Merrill Lynch is facing a lawsuit that criticizes the firm’s disclosures of a practice common at many brokerages — cash sweeps.

Sarah Valelly claims that inadequate disclosure and an unsuitable recommendation at Merrill Edge cost her more than $20,000 in cash yields over a 20-month period, according to a complaint which was filed in a federal court in New York in late August.

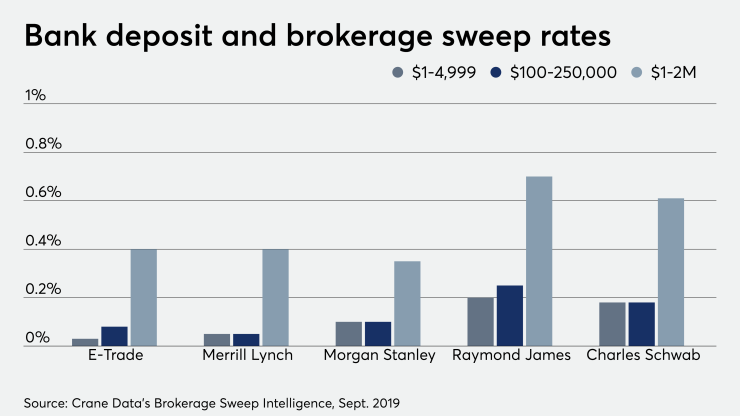

“[Merrill’s] sweep accounts pay investors a paltry 0.05% to 0.14% [APY] notwithstanding the absence of adequate disclosure, contract formation or customers’ prior written affirmative consent to be placed into a sweep account,” the complaint reads.

Among the claims in Valelly’s lawsuit: negligence, breach of suitability standards and breach of contract. She is seeking injunctive relief and damages.

“Merrill Lynch disputes the allegations in the complaint and intends to vigorously defend the case,” Merrill Lynch spokesman Bill Halldin said in a statement.

The firm will file a motion to dismiss the allegations by the end of the first week of November, according to a letter to the federal district judge that is dated September 20 and was filed in court by the wirehouse and retail brokerage’s attorneys.

Merrill Lynch is one of several firms, including LPL Financial, TD Ameritrade, Wells Fargo Advisors, Raymond James and E-Trade, at which cash in brokerage accounts is automatically swept into

Some low-yield accounts offer benefits including FDIC insurance or

Schwab CFO, Peter Crawford, recently

Valelly’s lawsuit alleges that the cash sweep disclosures she received as a client of Merrill Edge and Bank of America were inadequate and the recommendations she was given unsuitable.

“The specific disclosures on sweep accounts are buried deep within tens of pages of 8-point, two-column PDF ‘agreements,’” the complaint reads.

The disclosures themselves were also insufficient, according to Valelly’s attorney Robert Finkel.

“You couldn’t figure out what the actual interest rate was that you were getting on the account,” Finkel says, “and you weren’t given any comparison to other market interest rates, so you couldn’t make an informed decision.”

In addition, Valelly says the sweep program and its low yields were not mentioned in subsequent documentation sent to her via email and in hard copy after she opened her accounts.

In the lawsuit, Valelly compares Merrill’s cash program to those in place at other firms, noting that E-Trade provides detailed information about its three uninvested cash options available and provides a comparison tool, while Schwab’s “rates are both higher and easier to access than Merrill’s rates,” according to the complaint.

Fidelity and Vanguard have opted to default client cash into money market funds which had a 7-day yield of 1.81% and SEC yield of 2.13%, respectively, as of August 2019, according to the lawsuit.

Valelly had approximately $1 million held in cash across four accounts at Merrill and its parent company, Bank of America, according to the complaint. Three of the accounts were Merrill Edge investment accounts, receiving cash yields of 0.14% APY, while one was a Bank of America savings account she opened upon the recommendation of a Merrill representative in 2018, according to the complaint. The savings account generated an APY of 0.06%.

Valelly allegedly asked the Merrill rep, who is not named in the case, what to do with $675,621 in cash she had recently obtained after selling her parents’ home. She told the Merrill rep that “she had no immediate need for that money but wanted to preserve it in a safe investment,” as she might purchase an apartment in Boston. The rep, who operated out of a Merrill and Bank of America office in Boston, according to the complaint, allegedly recommended Valelly open a Bank of America savings account with an APY 0.06%.

From May 2018 to March 2019, Valelly says she earned $329 in interest. Had she deposited the money from the sale of her parents’ house in a Preferred Deposit account with a yield of 2.07% APY, she could have earned $11,654, according to the complaint.

This recommendation was “neither suitable nor in [her] best interest,” she asserts in the complaint. Valelly maintained those accounts until a Merrill assistant vice president in Philadelphia, who was not named in the case, wrote to Valelly in March 2019, questioning why the Boston rep had not recommended the account with the higher yield, according to the lawsuit.

Valelly says she could have earned an additional $22,400 had this money, as well as the money in her three brokerage accounts, been earning the higher interest she was eligible for, according to the complaint.

A pretrial hearing is scheduled for November 1.