Morgan Stanley's client assets hit a record $2.24 trillion, marking it as the largest wirehouse by headcount and AUM, and surpassing Merrill Lynch's client balances of $2.2 trillion.

The growth comes as the firm navigates a business environment being transformed by digital technologies and new regulations as well as recruiting cutbacks at three wirehouses.

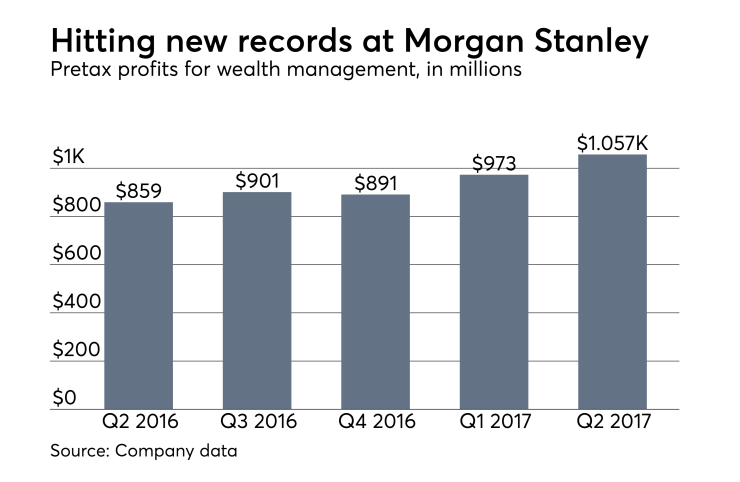

Morgan Stanley, which reported earnings Wednesday, notched a number of records: net revenues of $4.15 billion, up 9% from the year-ago period, pretax profits of $1 billion, up 23%, and record fee-based assets of $962 billion, up 17%.

Meanwhile, Morgan Stanley's brokerage force remained stable at 15,777. Adviser productivity hit a new record, rising to $1.052 million per FA, up 10%.

Morgan Stanley, Merrill Lynch and UBS have said they would reduce recruiting efforts. During an earnings call, an analyst asked if the firm was concerned about smaller rivals poaching Morgan Stanley's adviser talent.

"Listen, these are big organizations," CEO James Gorman downplayed replied. "Our competitors have 10,000 advisers, 15,000 advisers. It's not that you won't have movement. You will always have movement. What's changed is that there are fewer competitors."

He noted that Morgan Stanley itself is a composite of different firms, including Dean Witter and Smith Barney.

Plus, under the new recruiting environment, transition deals "have become more sensible," Gorman said.

Still, he added, "there will always be some recruiting. And people will move because they have a right to work where they want to work."

DIGITIZATION

Morgan Stanley has also embarked on ambitious digital projects. The firm is exploring how to leverage new technologies such as artificial intelligence and machine learning. A robo adviser is also in the works.

Gorman said there was not only a place, but a need for both the robo and human adviser at Morgan Stanley.

"The reality is that the market has different segments with different tastes and preferences. There is clearly a segment that wants advice," he said.

When asked about the threat posed by digital disruptors, Gorman downplayed it.

"If you look at the average basis points for the robos, it ranges, I think around 20 to 30 basis points. If you look at a full service brokerage firm, you get somewhere in the low 70s," he said. "It's not clear to me that that is such an expensive gap. We just need a compelling digital platform for clients who want to deal with Morgan Stanley, but not in a traditional relationship. And that's an exciting opportunity for us."

But even as robo advisers continue to grow, Morgan Stanley's wealth management business continues to grow.

Fee‐based asset flows during the second quarter surged 66%, rising to $19.9 billion from $12.0 for the year-ago period.

Concerns about management dragged down job satisfaction ratings in J.D. Power’s annual survey.

CFO Jonathan Pruzan attributed that growth partly to the Department of Labor's fiduciary rule as well as clients wanting to invest more.

The company's wealth management unit's pretax profit margin rose to 25% from 24% for the prior quarter and 23% for the year-ago period.

"With rates and higher markets, those are good trends that will drive our asset-based fees. I think the one area of volatility is transactional, given that we are in the summer months. But again, I think the tail winds for this business are very good," Pruzan said.

The wealth management's unit bank deposit program slipped 7% year-over-year to $139 billion. The bank attributed this to tax season as well as clients investing more money.