Busy doesn’t quite sum up Jamie Price’s first year as CEO of Advisor Group. Among his many challenges, the firm, which split off from AIG in 2016, had the herculean task of readying its network of independent broker-dealers for the first phase of the Department of Labor’s controversial fiduciary rule. Advisor Group also introduced flat fees for its advisory and brokerage platforms and launched a low-minimum advisory account for clients called Genesis Direct.

The new year will not bring respite. Executives in all industries are scrutinizing company culture as employees speak out about sexual harassment at work. Robo advice is pressuring fees and margins and bitcoin’s rapid gain has advisors taking cybercurrencies more seriously.

Price's candid responses to six rapid-fire questions in six minutes follows. Answers have been condensed and edited for clarity and flow.

FINANCIAL PLANNING: First up, what’s your take on cybercurrencies such as bitcoin?

PRICE: It’s way early in the process but there will likely be a cryptocurrency capability, whether it’s bitcoin or something else. The technology that it runs on — blockchain — presents lots of interesting opportunities across a wide spectrum of the financial services industry, beyond the actual currency itself.

On the investment side, we’ll just say it looks kind of speculative to me.

I think it’s way early to be placing bets on what kind of cryptocurrency [will become commonly used], or whether bitcoin is the one. But I think everybody believes, and I do as well, that digital currency is going to have a place.

The technology it runs on holds more interesting possibilities for the financial services industry, to essentially disaggregate value chains and repackage them up one at a time, in a more efficient way.

Financial Planning: What are your thoughts on robo advice?

PRICE: Absolutely going to become mainstream. Advisors will be using it, and the largest use of robo technology over the next five years will be in the hands of mainstream advisors that work with investors.

We are building our own digital platform. It’s one of our big strategic initiatives. We have a four-party agreement with Jemstep Advisor Group, Envestnet and Pershing. And we are fully integrating all of our account opening processes to go paperless from the start. And inside of that, there will be a robo platform that can be leveraged with various clients to the full or partial degree that you want to leverage it. It will be integrated right inside of our platform as a robo offering.

FINANCIAL PLANNING: Your take on sexual harassment in the financial advisory space?

PRICE: I think there will be a lot more training and education. The first questions that have to be asked are: how diverse is your company — both within the top leadership and throughout? And how do you actually get open dialogue happening inside of a company, in a trusting way, where you as a company can decide the culture that all employees want to live by and hold their standard up to?

We certainly are doing that through our cultural values, and through some of the training and education we plan to do this year. This also includes possibly doing something for advisors. They could leverage the capabilities we have to help their own training and education efforts throughout their own independent organizations.

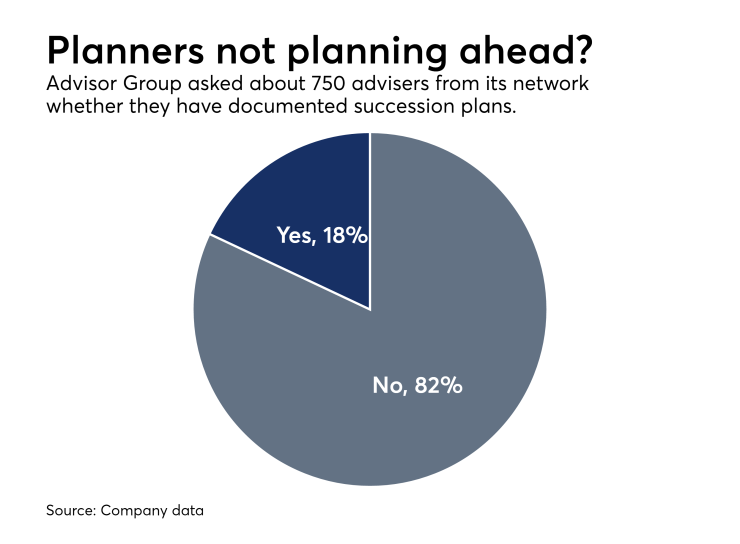

FINANCIAL PLANNING: What are your thoughts around succession planning?

PRICE: It’s a question of risk management. If you were working in a big company and didn’t have one in place, you’d be doing a disservice to your clients and the viability of your practice. I think everybody should have a succession plan. The question is, how robust does it need to be? If you’re within 10 years [of retiring], you should have a plan in place. Your clients deserve it.

Mysuccessionplan.com just launched. We had a subscription rate goal and we’ve exceeded that. We believe there is a big opportunity to help advisors who — over the next year — either want to slow down and/or want to have a succession plan in their business. This ultimately could end up in a sale of the business, but may just be a succession that’s before a sale.

We want to be the firm that is viewed as providing capabilities for them to do that seamlessly, and quite frankly, to be able to do it in a way that gets at the soft issues first.

This is a legacy question, first and foremost. How do they find like-minded individuals who will continue to handle the clients that are near and dear to their hearts? Who live in the communities they work in? Who are philosophically aligned — culturally and investment philosophy-wise — how they want to handle clients? And finding that match first is the key before money or anything else comes into play.

So, our platform is built around anonymity, and being able to go in and find a cultural fit first, and match buyers and sellers in a more elegant way. And then of course we have our whole succession planning department that helps facilitate that in a hard way, meaning contracting, build philosophy, how you value businesses, etc.

FINANCIAL PLANNING: Your strategy around fees and charging clients?

PRICE: For us, it was simplifying fees. In other words, not having multiple types of fees but a flat fee where possible.

When we went to our singular ticket charges for advisors last year — $9 on advisory, $15 on brokerage — it was to do away with all those little nickel-and-dime fees: the conference fee, the mail fee, the statement fee. And have just a flat, one-time fee, which we’ve done.

Secondly, it’s transparency. More and more advisors are going to show the full transparency of costs, including what the advisor themselves is tacking on for their advice and what a client is truly paying all-in, no matter what the product is or what the choices of product are. Transparency leads to a level of trust and honesty, and it doesn’t preclude you from picking the right solution for an advisor. Even if it costs more, if it’s the right solution, it should perform as it is intended to do.

Transparency is a way for advisors to actually bring one more piece of value to a complicated issue with clients, to be the light that shines on transparency and openness, for clients to make better informed decisions.

FINANCIAL PLANNING: Finally, DoL?

PRICE: Obviously, we are in the impartial conduct standards now, which means we are in a fiduciary era, and have to operate as one.

Those standards are pretty clear, from June 9th. The rest of the bill got pushed out to June of 2019.

Our view is that the SEC is actively looking to pick up the mantle here and either work with the DoL, or create a fiduciary standard themselves that we hope will cross both qualified and non-qualified business.

FINANCIAL PLANNING: Those are all our questions for you, Jamie. Any other insights?

PRICE: This next year, the stuff we’re going to be talking to our advisors about is, what will the next five years look like? We believe fee compression is going to continue to happen, as you get more transparent, and new entrants like robo will allow clients to have scalable offerings for a price. I think advisors will be still hugely valuable, but they’re going to have to reorient their value proposition to be more all-encompassing. And they’re going to have to manage more assets in order to continue to grow.