Baby boomers in the job market grapple with a persistent worry: What if I have a financial emergency that compels an early withdrawal from my retirement account? The income tax hit alone is painful but, unless an exception applies, the additional 10% penalty for those (usually) under age 59 1/2 applies salt in the wound.

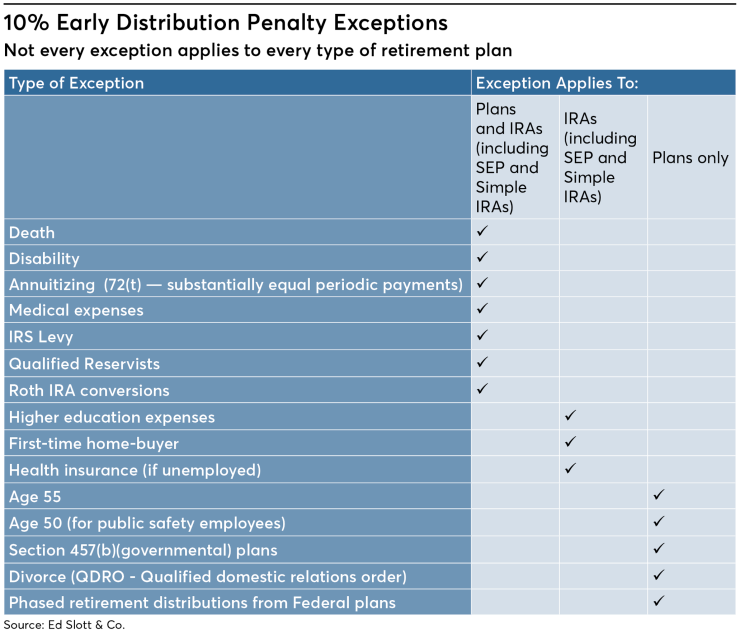

The good news is that tax law provides exceptions to such penalties — for example, for employees over age 55 and age 50 who withdraw from company plans after separating from service. But it’s important to know that not every exception applies to every type of retirement plan.

Some apply only to distributions from IRAs, while others apply only to distributions from company plans. Other exceptions apply to both. The exception for higher education, for example, only applies to distributions from IRAs, not company plans. If the client has funds in a 401(k) and those funds are eligible for rollover, the advisor should first roll them over to an IRA and then withdraw from the IRA to qualify for the exception.

Even if the funds are correctly used for education, if they are withdrawn from the 401(k), the 10% penalty exception will not apply. In numerous U.S. Tax Court cases, taxpayers had to pay the 10% early withdrawal penalty because the exception they claimed did not apply to the plan that they took the distribution from. We see the biggest errors here with first-time homebuyers and in higher education in which exceptions apply only to distributions from IRAs and never from company plans.

Look at the case of

In

Here’s a pitfall that surprises advisors — and even some tax pros: A client can be in such dire straits that they have negative income for the year. In this case, an IRA distribution can be withdrawn tax-free due to low or negative income, even after the distribution. But the 10% penalty still applies even if there is no income tax.

In

To qualify for the 10% penalty exception, expenses must generally be paid in the same year as the distribution. If funds are withdrawn from an IRA or company plan for medical bills, the bills must be paid in the same tax year as the distribution.

In

Note that to claim the 10% penalty exception for medical expenses, the expense would have had to qualify as a deductible medical expense, meaning that it must exceed the income threshold for claiming the deduction, which has been increased to 10% of AGI for 2019. However, the penalty exception is still available even when a taxpayer does not itemize and instead uses the standard deduction, as many have opted to do since the tax reform changes beginning in 2018 went into effect.

-

Now harsh penalties and taxes on late 60-day rollovers from company plans and IRAs can be avoided, but beware: There are some rollover mistakes that still cannot be fixed.

September 22 -

Some advisers and their clients are running afoul of an IRS rule, and oversights can result in substantial penalties.

June 22 -

There’s one goof every adviser should take extra precautions to avoid: being careless about those IRA beneficiary forms.

August 8

Another tax trap to watch out for: Sometimes it’s necessary for savers to tap their IRA or plan funds to pay for a medical emergency. But since those distributions are taxable, they increase income, which in turn decreases the amount of the medical expense deduction and the amount of the medical expense that qualifies for the 10% penalty exception. This is one reason it’s important for advisors to set up tax-free sources of income, such as non-IRA funds — already taxed money, available for large medical bills.

What about hardship exceptions?

This one should be easy: There are no exceptions to the 10% early distribution penalty for financial hardships, except for special provisions for natural disasters like hurricanes, floods and wildfires. But it is often one that involves the most confusion, mainly because there are hardship exceptions available in many 401(k) plans. These exceptions only allow access to plan funds where they would not otherwise be accessible. The tax and penalty still apply to these distributions. IRA funds are always available to be withdrawn but here, too, early withdrawals will be subject to tax and penalty, even if needed for a financial hardship other than those specific exceptions listed in the tax code.

What’s a disability?

This may be the toughest of all situations and one in which the 10% penalty exception is just as rigid. To qualify under the tax code’s definition of “disabled” for this provision, the person must be severely disabled, to the point that “ …he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite duration. An individual shall not be considered to be disabled unless he furnishes proof of the existence thereof in such form and manner as the Secretary may require.” – Tax code section 72(m)(7)

Translation: If you can work at anything, or expect to recover, the disability exception will not apply. Additionally, collecting a disability pension does not necessarily mean you qualify for the disability exception for early withdrawals from a retirement account.

In the sad case of

Unbeknown to Gillette, a side effect of her new medication was severe compulsive behavior, particularly compulsive gambling. Gillette’s life spiraled out of control. She stopped paying her mortgages, property taxes, maintenance expenses, and credit card bills. She received tax sale notices for her rental properties and a sheriff's warrant for unpaid state taxes. When the money disappeared, she borrowed from friends, took cash and credit cards from her husband's wallet, and eventually withdrew money from her retirement account in 2012.

Gillette and Szczepanski filed a joint 2012 return and reported an early IRA distribution of $104,001. They argued that they were not liable for the 10% penalty on the IRA distribution because Gillette had a mental illness caused by her medication. They contended that this qualified her for a disability exception to the 10% penalty. They lost and had to pay the 10% penalty. The court ruled that Gillette’s medical impairment was remediable and not a disability under IRC Section 72(m)(7).

IRS levy exception gone wrong

In extreme cases where IRS levies a retirement account for taxes owed, the 10% penalty does not apply. But the penalty exception does NOT apply to a voluntary IRA or plan withdrawal to pay IRS assessments.

A harsh example of this is found in the case of

They argued their retirement plan distribution fell under the IRS levy exception since (a) the money was used to settle an outstanding tax bill, and (b) the distribution came after the IRS issued a final notice and Intention to levy. The court disagreed and upheld the penalty because no levy was actually filed on the retirement plan. Instead, the Thompsons took a voluntary distribution. In the end, not only did they lose over a $1 million dollars in retirement assets to satisfy an old tax debt, but the additional $122,784 due to the 10% early withdrawal penalty was upheld.

Previous cases, and the tax code itself, make it clear that the exception does not apply unless the retirement account itself is levied, and the IRS triggers the distribution.

Prove it!

If a distribution is taken for an expense that qualifies for the 10% penalty exception, like anything else when it comes to taxes, it must be proven. In

Advisors must be familiar with the various exceptions to the 10% early distribution penalty and how they apply. It’s knowledge that can help a client when they need it — and you — the most.