It may seem counterintuitive to some advisers, but clients both want and need to be told that they’re wrong, according to Paul Blease, the director of OppenheimerFunds CEO Advisor Institute.

Clients panic and request portfolio changes during times of market or political turmoil. To make his points about keeping calm, Blease uses graphs and data to illustrate historical context. It's a strategy he's found useful since his early days as an adviser following the 1987 market crash, he said.

“They frankly appreciate the fact that I’m going to battle on their behalf, and sometimes that is to tell them, ‘No,’” Blease said. “I have never had a client go, ‘Well, who the hell do you think you are?'"

Blease, together with Sarah Newcomb, a Morningstar economist, unveiled a series of behavioral finance strategies in a Financial Planning webinar Thursday.

While Blease often appeals to history, Newcomb counsels advisers to nudge clients to the future. This approach requires planners to let go of a common assumption, she said.

“Income alone and wealth alone do not qualify people as being financially healthy. And it’s not your job as a financial adviser just to get more for them,” said Newcomb, a Ph.D. and author of the 2016 book, “Loaded: Money, Psychology, and How to Get Ahead without Leaving Your Values Behind.”

-

Positive psychology might be the key to determining just what a client needs.

September 15 -

Two planners spell out the common psychological biases that prevent clients from maximizing their benefits.

October 20 -

How advisers can help overcome their irrational expectations.

March 13

A 'GREAT OPPORTUNITY FOR ADVISERS'

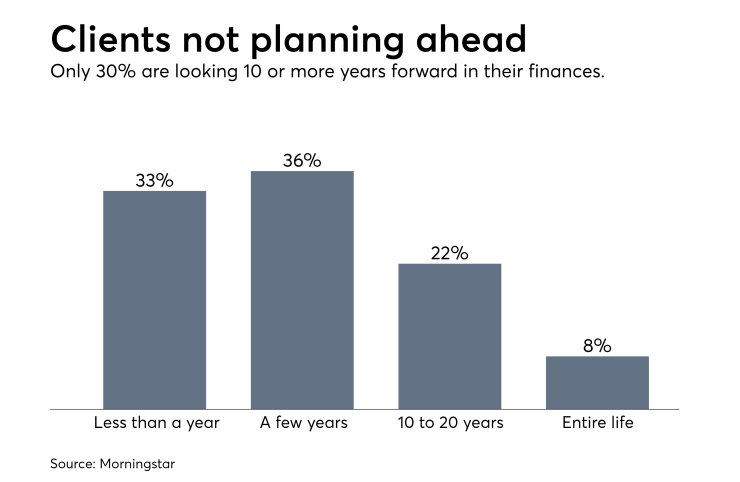

Less than a third of U.S. adults out of a group of several hundred polled by Morningstar for

“This is actually a really great opportunity for advisers, because you can’t change their age, their income, their education or their gender,” Newcomb said. “But you do have the power as an adviser to help them think further ahead than they currently do.”

Respondents were also asked whether they control their own financial destinies or feel they have very little power over them. Regardless of their wealth, the participants who felt in control of their finances said they were happier about their circumstances than those who said they feel powerless.

“The lesson here is fascinating: A sense of personal power — not money itself — may be the key to emotional well-being in our financial lives,” according to the Morningstar study.

HOW TO PROVE EMOTIONAL CLIENTS WRONG

Managing clients’ emotions should be a priority for all advisers, according to the panelists. The issue represents “the biggest challenge we face as an industry since its inception,” Blease said.

The politics of the moment, for example, often terrify clients on either side of the political spectrum, he noted. Blease recommends presenting clients with charts comparing earnings in the Dow in times of one-party control of Congress and the White House, versus times of divided government.

Between 1901 and 2014, annual returns in the Dow under unified governments averaged 4.6%, while the index rose around 7% per year under divided governments, according to Blease.

“What’s ironic is that the market seems to agree with our Founding Fathers,” he said. “Tell your clients to relax. There’s a pendulum that swings back and forth between the two parties. If you’ve been alive the past 20, 25 years, you’ve seen it. It doesn’t affect the market long-term.”

Blease, who made all of his graphics available free through

“Hopefully, this will give you some ammunition to keep your client buckled in to your long-term strategy,” he said.

BRINGING THE LONG TERM INTO FOCUS

Asked for book titles for additional study, Blease mentioned “The Excellent Investment Advisor” by Nick Murray. Newcomb referred the webinar audience to her book, as well as “Strangers in Paradise: How Families Adapt to Wealth Across Generalizations,” by James Grubman.

Advisers should think of their clients’ situations like a landscape painting with far-off objects appearing fuzzy or tiny in the distance, according to Newcomb. Planners can help them bring the future into greater focus, they just need to help their clients buy into the process, she said.

“Any time that we are talking about behavioral change, that’s more than something you can just automate or program,” Newcomb said. “We don’t change overnight, we sometimes need people to work with us and be patient with us.”