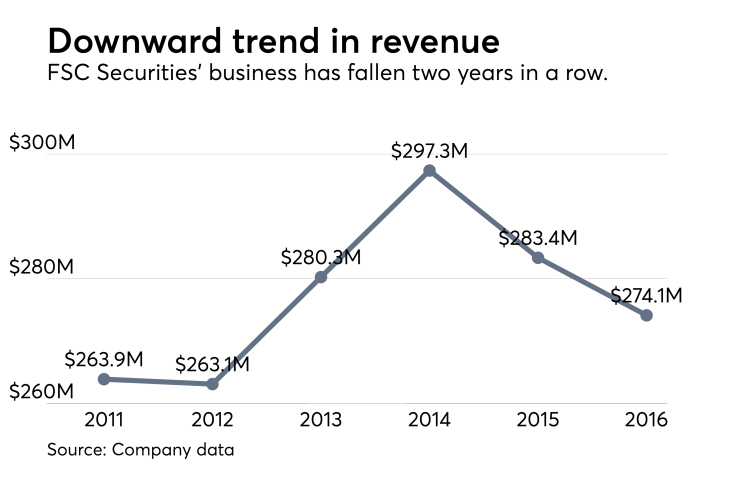

Fresh off a shakeup at the top, FSC Securities is poised to reverse its downward trend and enter “growth mode,” the company’s new CEO says.

“We’re very much focused on helping our advisors grow their business,” says Derek Burke, speaking in a phone interview last week after

Revenue at FSC — the third-largest of Advisor Group’s four BDs —

Burke, who last served as president of Waddell & Reed, assumed the new post after Jerry Murphy stepped down to become partner at one of FSC’s largest offices of supervisory jurisdiction. The new CEO discussed an upcoming digital strategy for smaller accounts, as well as the challenges facing IBDs.

“We’ve seen the change as opportunity,” says Burke. “It’s exciting that the firm is embracing the change and looking to exploit those opportunities rather than playing defense, which I don’t think is a long-term solution.”

-

Private equity-backed parent Advisor Group made the shakeup at a challenging time for IBDs.

September 13 -

After an abrupt exit from industry, Brown returns and reveals plans for the country's largest woman-run IBD, along with Lightyear's Donald Marron and Advisor Group's Erica McGinnis.

January 28 -

The IBD selects UBS veteran to become CEO

November 15

See which independent broker-dealers outpaced their peers at the top line.

BY THE NUMBERS

Roughly 1,000 of Advisor Group’s 5,500 brokers work for FSC, which reported 620 branches and 128 OSJs at the end of 2016. Representatives for FSC said Murphy, who had been CEO since 2011, was not available for an interview to discuss his resignation.

Murphy will remain in Atlanta and work remotely as a partner for FSC’s Houston-based OSJ, The Legacy One Group, according to managing partner Lea Goodman. The OSJ manages 63 advisors and 42 branches with $1.76 billion in assets under management, and Murphy will ensure an orderly succession, she says.

“Jerry will spend the next year or so recruiting, learning how we do business, and getting better acquainted with our advisors,” Goodman says an email. “It will make for a smoother transition when the time comes for me to waltz into the sunset. He will be perfectly ready to assume that role.”

CHALLENGING TIME FOR IBDs

FSC and firms like it have faced difficulty in shifting to advisory services from commission-based products, according to consultant Tim Welsh of Nexus Strategy. The fiduciary rule and the influx of robo advisors made for a “double whammy” on IBDs, but Burke’s expansion pledge is realistic, Welsh says.

“They’ve done all the retrofitting and re-engineering, so it makes sense that they could go to growth mode,” he says. He notes Advisor Group’s

Jamie Price, the onetime head of UBS wealth management Americas, became Advisor Group’s CEO

Lightyear’s previous ownership of Brown’s former firm, Cetera Financial Group, gives some advisors doubts about Advisor Group, says recruiter Jon Henschen. The PE firm sold Cetera in April 2014 to RCS Capital, whose

“I kind of have a hard time trusting private equity, they’ll say one thing and do another,” Henschen says. “They’re not in there for the long haul.”

On the other hand, Henschen says firms with insurance company ownership face a similar long-term issue, and he praises PE firm Stone Point Capital’s

Representatives for Lightyear said no one was available to discuss FSC’s appointment of Burke.

CEO COURTSHIP

Burke, 54, who declines to discuss his reasons for leaving Waddell & Reed earlier this year, worked with Price at UBS and knew Brown before taking the job at FSC as well. The two sides went through a “fairly short courtship” before the appointment, he says.

The new chief will unveil the company’s tech offering at Advisor Group’s conference next month in Orlando. While Burke describes it more as a digital strategy than a robo advisor, the tool will provide an easier way for FSC advisors to take clients with as little as $5,500 to invest, he says.

For now, establishing a relationship with the firm’s advisors represents Burke’s top priority, he says.

“I want to get out there with the people who I believe are my clients,” Burke says. Doing so, he adds, will allow him to “communicate some of the good work going on here and help them understand how we can build their practices.”