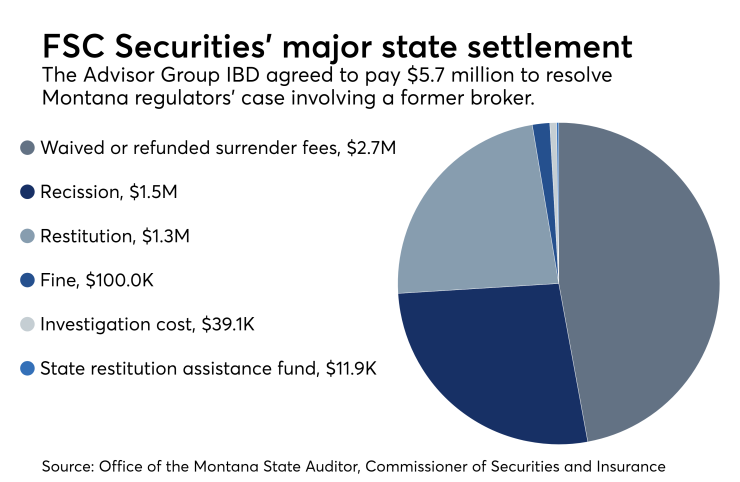

Advisor Group’s FSC Securities has paid the network’s largest regulatory settlement in at least two years after agreeing to a $5.7 million payout in connection with a fired and barred former advisor.

Barry G. Hartman sold his clients unsuitable products, as well as private securities that became worthless when a financial firm he beneficially owned closed its doors,

Atlanta-based FSC’s payout represents the biggest by Advisor Group since a $9.5 million

The largest independent broker-dealer, LPL Financial, disclosed

“This guy did stuff he shouldn’t have been doing,” Advisor Group CEO Jamie Price said in an interview in late April. “It’s 100% resolved, and I think Montana did the job that they’re required to do to protect the people in their state.”

Efforts to reach Hartman, 70, were not successful, and one lawyer who later represented Hartman and Invizeon in bankruptcy proceedings didn’t respond to requests for comment. Another lawyer who represented Hartman before FINRA declined to comment.

The Feb. 15 consent

-

Jamie Price doesn’t expect the firm's advisors to have any problem with a new standard after taking steps to comply with the more restrictive DOL rule.

April 20 -

The Advisor Group IBD added three new teams, but state regulators required enhanced oversight of one new recruit.

April 4 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

FSC had cited Hartman’s “participation in an undisclosed outside business activity and an undisclosed private securities transaction” as the reason for his March 2015 termination, FINRA BrokerCheck shows. FINRA

Missoula-based Hartman filed for bankruptcy protection in October 2015, but a bankruptcy judge discharged his nearly $1.4 million in unpaid liabilities three months later. Invizeon’s proceeding remains pending, with the shuttered firm reporting almost $9.9 million in liabilities in a January 2017 filing.

The firm’s bankruptcy application lists it as a finance or insurance firm. Reports from clients, FSC’s Form U5 termination filing and several arbitration cases resulted in the investigation by Montana regulators into Invizeon and Hartman, says Deputy Securities Commissioner Lynne Egan.

“The positions were not held at FSC Securities,” Egan says. “If your money seems to be leaving the firm and going elsewhere, it could be a red flag.”

Egan declines to state further details about the Invizeon offering or any possible criminal referral of Hartman’s case. A spokeswoman for the U.S. Attorney’s Office in Montana said she could not confirm or discuss any criminal investigations.

The SEC had alleged in March 2016 that FSC and fellow Advisor Group IBDs Royal Alliance Associates and SagePoint Financial steered mutual fund clients to higher-cost share classes. In a similar case earlier this year, the SEC

Both the SEC and FINRA have

The four Advisor Group IBDs agreed with FINRA to pay total fines of $400,000 and restitution of $1.3 million in December. Like the other firms, FINRA had

The compliance team of Phoenix-based Advisor Group completed a full review of client accounts to determine which clients had been entitled to the break on fees but hadn’t received them, Price says. Some mutual funds allow a charity that’s part of a household to receive the waiver, while others do not, he notes.

Any time the client “would have been in a better position in the same product set than we structurally allowed, we were all for that,” Price says.

The four firms also agreed to a $550,000 payment