An ex-NFL star settled with his barred advisor's former firm for $1.5 million. The same firm also won an award for $2 million from another banned representative who has pleaded guilty to fraud.

The two former Next Financial Group advisors have cost the firm a combined $3.7 million already — and the cases pose further questions ahead of its pending sale to Atria Wealth Solutions. The private equity-backed parent of three independent broker-dealers

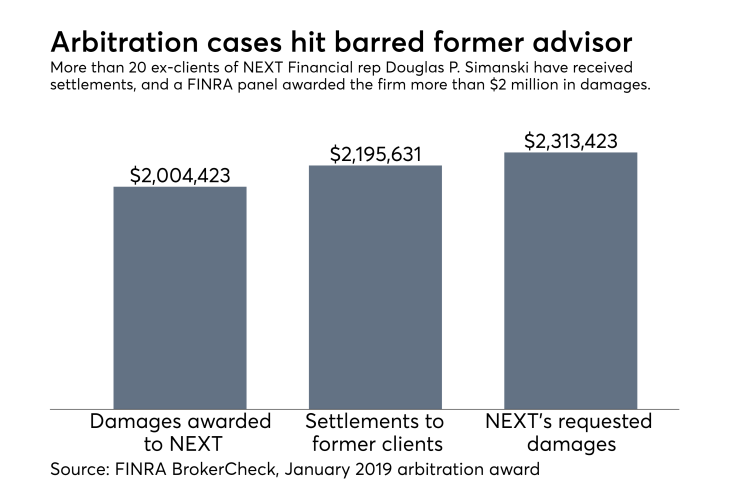

Simanski’s ex-clients have won 21 settlements for $2.2 million, FINRA BrokerCheck

Next also settled for $1.5 million with former NFL star offensive lineman Leonard B. Davis and his wife Amanda, after they alleged in a civil lawsuit filed in Houston court that two lawyers and an accountant conspired with advisor Tye C. Williams to defraud them in a franchise restaurant venture.

The onetime Pro Bowl guard with the Dallas Cowboys and VH1’s “Football Wives” cast member have no pending action against Next, but their lawsuit will likely shed more light on the case. The Davises also have a pending arbitration against Williams and his practice’s bookkeeper, who has pleaded guilty to fraud.

In a Dec. 26 ruling, a Harris County judge allowed the Davises’ claims of fraud and conspiracy to enter the discovery phase while dismissing their allegations of breach of fiduciary duty and aiding and abetting. The Davises have filed a motion to reconsider the ruling, and the lawsuit could stretch into 2020.

FUTURE LIABILITIES?

Compliance and regulatory cases involving conduct under a prior ownership structure often stretch two to three years after an acquisition, according to Stevens & Lee attorney Thomas B. Lewis, who isn’t involved with the cases but represents financial firms in litigation.

It isn’t unusual for M&A deals to result in additional claims. Sellers often set up contingencies like escrow accounts for potential liabilities under the previous owners, Lewis says. They also frequently provide buyers with disclosure documents about current cases, he adds.

“What you don’t know about are the potential liabilities in the future,” he says. “It could be a real windfall for claimaints’ counsel. There could be a lot of potential claims out there, and it’s probably in the interest of the new company to settle claims as fast as it can.”

A Next spokeswoman declined to discuss either case via email, saying the firm doesn’t comment on pending litigation or lawsuits. The Houston-based firm would keep its management and headquarters as an independent subsidiary of Atria, which

Next fired Simanski in May 2016, alleging he “sold fictitious investments and converted the funds for his own personal use and benefit,”

A three-member panel awarded Next damages plus costs of $6,200 for an award of $2.01 million, the Jan. 8 decision

Christopher Brown, the public defender representing Simanski in the federal case, declined to comment in an email. It’s not clear whether the former Next representative or the firm could face additional arbitration filings. Simanski’s judge has scheduled his sentencing for April 4.

FINRA barred Simanski and Williams in 2016 because both advisors failed to provide documents and information in connection with investigations into their conduct, according to BrokerCheck. The regulator also barred Williams’ bookkeeper, Gwendolyn M. Berry, for the same reason that year.

Berry, 66, pleaded guilty last February to federal charges of wire fraud, mail fraud and false tax returns. She had embezzled $1.8 million from the Davises between 2008 and 2014 by siphoning money from their 529 plans and other accounts, according to investigators in the Southern District of Texas.

Two attorneys representing Berry in the civil and criminal cases didn’t respond to requests for comment. She’s serving prison time at a Houston facility until her expected release in July 2022, according to federal inmate records.

-

Douglas P. Simanski allegedly told clients he would invest their money in a “tax-free,” fixed-rate investment, a rental car company and a coal mining firm.

November 6 -

The deal for Next Financial would grow the firm's portfolio in the sector to nearly 2,000 reps.

January 8 -

Many NEXT Financial reps would cash out their company shares while it boosts technology under a deal with Atria Wealth, the parties say.

January 14

From the SEC to the Supreme Court, here's what could be playing out this year.

RESTAURANT RED FLAGS

Davis earned more than $70 million between 2002 and 2013, but he and his wife fell victim to a “scheme” in which the lawyers and accountants “knowingly ignored and failed to communicate numerous red flags to Davis that are now being brought to light,” the lawsuit says.

The Smashburger venture turned out to be “financially catastrophic” to the Davises after the first five eateries in a 30-location agreement had to be sold back to the franchise restaurant chain due to cash flow problems caused by the structure of the deal and Williams’ management, according to the complaint.

Davis “lost not only the capital invested, he also lost the money he loaned to the Smashburger venture, the money embezzled, the money paid to the Advisor Team as ‘legal and professional fees,’ and the money squandered over the course of the investment,” according to the filing in Harris County court.

The Davises had originally sued Next, Berry and Williams under their initial July 2015 filing, but the court ordered them to pursue the defendants in arbitration, according to the complaint. Next settled their claim in December 2017. The claim against Berry and Williams has been stayed, pending the lawsuit.

“I can tell you that Tye Williams represented the Davises with professionalism and concern for his clients,” Craig Nevelow, the attorney representing Williams, wrote in an email. “As you know, anyone can make sensational statements in a pleading in an attempt to buttress their case.”

Nevelow didn’t answer follow-up questions, having referred Financial Planning to a Nov. 26 motion for summary judgment filed by Michael Baldwin, a lawyer named as a defendant, and his firm Jackson Walker. Nevelow is “hesitant to go further into details” about the issues involving the Davises, he said.

The Davises never asked Baldwin to review any contracts with Williams or their decision to hire him in 2005, the motion states. Their spending at the peak of Davis’s career was “profligate,” and the lawyers warned Davis he could lose millions on his investment into the restaurants, the filing states.

“We think these claims are without merit,” says Alistair Dawson, the attorney representing Baldwin and the law firm. “All the risks associated with that transaction were conveyed to Mr. Davis before he entered into it, and he entered into it fully aware of the risks.”

Judge Debra Ibarra Mayfield ruled on Dec. 26 that the Davises had “not alleged sufficient facts” to sustain two of their claims under the relevant law and found that a five-year statute of limitations under the Texas Securities Act voided another claim around the 2009 Smashburger investment. Mayfield denied the defendants' motion to dismiss the claims of fraud and conspiracy.

Mayfield, a Republican, lost her re-election bid to Democrat Beau Miller in November, making Miller the new judge in the Davises’ case. The Davises are challenging the Dec. 26 ruling as the other claims move forward. The next hearing is scheduled for March 1.