Despite the massive global expansion of sustainable investing assets, many investors are still unsure of where to find useful ESG data on which firms are living up to their corporate pledges.

Nearly 75% of U.S. adults disagree or strongly disagree with economist Milton Friedman’s doctrine stating that companies have no social responsibility other than to shareholders, according to more than 2,200 surveyed randomly in April by market research firm J.D. Power. At the same time, 29% said they have never looked for information about any firms’ corporate citizenship and 41% said that it could be somewhat or very difficult to find, the poll showed.

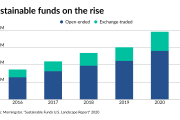

The answers reflect a dearth of easily accessible metrics that financial advisors, asset managers and researchers are readily trying to address through their work. The sheer numbers display the interest in ESG metrics: Between 2014 and 2018, U.S. sustainable investing assets soared by 83% to $12 trillion, according to the Global Sustainable Investment Alliance.

Advisors say it can be difficult to square clients’ desire to invest according to ESG principles with the lack of data on what companies are actually doing to meet those standards and the surge in new ESG funds and investment options. Investors have reason to be confused or skeptical about upstarts’ track records, says advisor Keith Beverly of Washington, D.C.-based Grid 202 Partners.

“It's always been something that's been a focal point for us, but what you see now is this proliferation of companies and products,” he says. “What you don't want to do is discount folks who have been doing the work for decades for some new Wall Street product that has great marketing behind it because they manage trillions of dollars.”

Beverly recommends Morningstar data created through the research firm’s

Adasina is one example of the rush toward ESG investments for eager clients. Its Social Justice All Cap Global ETF has

“Transparency is our priority because we believe that's where we're going to make the most change,” Luong says. “To move companies to be better in terms of social justice, there needs to be transparency and accountability and working within communities is really crucial to that.”

Potential clients seeking to hold firms accountable may be searching in the wrong places for the data, according to the J.D. Power survey. As sources of information about corporate citizenship, more respondents cited social media (42%) and company websites (38%) than newspapers and magazines (33%), TV (28%), word of mouth (26%) or other (13%).

Still, almost two-thirds have changed their purchases or investments in response to a company’s actions, with fair wages (59%), human rights (58%) and gender pay parity (53%) as the issues they most often called “non-negotiable” as a customer, employee or investor.

“A set of issues with the power to influence massive behavioral changes has become a core area of focus, but few best practices are in place and few clear-cut leaders have emerged to pave the way,” Craig Martin, J.D. Power’s global head of wealth & lending intelligence, wrote in a report on the survey’s findings.

“What is clear,” he wrote, “is that proactive communication around ESG will be critical for the foreseeable future and companies that can distinguish themselves with clear, quantifiable ESG metrics that can be easily located and understood by consumers will be in the best position to benefit from increased investor appetite for companies that not only do well, but also do good.”

Rising AUM and missing information amounts to a “frustrating” combination, according to Marypat Thenell Smucker of gender-lens investing research firm Parallelle Finance. In its first-quarter

Smucker has heard increasing criticism in recent years about

“Consumers want to pick managers who are following a standard, adhering to a style and watching their holdings,” she says. “I dont think it's as easy as it should be.”

More universal reporting standards could help fill in the missing information, Smucker says. For now, Beverly’s firm assesses stocks based on publicly available data, reviews from career resource database

“We had to go out and find the data,” Beverly says. “You can kind of piecemeal it together, but there's no single source where you can go and get a clean answer to that problem.”