After “a long and intense project with the goal to best position our firm in the industry,” a major OSJ says it has affiliated with a new broker-dealer.

Brothers Anthony, Chris and Ken Nettuno of the Nettuno Group spent a year assessing their options before deciding to switch the BD affiliation of their office of supervisory jurisdiction enterprise to Cambridge Investment Research from Advisor Group’s FSC Securities, the fraternal partners said in an email.

For Atlanta-based FSC, Nettuno may well be the OSJ that got away. The firm also lost a Louisiana-based group with 10 advisors managing $1 billion in client assets

The enterprise had maintained its affiliation with FSC since 2003. Nettuno has more than 60 advisors generating $22 million in annual gross dealer concessions while managing some $3 billion in assets under administration, according to its founders.

Anthony Nettuno said his group expects to retain around 75% of its client assets through the transition, after a “small number” of the Milton, Georgia-based OSJ’s advisors elected to remain with FSC, in an email. OSJs lose varying amounts of practices when they make a BD switch, sometimes as much as half of their group.

The enterprise formally affiliated with Cambridge Oct. 4, according to FINRA BrokerCheck. Investment News first

“This effort included discussions with FSC, independent consultants and many independent broker-dealers and their OSJs and advisors,” the brothers said in a statement. “Our advisors played a critical role throughout the process by providing input and analysis every step of the way.”

“While we are confident FSC and Advisor Group will continue to grow and succeed, we ultimately decided to affiliate with Cambridge,” the Nettunos continued. “We believe it is the best fit for our clients, advisors and firm.”

FSC is the smallest of Advisor Group’s four IBDs — the others are Royal Alliance Associates, SagePoint Financial and Woodbury Financial Services — but it’s the No. 24 firm overall in the sector with $305.6 million in 2018 revenue,

“We wish this group all the best,” Advisor Group spokesman Joseph Kuo said, “and we appreciate both the unique succession planning needs that drove this decision, as well as their consistent positive feedback about Advisor Group and its future.”

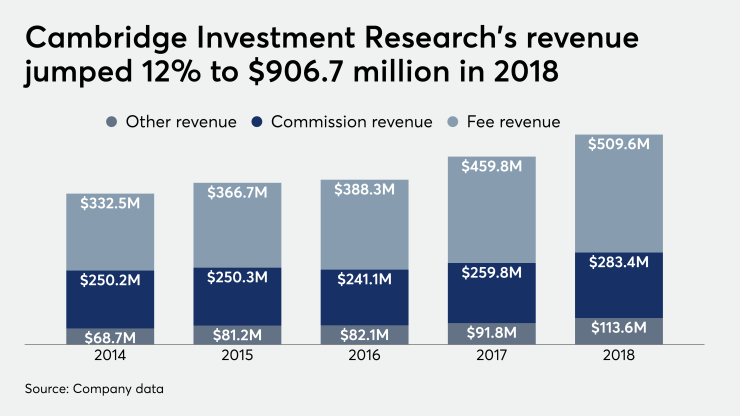

Cambridge boosted its revenue by 12% in 2018 to $906.7 million. The No. 8 IBD expects to top $1 billion in 2019, according to

Nettuno “is a high quality enterprise with values closely aligned with Cambridge,” Cambridge spokeswoman Cindy Schaus said in a statement. “We are pleased the Nettuno Group chose Cambridge from the numerous options they had.”