Despite a substantial dip in wealth management earnings and a headcount of financial advisors that remains roughly flat, Ameriprise brought in record net new assets.

Low interest rates amid the coronavirus cut the Ameriprise Advice and Wealth Management division’s earnings by $92 million in the fourth quarter — closing out a year that saw its pretax adjusted operating profit fall by $188 million to $1.32 billion. The Minneapolis-based wealth manager

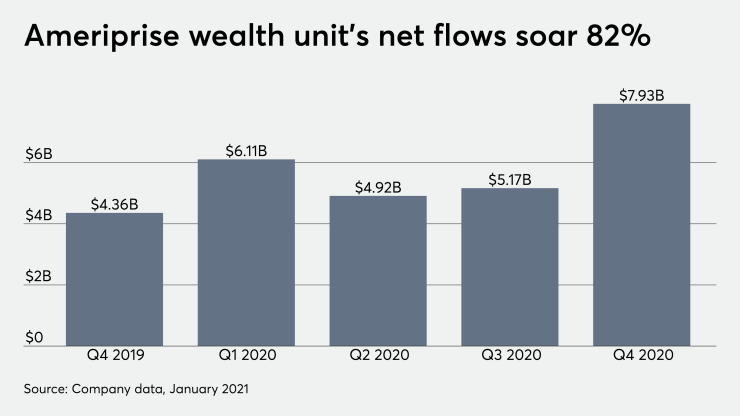

After a challenging year, the numbers looked mixed. Ameriprise added a net 51 advisors over the course of the year to finish with a headcount of 9,922, including 7,805 in its independent franchise channel and 2,117 employees. At the same time, net flows into wrap advisory accounts soared 82% year-over-year to $7.9 billion in the fourth quarter.

“Now, some of that could be people feeling a little better as the vaccine came about as well, and the idea that the economy and activities would continue to open up,” CEO Jim Cracchiolo said,

The record flows had prompted Credit Suisse analyst Andrew Kligerman to gush at Cracchiolo about the “phenomenal” growth, considering his team projected the run-rate at about half the level only a year and a half ago. Ameriprise advisors grow 2.5 times faster than their counterparts at rival firms, according to Cracchiolo.

For the quarter, Ameriprise made $352 million in pretax adjusted operating earnings on net revenue of $1.78 billion. It was a 9% drop from the year-ago period. Total client assets expanded 14% year-over-year to $732 billion in the fourth quarter. The company remains focused on growth and advisor-client engagement, Cracchiolo says.

“Our advisors are utilizing our tools and capabilities on our integrated technology platform,” he said. “They are reporting that they're processing business more efficiently and spending more time with their clients and growing their practices.”

The 12% drop in earnings for the wealth unit this year will give way to double-digit growth in 2021, according to a note by William Blair analyst Adam Klauber. The unit’s revenue will rise 15% and its pretax earnings will jump 20% this year as the company regains its momentum, Klauber’s team predits. William Blair maintained the stock’s “outperform” rating.

Ameriprise has “an expanding wealth management franchise” working in its favor, alongside higher asset levels, stock appreciation, expense discipline and share buybacks, Klauber wrote. “Wealth management should see a material recovery in results on strong flows, productivity gains as transactional activity improves, and the normalizing impact of lower interest rates.”