The changing concept of retirement in America is disrupting the parts of the financial services machine that are geared around it.

First of all, people are giving up on retiring. That's particularly true for millennials and members of Generation X, who generally will want or need to keep working, said Aron Levine, head of Merrill Edge, Bank of America's online investing unit.

"The idea that there's this moment in time when people plan on truly leaving the workforce and spending 30 years on the beach traveling or playing golf, is no longer something we should be talking about," he said.

There are other forces changing retirement and the way people save for it, too.

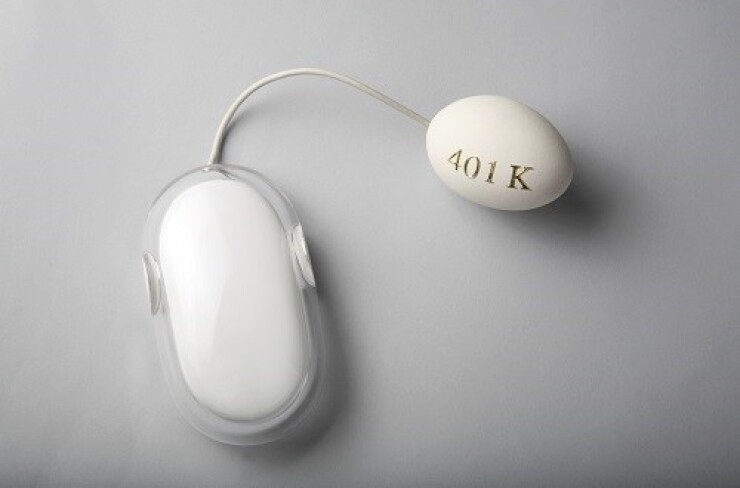

There is the growing gig economy, where workers do short freelance jobs and may never be offered that time-honored staple of retirement saving — the 401(k).

People increasingly expect to plan their financial lives digitally. A survey conducted by advisory firm Willis Towers Watson found that two-thirds of millennials and baby boomers agree that mobile apps and tools are either important or very important to manage and track the value of their retirement savings. Six in 10 millennials — and about the same number of boomers — also place a high value on tools to help monitor when they will be able to retire and how much income they can expect in retirement.

Also, the Department of Labor this year issued new rules around 401(k) plans that call for low fees and transparency. Though the fate of the rules under the Trump administration could be in question, they brought attention to the fact that some 401(k) plans and other retirement options are expensive and opaque.

Indeed, many would argue the 401(k) is archaic, inelegant and user-unfriendly.

The 401(k) is "a terrible participant experience. People enroll in a 401(k) plan, there's a menu of mutual funds they can choose from, and they're on their own," said Eli Broverman, president of Betterment, the largest robo adviser. "People deserve more advice and guidance than that, and they deserve a better experience.…Your 401(k) should work as well as the best financial products."

'IMPOSSIBLE TO FIGURE OUT'

Broverman recalled once trying to log in to his 401(k) account. Three screens with three different passwords later, he got in. "It was impossible to figure out how to do anything or understand what was in my account," Broverman said.

Ryan Gilbert, partner at Propel Venture Partners, a venture capital firm funded by BBVA, feels similarly.

"Ask the average worker what her balances are in her 401(k), how the 401(k) has increased over time, the types of products she's invested in, and what the costs are, and you'll be given blank stares," Gilbert said.

Is it time for the financial industry to come up with new, tech-oriented solutions to retirement saving?

About 70% of workers in the Bank of America survey said they want a hands-on approach to retirement saving.

So the inflexible, old-school 401(k) with its quarterly paper statements is unlikely to cut it with digital-native generations.

"Gen Xers and millennials are used to programs and products that are transparent and flexible by design and enabled by technology," Gilbert said. Ease of use, strong user interfaces and experiences, responsive support and easy access to answers to questions will all be demanded.

One idea, suggested by April Rudin, founder of marketing firm The Rudin Group, is that financial institutions could provide a portable 401(k) that workers could take from job to job. "Just as there's portable heath care, I think there will be the portable retirement plan that would stay with the person" as they go from job to job, Rudin said. "It's not hard to imagine."

Employers would contribute, perhaps through a federal tax. Gilbert says this can be done today. In fact, he did it when he moved from Better Finance to Propel.

"Folks don't understand what's possible under the current models and part of the fault there lies with existing vendors and promoters," Gilbert said. "They're not exposing any of these opportunities because, frankly, it's not to their benefit."

'ROOM FOR IMPROVEMENT'

Like so many other areas of financial services, fintech is looking to disrupt retirement savings. Several fintech companies offer apps and online sites that aim to make existing 401(k) plans higher-tech and user-friendly.

Guideline Technology was formed two years ago by Kevin Busque, a co-founder of TaskRabbit, one of the first gig economy companies. At TaskRabbit, he noticed that employee participation in the company 401(k) program was low, partly due to high costs and a lack of transparency and flexibility. In Guideline's platform, 401(k)s are invested in low-cost (fees of 10 to 15 basis points) Vanguard funds; employers pay a flat fee of $8 per month per participant. Propel

Betterment's robo adviser also supports 401(k)s.

"Just as there's portable heath care, I think there will be the portable retirement plan."

"We ask you about your plan, your spouse's situation, where you live, your cost of living," Broverman said. "Then we give you very actionable advice: you should be thinking about saving X dollars a year, here's how much should go in your 401(k), here's how much should be outside your 401(k), press a button and you're done; we'll take care of it for you."

Betterment, like other robo advisers, invests in ETFs. ForUsAll offers businesses an app and website for their 401(k) plans, with a virtual adviser that answers employees' questions. Blooom's app automatically rebalances workers' 401(k) portfolios to ensure their allocations are in line with their aims and objectives.

Of all the current efforts, Gilbert says progress has been made, "but perfection hasn't been reached yet." Part of the reason for this is the complex nature of these products, with their required terms, conditions and disclosures that need to be clearly described and communicated. "I would be very cautious to ever advocate that a truly one-click Amazon-like solution is the way to manage everything you have, particularly retirement assets."

That said, there's room for improvement. "Let's make it as easy as hailing an Uber cab or calling somebody to mow your lawn using TaskRabbit," Gilbert said.

WORK IS CHANGING

For many, retirement is no longer a given.

"American workers are saying, we're not going to stop working even when we stop working," said Gilbert. "In San Francisco, many Uber drivers are retirees. I ask myself and them the question, why are you doing this? Their response is, 'It's better than sitting at home, my wife is making me get out of the house, and I like being active.' "

Levine says younger people are taking note of their parents and grandparents active and spry at the ages of 70 and 80.

-

Prices and guarantees will improve for clients as robo-advisor tools continue to develop in the annuity industry; Plus, these two moves can ensure your clients will retire no matter what happens with the market.

October 28 -

Robos can give ETF providers brand new channels to distribute products and access new investors, says Dodd Kittsley, head of ETF strategy and national accounts at Deutsche Asset & Wealth Management.

November 25 -

Robo advisor seeks to add a piece of the $4.6 trillion market to its business.

September 11

"This is not a generation that's going to stay in one job until they get the gold watch, he said. "They're changing jobs, taking on projects, doing things that are community oriented, and that will continue on all the way to the end."

The anti-retirement stance is not all a matter of choice.

In the Bank of America survey, one in five respondents said they'd have to win the lottery to obtain the million-plus dollars they would need for a nest egg.

Many baby boomers haven't saved enough for their own retirement. Meanwhile, millennials are burdened with student debt, Levine pointed out. "They think, I want to pay this off first, then I have to pay off my credit cards, I'm not thinking about retirement yet," Levine said.