Banks across the country have been closing branches or scaling back retail operations as part of efforts to curb cases of the novel coronavirus. Yet others are adamant about staying open to foster public confidence in the banking system’s stability during the global health crisis.

Numerous banks as of Monday had said they would restrict branch services to drive-through only in order to comply with health experts’ recommendations of distancing people from each other in public places. Epidemiologists have stressed that limiting human interaction in the early weeks of the outbreak is crucial to slowing the disease’s spread and preventing the health care system from becoming overwhelmed.

“If we’re going to prevent a really bad outcome, really the only tool we have right now is to emphasize keeping people safe and away from each other as best as we can,” said Philip Flynn, president and CEO of the $32 billion-asset Associated Banc-Corp in Green Bay, Wis. “It’s all about reducing the odds of spreading this.”

The United States had reported 3,487 cases of COVID-19, including 68 deaths, as of Monday afternoon, according to the Centers for Disease Control and Prevention. Public health officials are concerned that the U.S. could follow the same trajectory as Italy, especially if younger people without underlying health issues

Read more:

Governors in states including New York, New Jersey, Connecticut and Massachusetts took steps to limit large public gatherings, closing establishments like gyms and bars and restricting restaurants to takeout and delivery only. The consulting firm Deloitte also issued a paper on Monday recommending that banks limit access to lobbies and make sure that ATMs are stocked so that consumers have access to cash.

Regulators had

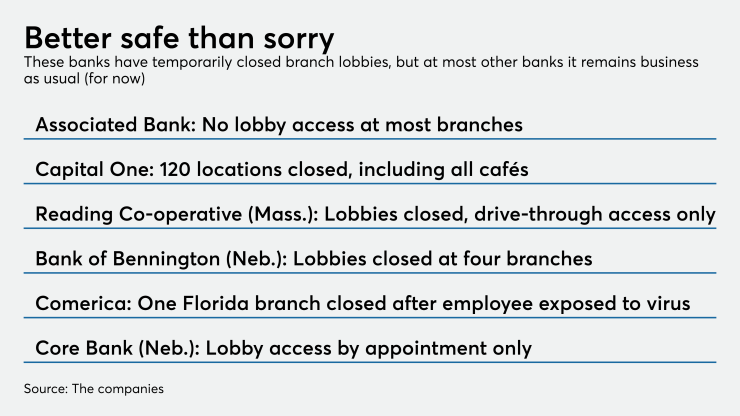

Capital One Financial is closing all of its café locations and 120 branches in selected locations for an indefinite period of time, a spokeswoman for the $390.4 billion-asset company in McLean, Va. said Monday. A total of 341 branches will remain open, though employees will primarily serve customers behind protective glass or via the drive-through.

“While we have not had a confirmed case in any of our cafés or branches, we believe these are the right steps to take to maintain essential banking access while also helping prevent the spread of the virus and supporting the well-being of our customers, associates and communities,” she said.

Some industry groups like the Nebraska Bankers Association and the North Carolina Bankers Association said some of their members are closing lobbies or limiting walk-in access.

The $593.8 million-asset Core Bank in Omaha, Neb., is allowing lobby access by appointment only at its seven branches, according to Executive Vice President S. Michael Rassmussen.

“We’re instituting a plan,” Rassumussen said. “We’re out for the safety of our customers and employees.”

The $597 million-asset Reading Cooperative in Massachusetts will operate its branches in drive-up mode only beginning Tuesday morning, President and CEO Julieann Thurlow said.

“We cannot accomplish the social distancing that is being requested in our branches if we keep our lobbies open,” she told American Banker.

-

The worker, who tested positive on Monday, and colleagues in close contact with the person are in self-quarantine.

March 12 -

The employee “is at home while their health is being closely monitored by their doctor and public health authorities,” a spokeswoman for the bank said.

March 9 -

We can all play a part in preparing for this and future outbreaks.

February 25

The Bank of Bennington in Bennington, Neb., said it would close the lobbies of all four of its branches. The $146.7 million-asset bank said it would offer appointments to customers who need to access a branch, say to get to a safe deposit box or meet with a loan officer.

Dallas-based Comerica Bank said Monday it was closing its office in Boca Raton, Fla., after an employee had a recent interaction with someone who had tested positive for COVID-19.

“Out of an abundance of caution, we decided it was in the best interest of our customers and colleagues to stringently sanitize the facility,” a spokesperson for the $73.9 billion-asset bank said. “The health and well-being of our customers, colleagues and community is paramount.”

The spokesperson did not say if the bank was planning to close more bank lobbies across other markets.

Early Tuesday, the $35 billion-asset Wintrust Financial in Rosemont, Ill., said it is temporarily closing about 50 branches in northern Illinois and southern Wisconsin. The remaining 135 branches in its the two states will remain open.

"Wintrust made this precautionary decision to allow for staff to manage for school closures and aid family members, and to support the public health efforts to reduce transmission of the COVID-19 virus, although to date, Wintrust is not aware of any employee or customer at any location who has been infected," the company said in a statement.

Some banks, including Bank of America, Citigroup and Citizens Financial Group, said they had not yet closed branch lobbies.

“We intend to keep our branches open as normal in order to ensure that our customers remain able to access their banking services,” a spokesman for the $165.7 billion-asset Citizens Financial in Rhode Island said. “With that said are looking at customer traffic patterns, branch staffing needs, and will make adjustments as needed as the situation evolves.”

Banner Bank, a $12.3 billion-asset firm in Walla Walla, Wash., said its lobbies would remain open in the hard-hit state for now.

“With this being a fluid situation, our tactical team meets everyday so we can respond to the evolving directives and state orders, but right now we are business as usual,” a spokeswoman for Banner said.

It is less clear how branches located inside grocery stores could be affected at this point in time.

Dave Martin, founder of the retail bank consulting firm bank mechanics, said he anticipated some banks may keep their in-store branches open but could reduce their hours to deal with staffing shortages.

“Even customers that rarely use a branch and may do most of their banking digitally, the access to a bank branch is a primal response we have. It’s important to show that we’re still here, we’re still here to help you,” he said.

Flynn said Associated had decided to close all of its grocery store branches, but customers will still be able to get cash and make deposits using the ATMs at those branches.

Thurlow said Reading Cooperative has one branch in a strip mall that will be closed because it doesn’t have a drive-through window.

In addition to the measures it is taking around its branches, she said that Reading Cooperative had also ordered extra cash from the Federal Reserve and was filling up its ATMs. Thurlow said she anticipated that consumers relying on takeout and delivery will need cash and said she hoped that access to cash would calm any potential financial fears consumers might have.

“Our biggest concern is that there becomes a hysteria around banking like there was around groceries,” she said. “The banking system is stronger and more resilient than it’s ever been.”