Market appreciation, larger sales and massive inflows to wrap advisory accounts helped boost one of the largest wealth manager’s profits by more than 50% in the second quarter.

Minneapolis-based Ameriprise’s Advice & Wealth Management unit raked in nearly half a billion dollars in pretax adjusted operating earnings with a bump of 380 basis points over its profit margin of the same period a year earlier, the firm

- The firm’s headcount expanded by 2% year-over-year, or a net 153 net advisors, to 10,047 at the end of the quarter. That included 7,943 independent franchise advisors and 2,104 employee representatives. Despite the smaller crop of recruits, however, the net gain surpassed

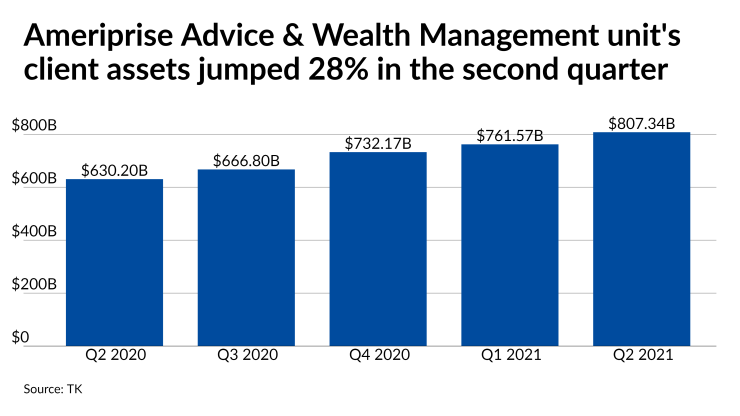

those of the prior twoquarters . “We're hearing that advisors have been focused on all that comes with reopening,” Cracchiolo said in his prepared remarks,according to a transcript by The Motley Fool. “People are getting back to a more normal rhythm. We are now hostingin-person meetings that complement our virtual recruiting, and we feel good about our pipeline for the third quarter.” - The wealth manager’s total client assets soared by 28% from the year-ago period to $807 billion, with an in-flow of $10 billion to wrap advisory accounts and an overall infusion of $9.5 billion in flows. Adjusted annual net operating revenue per advisor surged 9% to $731,000, or by 14% excluding the impact of lower interest rates. The difference between the turmoil marking the second quarter of 2020 amid the pandemic and greater economic strength in the recently completed one was striking, with overall flows up by more than 75% and advisory in-flow increasing by more than 50%.

- Ameriprise’s wealth unit generated $423 million in pretax adjusted operating earnings on $1.98 billion in net revenue, a margin of 21.4%. Revenue climbed 29% from the same period a year ago, while distribution expenses relating to advisor compensation for the increased business grew by nearly a third. The company also expects to close

its $845-million acquisition of BMO Financial Group’s EMEA asset management business in the fourth quarter, which Cracchiolo noted “will add important capabilities and build on our reach” in international markets. - He credits Ameriprise’s advisors for the sales and asset flows. Part of the firm’s growth came from favorable economic conditions like rising equity values amid the reopening of more in-person businesses and activities in 2021, according to Cracchiolo. Ameriprise’s technology is also playing a role, he says. “We are integrating everything in an ecosystem that works together, not just putting tools on a platform and saying, ‘Hey, we got this service,’” Cracchiolo said. “It's not something like we just thought of, just introduced or just added. It's something that we really have tested out, we've proven, we've actually rolled it out. And it really works well. And so I would just say that it has a lot to do with our advisors having this type of engagement with the clients and also the way they are able to transact with the firm and the information that we're providing. So, I think it's a combination of all of that.”