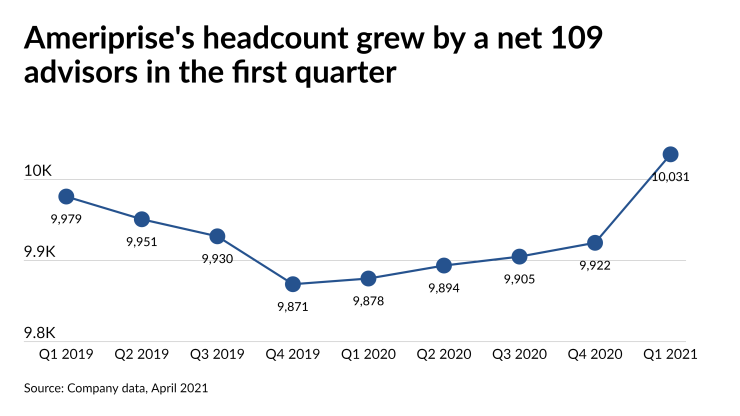

The financial advisor headcount at one of the largest wealth managers grew by more representatives in the first quarter than it did in any period for at least the past two years.

The Ameriprise Advice & Wealth Management unit added a net 109 advisors above the prior quarter to reach 10,031 — including 7,924 in its franchise channel and 2,107 employee reps —

Although the wealth manager’s earnings remained basically flat due to the ongoing impact of low interest rates, the Minneapolis-based firm’s total client assets soared by 36% from the year-ago period to $762 billion. In an earnings call with analysts after the firm disclosed its earnings, Ameriprise CEO Jim Cracchiolo said the company is reviewing whether it should further ramp up its recruiting or make an acquisition in order to boost its headcount faster.

“But very important for us, we want to bring in the right advisors that fit the brand, the culture, the compliance,” he said,

Still, he acknowledged that “maybe we could be more aggressive out there,” given the company’s calculation that its advisors’ productivity increases 2.5 times as fast as those of its independent and wirehouse rivals.

The company hasn’t made any wealth management acquisitions since 2017, when the firm

At least 93 experienced advisors affiliated with the firm in the first quarter, including two teams from Morgan Stanley and MassMutual that

The in-flow of assets came from existing practices, as well as the new recruits. Asked by an analyst about the “phenomenal” record advisory flows, Cracchiolo cited technology tools like an online goals-tracking software that more than 500,000 clients are already using, along with more enhancements on the way. The expansion also stems from the economy, he says.

“It's probably a combination of factors,” Cracchiolo said. “We have a reopening of the economy. I think people have been starting to feel a bit more comfortable. I think the markets have done well.”

Overall, the wealth unit earned pretax adjusted operating income of $389 million on net revenue of $1.88 billion in the quarter. The earnings ticked up 3% from the year-ago period, or 30% when excluding a loss of $78 million due to lower interest rates.

“We continue to rate Ameriprise ‘outperform’ as a rebound in the wealth management and asset management segments and high capital return should drive materially higher EPS levels over the next several years,” William Blair analyst Adam Klauber wrote in a note. “Risks include exposure to interest rates, exposure to equity markets, and asset-based fee pressures.”