Ameriprise’s advice and wealth management unit gained 79 new advisors in one quarter while losing 94 from its existing headcount, as the firm attempts to boost the productivity of its nearly 10,000 brokers.

On a year-over-year basis, pretax earnings grew 27% to $316 million and net revenue went up 14% to $1.5 billion, Ameriprise reported on April 24.

The results fell in line with recent trends at the Minneapolis-based firm’s advice and wealth management unit. The employee brokerage and independent broker-dealer

The sequential drop of 15 advisors contrasts with the increasing productivity of the division, as average advisor productivity ticked up 3% to $590,000 per year in the first quarter. Noting gains in productivity and a “clearer” regulatory environment, CEO Jim Cracchiolo predicts more expansion is on the way.

“We feel very good about the productivity of the system and the advisors,” Cracchiolo said on a call with analysts. “They’re not worried about the next regulatory overhang.”

Asked earlier about

-

CEO Jim Cracchiolo says the firm’s headcount is poised for growth again following a stagnant year.

January 25 -

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

The rule has cost the firm tens of millions of dollars in compliance and lost revenue.

July 26 -

The firm's adviser headcount slipped 98 year-over-year.

April 25

One of the biggest notable losses came from Merrill Lynch, which lost a team managing $1 billion to the independent space.

Overall, Amerprise has a fleet of 9,881 advisors between its employee brokerage and its IBD, which is the second largest IBD by revenue after LPL Financial. The wealth unit’s expenses ticked up by 10% to $1.2 billion as the employee brokerage absorbed Investment Professionals into its headcount of 2,176 advisors. Meanwhile, the number of franchise advisors grew by 34 advisors year-over-year to 7,705.

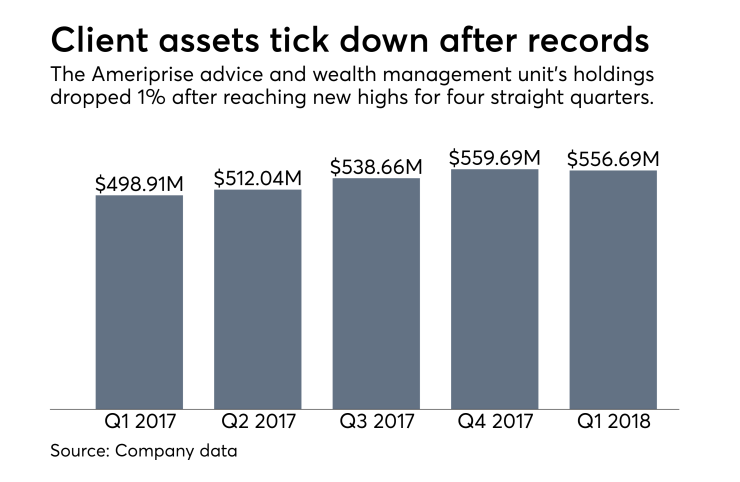

Other sources of additional expenses included greater spending on advertising and more distribution fees relating to 12% year-over-year rise in client assets to $557 billion. Client assets had reached a record $560 billion in the prior quarter, but volatility in the equity markets forced them down slightly in the first quarter, according to the firm.

Cracchiolo praised the inflow of $5.7 billion in assets to advisory wrap accounts, a 44% increase from the year-ago period. Wrap assets have increased 18% over the past 12 months to $251 billion, which he noted is one of the largest advisory platforms among the company’s peers.

“Our wealth management business is one of the best in the industry and has significant growth potential, and is responsible for driving approximately 75% of the company’s overall revenue,” he said in prepared remarks.

The company’s first-quarter earnings usually turn out lower than other quarters, Ameriprise says, because it has two fewer days and also pays higher payroll taxes at the beginning of the year. The fewer business days reduced earnings by $12 million, and the higher tax payments cut them by $7 million.

The overall company’s earnings surged by 30% year-over-year to $563 million, or $3.70 per share, which

“However, its efforts toward modifying its product and service-offering capacity are expected to support top-line growth in the quarters ahead,” the research firm says.