What effect does inflation have on a portfolio, and what kind of portfolio is better built to withstand it?

In recent years, inflation has been on the lower end of the scale. Of course, that will change eventually, and, if the past 47 years are any guide, when inflation ticks back up, we may see a distinct shift in the performance of various asset classes. So how might advisers adjust their clients’ portfolios as inflation rises again?

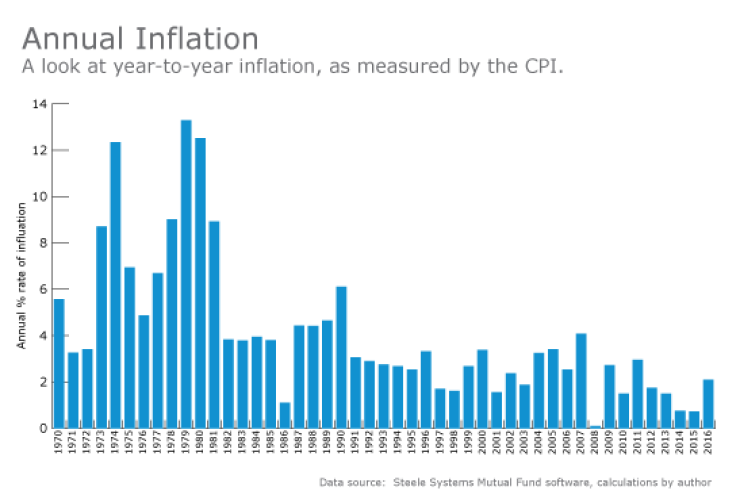

First, a bit of background. From Jan. 1, 1970, through Dec. 31, 2016, the 47-year average annual inflation, as an arithmetic mean, has been 4.07%, whereas the 47-year median CPI has been 3.27%. The average annualized growth rate of inflation (the geometric mean) between 1970 and 2016 was 4.03%.

Here we will focus on the 3.27% rate. Doing so will facilitate the analysis of asset class performance during the years of both low and high inflation. The median rate of inflation during the 23 years with below-average CPI was 2.09%; it was 4.54% during the 24 years with an equal-to-or-above median CPI. Please see “Inflation: Low Years and High Years” for an illustration.

As shown below in “Annual Inflation,” the most recent year with inflation above 3.27% was 2007, when it increased by 4.08%.

Since then, through 2016, we have experienced very modest levels of inflation: 2008 at 0.09%, 2009 at 2.72%, 2010 at 1.50%, 2011 at 2.96%, 2012 at 1.74%, 2013 at 1.50%, 2014 at 0.76%, 2015 at 0.73% and 2016 at 2.09%, using the U.S. BLS CPI All Urban non-seasonally adjusted data.

In fact, since 1990, there have only been five years in which the annual rate of inflation was over 3.27%.

A LONGER LOOK

We will now review inflation and asset performance over the 47-year period from 1970 through 2016. The performance of seven major asset classes will be reviewed during the 23 years of low inflation, as well as the 24 years with higher inflation. The seven asset classes include large-cap U.S. stocks, small- cap U.S. stocks, non-U.S. stocks, U.S. bonds, U.S. cash, real estate and commodities.

Large-cap U.S. equities are represented by the S&P 500, while the performance of small-cap U.S. equities was captured by using the Ibbotson Small Companies Index from 1970 to 1978, and the Russell 2000 from 1979 to 2016.

The performance of non-U.S. equities is represented by the Morgan Stanley Capital International EAFE Index (Europe, Australasia, Far East). U.S. bonds were represented by the Ibbotson Intermediate Term Bond Index from 1970 to 75, and the Barclays Capital Aggregate Bond Index from 1976 to 2016.

Cash was represented by three-month Treasury bills. The performance of real estate was measured by using the annual returns of the NAREIT Index from 1970 to 1977, and the annual returns of the Dow Jones U.S. Select REIT Index from 1978 to 2016. Finally, the historical performance of commodities was measured by the Goldman Sachs Commodities Index. As of Feb. 6, 2007, it has been known as the S&P GSCI.

In addition to the seven individual asset classes, we will also review the performance of two portfolios. The first portfolio is composed of all seven asset classes in equal allocations of 14.28%, and was rebalanced annually. The second portfolio consists of 60% large-cap U.S. stocks and 40% U.S. bonds —the classic 60/40 portfolio.

As shown in “Asset Performance,” large-cap U.S. stocks had an average nominal annual return of 12.70% during the 23 years when inflation was low. By comparison, they had an average real return of 10.42% during the same time period. Both performance figures are impressive.

Now, let’s turn the tables and look at performance during the 24 years in which there was higher inflation. We observe that large-cap U.S. stocks had an average nominal return of 10.82%, but an average real return of just 4.70%. These results clearly do not support the notion that large-cap U.S. stocks have been a standout performer during inflationary times.

The performance of small-cap U.S. stocks has been better than large-cap U.S. stocks during years with low inflation (refer back to “Asset Performance”). The average nominal return for U.S. small stocks was 13.73%, whereas the average real return was 11.41%.

When looking at performance during years with higher inflation, the superiority of U.S. small-cap stocks versus U.S. large-cap stocks increases; the average nominal return was 12.61%, compared to 10.82%. Even more dramatic is the difference in average real returns during years with higher inflation rates: 6.26% for small-cap U.S. stocks versus 4.70% for large-caps. If inflation protection is your goal, U.S. small-caps have been a better defender than U.S. large caps.

But the real story here is commodities. Very simply, broad-based commodity indexes suffer when inflation is low. When inflation is high, commodity indexes and funds perform admirably. This is very likely precisely because energy and commodity prices have gone higher, thus effectively creating inflation.

The average nominal return for commodities during the 23 low-inflation years was -2.31%, compared to a 21.98% nominal return during the 24 years when inflation was higher. The average real performance of commodities was -4.36% during low-inflation years and 15.13% during high-inflation years.

Commodities serve as a protector against inflation — and, in that role, completely dominate any other asset class. The next-closest performer using real returns is real estate, at 6.93%.

As we have been in a low-inflation environment in recent decades, it’s not surprising that commodities have performed relatively poorly. This will change.

MODEL PORTFOLIO PERFORMANCE

Inasmuch as advisers don’t generally build one-asset portfolios for clients, it’s important to consider how a multi-asset portfolio performs during periods of low and high inflation.

Toward that end, we can evaluate two different portfolios: a seven-asset portfolio and a two-asset portfolio. The equally weighted seven-asset portfolio underperformed the 60/40 portfolio during periods of low inflation, both in nominal and real terms.

The average nominal return for the seven-asset portfolio was 8.06%, with a 5.87% average real return, during the 23 years with low inflation — nearly all of those years being recent. The two-asset 60/40 portfolio had an average nominal return of 10.23% and an average real return of 8.01%. The two-asset model did not have commodities dragging it down.

Now, let’s turn our attention to the years when there was higher inflation. The seven-asset model had an average nominal return of 12.35%, compared to 10.10% for the two-asset portfolio. More important, the seven-asset portfolio had an average real return of 6.08%, compared to 4.02% for the two-asset portfolio.

If you believe inflation will rear its ugly head again, it would be wise to build a portfolio that has demonstrated an ability to defend itself against inflation.

Commodities, real estate and U.S. small-cap stocks — all missing in the two-asset model — were helpful contributors in the seven-asset portfolio during inflationary years.

As an adviser, if you believe inflation will remain low forever, stay with a two-asset portfolio. However, if you believe inflation will rear its ugly head again, it would be wise to build a portfolio that has demonstrated an ability to defend itself against inflation. This will require a wider variety of asset classes — including real estate, commodities and small-cap U.S. stock. In short, over the long term, it’s beneficial to build a broadly diversified portfolio.