Cerity Partners is expanding its ultra-high-net-worth footprint to Texas and Colorado.

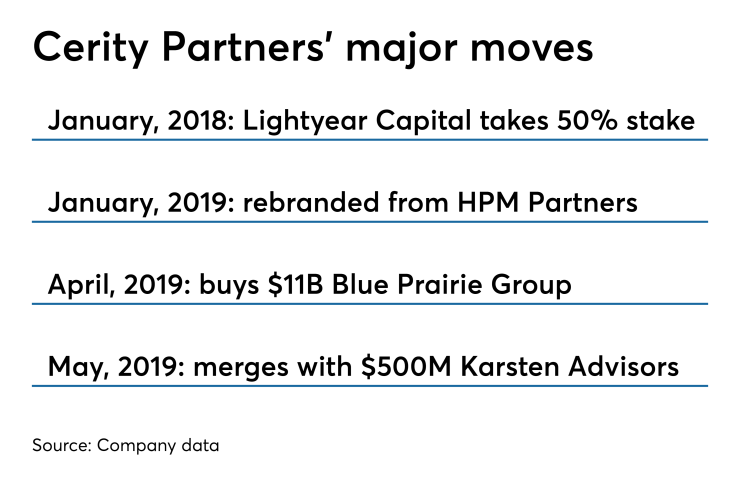

Formerly known as HPM Partners, Cerity will acquire Karsten Advisors, a Fort Worth-based wealth management firm with $500 million in client assets. This is the first acquisition for the firm since merging in April with the Blue Prairie Group, an $11 billion retirement and investment consulting firm.

The merger allows the national RIA, backed by a 50% equity stake from private equity firm Lightyear Capital, to expand into the Fort-Worth and Denver markets, as it continues to grow its network for ultra high-net-worth clients. Cerity had around $10 billion in AUM before merging with Blue Prarie.

“We see a lot of growth potential in these markets and look forward to deepening our presence in both Texas and Colorado,” says Kurt Minscinski, CEO of Cerity. “We intend to expand the services available to existing clients in these new offices and to provide our premier services to new clients in these regions.”

Karsten has eight wealth management advisors and six CPAs, says Tom Karsten, CIO of Karsten Advisors. He says the majority of the firm’s $500 million assets are advisory managed.

“Cerity Partners offers a broad range of access to alternative investment managers as well as a dedicated and talented investment analysis team to assist with portfolio development, both of which were important to us when evaluating potential partners,” says Karsten.

Cerity’s private partnership model, which has been in place since the firm was founded in 2009 as HPM, was also appealing, according to Karsten.

New York-based Cerity, which rebranded in January, has offices in Los Angeles, Cleveland, Chicago, Bloomfield Hills, MI and Orange County. They provide a range of services for ultra high-net-worth individuals, including tax and estate planning, insurance planning, legal services and wealth management.

The majority of Cerity clients have a net worth in excess of $10 million, Miscinski said in an

Negotiations between Cerity and Karsten started in February 2018, when Karsten retained the services of Silver Lane Advisors, who advised the company throughout the deal.

The firms declined to disclose the terms of the deal.