Despite

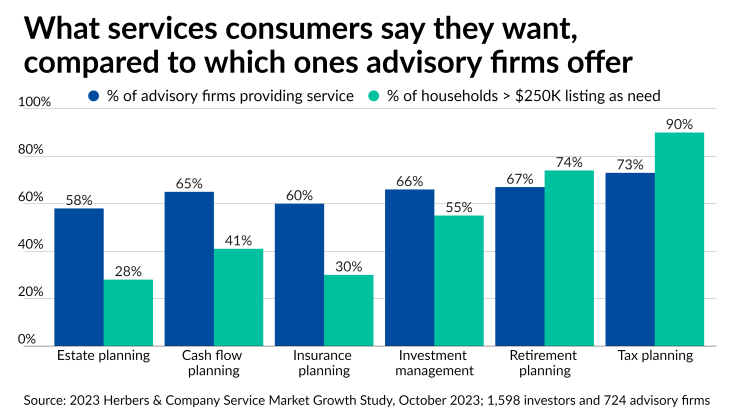

Consumers from at least 90% of households with more than $250,000 in assets told Herbers & Company that they wanted tax planning services, while 73% of advisory practices reported that they currently provide them, according to a survey this year of nearly 1,600 investors and more than 700 advisory firms

Among the advisory teams growing organically at the fastest rate, 97% do tax planning — compared to 49% among all other firms. Tax planning easily surpassed more traditional industry services such as retirement (74%), investment management (55%), cash flow advice (41%), insurance (30%), estates (28%) and education (21%). Interestingly, the share of advisory firms that help clients with those needs outpaced each of those figures by double digits, except in the area of retirement planning, where the 67% of practices came in seven points lower.

Retirement planning usually takes the top spot in the firm's consumer studies, but tax advice and strategy "jumped to No. 1" in the past year, according to Angie Herbers, the managing partner of the consulting firm.

"The big takeaway here is that really, regardless of consumer demand, the firms that are growing faster are more able to meet consumer demand as consumer demand evolves and changes. To me, if you want to grow and you want to capture the consumer market as an advisory firm, you would focus 100% of your growth efforts on expanding the services that you provide," Herbers said in an interview. "The survey clearly said that growth comes from expanding your services."

Financial advisors

Creative Planning

Edelman Financial Engines closed a similar deal to those of its fellow giants in 2021 with the

Tax planning is a "key component" for client retention alongside risk management, trust services and estates, according to Suzanne van Staveren,

"As someone's wealth grows, as their complexity increases, that's really an area where we want to be helpful to our clients," van Staveren said in an interview. "Clients stay with us for the long term, and their complexity grows as well. So we want to make sure that we can continue to service them."

Software and other technology solutions replacing planners' previously widespread manual Excel spreadsheets could help more advisory teams add tax services, Herbers said. Her company is hosting a webinar about the more than 300 different data points from its "

The larger economic conditions and higher interest rates, as well as

"We had a good 10-year bull market and now we have more turbulent economic times, and often that also triggers tax issues," Herbers said. "All of those things combined together — what consumers said was, 'We are relying on our financial advisor to fill in the gaps on tax planning.'"