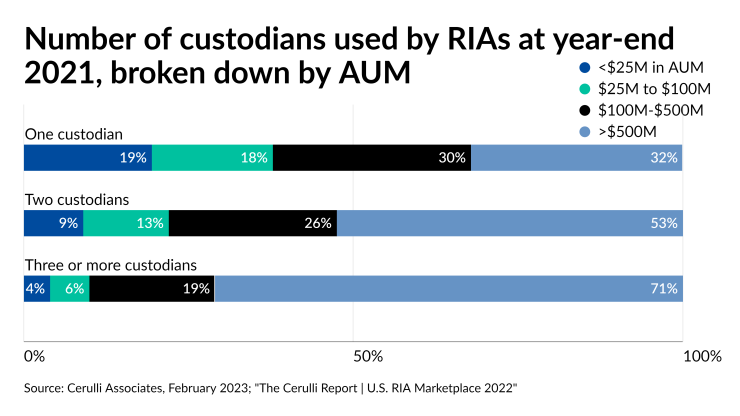

A substantial share of RIAs, or 44%, use just one custodian, but 71% of those with at least $500 million in AUM use three or more, according to the Cerulli report. At least 53% of that group have tapped two custodians' services. With Schwab's assets under custody comprising 54% of the industry's advisory holdings, the "inertia" of avoiding the cumbersome, bureaucratic process of switching often works in favor of the incumbents, according to the report.

"A few custodians dominate the RIA channels, an unavoidable side effect of the economics of RIA custody, a low-margin business that necessitates scale," according to the report. "Custody itself is commoditized, prompting custodians to compete on pricing, client service, and technology."

The latter two areas especially have emerged as key to Betterment's approach in working with RIAs, Moore said. Since launching nine years ago as an offshoot of the robo advisor as a way to enable RIAs to land more small clients that might otherwise go to self-directed accounts, Betterment has rolled out "scalable technology to make advisors more efficient" and built "really, really hands-on service" for teams that might otherwise be neglected by the giant firms with much older platforms, he said. Betterment doesn't break out the amount of assets under its custody. The total across its three units is a combined $32 billion.

"Over the last couple of years, we've really evolved from what I'd call a robo for advisors to a full-fledged custodial service for advisors," Moore said. "That's allowed us to increase adoption with the firms that we're working with and to start to take meaningful market share."