The public markets appear to have validated AssetMark’s rapid growth as a turnkey asset management platform company.

The firm raised $275 million by offering 12.5 million shares at $22, giving the TAMP a market capitalization of more than $1.6 billion, according to the IPO research firm Renaissance Capital. The firm was expected to price between $19 and $21 a share.

By midday on its first day of trading on the NYSE, AssetMark stock had rallied 15%, a beneficial sign for investors, says Kathleen Smith, principal of Renaissance Capital, a provider of institutional research and IPO ETFs.

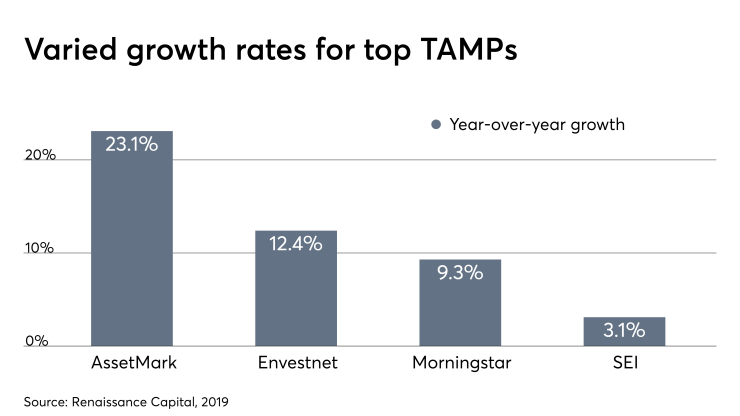

“There is strong investor interest in this sector,” Smith says. The largest TAMPs by assets — including Envestnet, SEI and Morningstar — have seen significant growth and have positive earnings and cash flow, she says.

“When compared to other companies that go public — the likes of Uber that are money-losing operations — these are companies that have a lot of stability and cash flow,” Smith says.

AssetMark’s revenue grew 23% year over year to $364 million in 2018. Over the past six months, shares of Envestnet and SEI, the firm’s top two competitors, are up 36% and 15% respectively, she says.

AssetMark CFO Gary Zyla pegs future growth on advisors who haven’t already signed on with a rival TAMP.

"Valuations are really high right now," says Eric Clarke, CEO of Orion Advisor Solutions.

“Asset management is a $9 trillion market and TAMPs currently have around $400 billion to $500 billion,” Zyla says. “We’re targeting advisory firms with between $50 million and $500 million in assets and we think there’s a big enough number out there who haven’t already made a commitment.”

Envestnet dominates the sector with over $500 billion in advisors’ assets on its platform, while the next closest TAMP, SEI Advisor Network, has around $65 billion.

The successful IPO is a boon for the entire wealth management industry, according to industry executives, including rival Envestnet.

“We believe AssetMark has a very good model and their successful IPO is validation that advisory is a growth business,” says Bill Crager, CEO of Envestnet Wealth. “Charles [Goldman] and team have done a great job and we are happy that they listed today. It is a great achievement and important milestone.”

AssetMark's IPO has “reinforced demand to invest in the independent advisor market,” says Tiburon's Chip Roame.

Eric Clarke, CEO of Orion Advisor Solutions, another fast-growing TAMP, says “valuations are really high right now which makes it a pretty attractive time to go public. You’re seeing firms take advantage of this opportunity. It’s a great time to make these kinds of moves.”

AssetMark’s “deep roots in the independent space are yet another validating moment for the independent movement, which has become a mainstream alternative to banks and brokerage firms,” says Shirl Penney, CEO of Dynasty Financial Partners.

The stock’s first day trading “reinforced demand to invest in the independent advisor market,” added Chip Roame, managing partner at Tiburon Strategic Partners.

-

The offering validates the explosive growth seen in the independent channel, experts say, which has now grown fast enough to catch the eye of retail investors.

June 28 -

The largest turn-key asset manager added five new features that leverage the firm’s vast stores of data.

May 3 -

The deal underscores an industry trend combining planning with portfolio management.

July 11

In August, AssetMark hit $50 billion in assets by agreeing to

In 2016 AssetMarkwas purchased by Huatai Securities for $780 million and has increased the assets it administers by about 65% since the China-based brokerage took over. The TAMP was previously owned by private equity firms Genstar Capital and Aquiline Capital Partners.

The IPO signals a bright future for TAMPs, Smith says.

“These guys have profitable operations and significant growth rates,” she says. “That’s like the perfect formula.”