Amid policy uncertainty and market volatility, financial advisors' confidence levels sank to new lows this month.

That's the overall sentiment reflected in the April

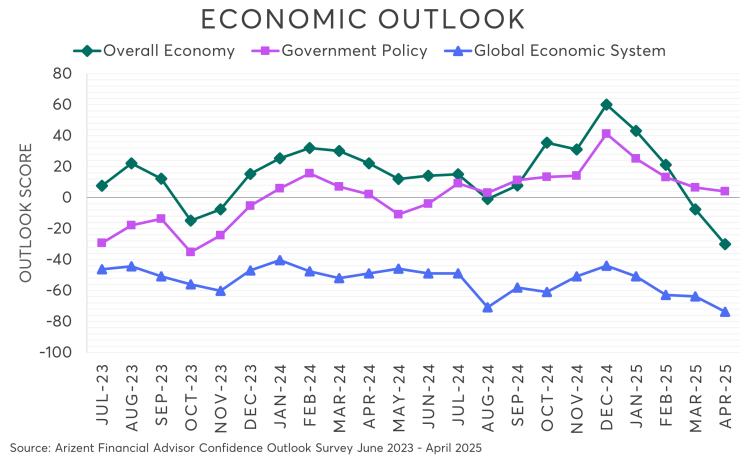

After last year's elections, advisors' overall confidence bounced upward, reaching all the way to a score of 24 in December 2024. But those gains were short-lived, dropping to a staggering minus-16 by March.

The landscape looked even bleaker this month, as the overall confidence score dropped all the way to minus-24, an all-time low for the survey. (By comparison, in April 2024, retirement advisors' overall confidence was essentially neutral, the score at 0.)

READ MORE:

However, month over month, the rate of decline in overall confidence slowed somewhat, dropping eight points after having fallen 16 points in January and 12 points in both February and March.

A main driver of this month's sinking confidence scores was the overall economic category, which tumbled from minus-8 to minus-30 — also the worst score yet recorded.

"The chaos in Washington, D.C. is causing the greatest impact on the emotional health of my clients at this time," said one advisor.

Just as they did

"Everyone is upset over [Elon] Musk and Trump," said another advisor. "No one can figure out what is going on and how long that will last. And, of course, the impacts of it. We live in an interesting time."

Given the

"The uncertainty surrounding future trade policies, both domestically and internationally, is making it hard to provide long-term economic forecasts in our current advisory practice," said one advisor. "This uncertainty affects our business outlook."

READ MORE:

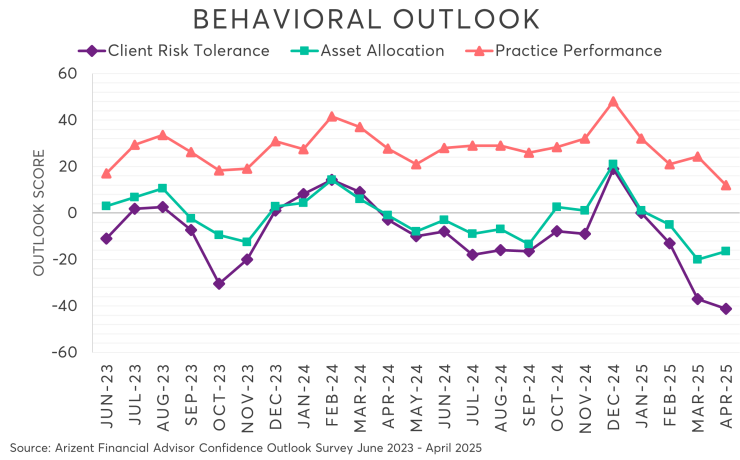

Client risk tolerance also took a hit, going from minus-37 in March to minus-41 in April, a record low for the category.

"We have to stay focused on the long-term, making sure our clients are invested in an appropriate way for their level of risk and their need for distributions," said one advisor.

Confidence in practice performance also reached further into the red than ever, dropping 12 points in April from 24 in March.

Some advisors cited a perceived threat from artificial intelligence to their practices as increasingly worrying, with one advisor saying the technology is leading "folks [to] thinking they do not need advisors as much."

Another advisor cited concerns over "innovation in AI to be used more in investment decisions."

Not every category achieved the all-time ignoble lows, though.

Despite concerns over market volatility and more, advisors remained relatively steady in their outlook on government policy, which dropped only slightly, from a 6 in March to a 4 in April.

"The White House is moving forward with real solutions, we just need 18 to 24 months and we will be past the initial wave," said one advisor.

Another advisor said they hoped for more clarity on which of the Trump administration's dramatic policy shifts would stand the test of time.

"It would be nice if I knew which governmental changes were going to stick instead of being rolled back," they said.

While one advisor said they were a supporter of both Trump and Musk, "the executive orders seem to be flying out very quickly."

"Therefore, there is no 'heads up' which makes info more difficult to gather prior to release," they said.

Asset allocations went from minus-20 in March to minus-17, the only category to see a change for the better.

"I'm very positive about the outlook," said one advisor. "Volatility is generally good for my industry. People have less confidence in their own ability and seek advice."