Fintech firms have long sought ways to build out the advisor tool kit — but new technologies are also shaping the investment products advisors ultimately recommend to their clients.

From natural language processing systems that uncover stock market trends to analyzing decades of investment decisions to root out investor bias, firms are looking to analytics to create precise investment vehicles that increase their chances of generating alpha.

“There is definitely movement toward, and real value, in being able to have scientists look at the data sources,” says Vijay Raghavan, senior analyst at Forrester. “To find signals and draw insights to make better recommendations and guide investment decisions — that’s the direction everything is moving toward in fintech.”

The data research ultimately helps quantitative analysts understand macro trends and market conditions — information that is then used to create the next generation of mutual funds and ETFs offered to their customers.

“There’s an unbelievable amount of data in the walls of this building,” John Avery, head of artificial intelligence and advanced analytics at Fidelity Investments, told Financial Planning at the Boston-based firm’s office in September. His department maintains a database of 400,000 research notes on investment decisions dating back to the 1970s, he says.

“That’s where we are looking to generate value that no one else is going to see,” Avery adds.

By working with asset allocation groups, the Fidelity analytics team is looking to catalogue all the firm’s investment decisions over time to pinpoint investment biases. Knowledge that could drive future algorithms, he says.

For example, confirmation bias makes analysts subject to dismissing evidence that is contrary to their beliefs, says Darby Nielson, managing director of research at Fidelity. The research gives quantitative analysts an independent view on stock selection and portfolio construction.

“We’re able to go back and study the good decisions from the bad decisions,” Avery says. “And find out what particular biases they’ve had in order to push models forward.”

In addition to the cataloguing project, Fidelity analyzes all phone conversations on their customer hotline to better understand client needs, he says. “The things that we can find out about the information in that data — it’s mindboggling,” Avery says. “That’s where we’ve been spending a lot of our time.”

Fidelity is currently working on a backlog of 80 projects, many of them fintech startups, that look to boost analyst effectiveness, he says. “We haven’t found the silver bullet yet,” Avery says, adding that a lot of analysts are using the same data sets as their competitors. “But by improving the productivity and efficiency of the really smart analysts, then by definition, you increase alpha.”

-

The startups competing at XY Planning Network's fintech competition say they're solving RIA practice concerns that the industry has failed to address.

September 26 -

Applications that tackle the industry's compliance issues, automate back-office processes and streamline clearing and settlements are drawing interest from venture capital firms.

September 19 -

Regulators including FINRA are looking at ways to help spur innovation.

September 12

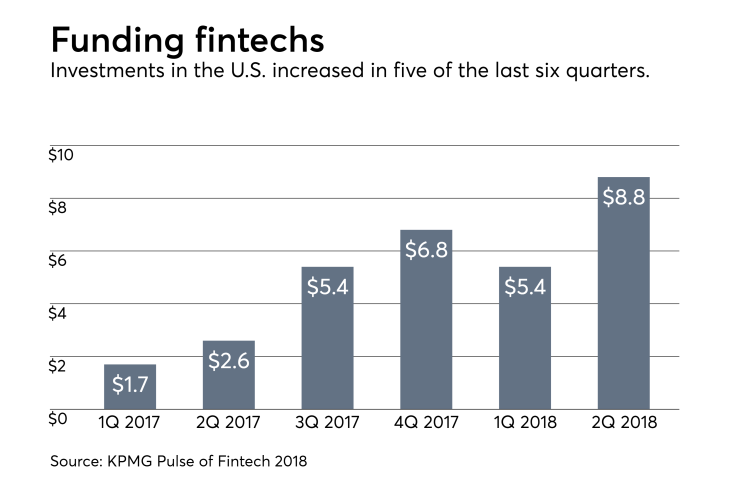

Fidelity’s work is all part of $8.8 billion funding ecosystem made into U.S. fintech firms in the second quarter, up from $2.8 billion from the year-ago period, according to KPMG’s

A smaller fintech is looking to natural language processing to uncover alpha. The St. Louis-based investment research firm Prattle scans hundreds of thousands of pieces of communication — like earnings calls from 3,000 companies and 15 central banks — and then offers the proprietary data sets to fund managers looking for a pulse on the markets.

“We’re built to ingest information fast,” says Prattle CEO Evan Schnidman. The startup

attracted

The largest independent digital advice platforms profited significantly from a strong M&A market last year.

TD Ameritrade is also using natural language processing to optimize efficiency. The firm recently launched a

“That’s where things are heading,” Raghavan says. “A reliable application where clients can punch in some basic queries without having to pick up the phone and call a financial advisor — and don’t even have to go beyond their Facebook app.”

While AI is opening new doors in asset management, some industry experts worry the technology may prevent analysts from fully understanding the processes going on inside machine learning tools. For example, it may be difficult to discern if big data algorithms are reliably analyzing data sets to find the best outcomes.

“Machine learning is only a black box if you don’t want to look inside,” says Schnidman.

Data aggregation presents another challenge, Raghavan says. Wrangling information across company silos is a sizable and costly hurdle. “The biggest challenge especially for legacy institutions is getting that data normalized and in a spot where analysts can actually draw insights,” Raghavan says.

By dovetailing the outside data sets with internal data, Avery and others hope to shape the next generation of investment products. “The saying goes, ‘He who turns over the most rocks wins,’ ” Avery says. “What we’re doing is moving more rocks faster — and finding rocks with more opportunity.”