The nation’s largest independent broker-dealer scored a massive recruiting grab in the bank channel, its second in the past four months.

BMO Harris Financial Advisors — the retail brokerage and advisory business for the U.S. arm of the Bank of Montreal — will affiliate with LPL Financial by mid-2021, the firms

The decision follows a similar one in July, when M&T Bank

BMO lists BNY Mellon’s Pershing as its custodian, and its RIA has more than 17,500 individual clients and $4.9 billion in assets under management, according to the firm’s SEC Form ADV. Under the move, the AUM will migrate to LPL’s corporate RIA, and BMO will use LPL as its custodian.

“We look forward to helping them serve and support their clients, expand their value proposition, and grow their business moving forward,” Rich Steinmeier, LPL’s divisional president for business development, said in a statement.

While BMO will continue offering broker-dealer services to clients, LPL “will serve as the single source for all retail broker-dealer and investment advisory operational services,” BMO spokeswoman Chris Nardella said in an emailed statement.

“LPL will provide best-in-class technology at the scale and pace that will help us differentiate our services and deepen our relationships with clients,” Nardella said.

A Pershing spokeswoman declined to comment on the move. M&T’s program is also leaving Pershing for LPL.

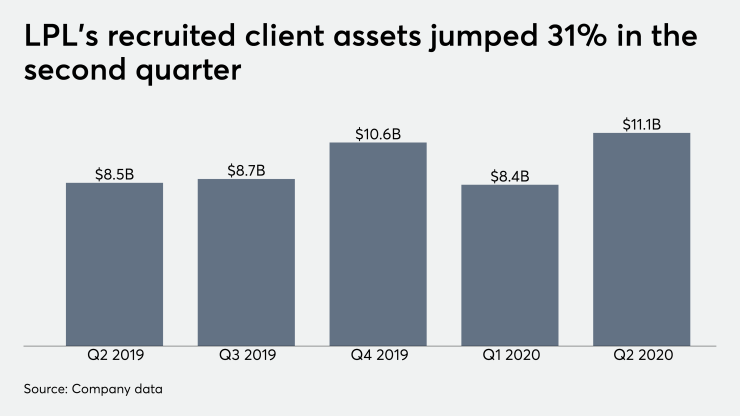

LPL has added a net 812 advisors and $38.8 billion in recruited client assets in the past 12 months, its second-quarter earnings