It only took four months — and some haggling the day before the agreement — to negotiate one of the largest deals of the year in wealth management.

Despite hitting a speed bump when Advisor Group and Ladenburg Thalmann were closing in on an agreement, they cruised to a billion-dollar deal. Five days before the deadline of Advisor Group’s exclusive talks to buy Ladenburg, the private equity-backed network cut its offer to $3.23 per share from $3.50,

Even though the only other offer in the second round of bidding was $2.50 per share from a company identified in the proxy as “Party B,” Ladenburg’s board rejected the Advisor Group offer. The mystery suitor had mentioned a price of $4.75 to $5 per share months earlier, the filing shows.

Advisor Group — which itself had

While last-minute bargaining like this may be common, the agreement to create a nine-firm, 11,500-advisor network carries challenges. The deal “will be a transformative acquisition for Advisor Group but entails a complex integration,” according to Moody’s Investors Service.

In a Nov. 25 report about the ratings agency’s

The fact that advisors with the five Ladenburg IBDs won’t need to repaper client assets under any new custodians helps explain why there may not be any retention bonuses, according to Carolyn Armitage, managing director of investment bank and consulting firm Echelon Partners.

Most BD corporate matters don’t “have too much of an impact” on advisors’ day-to-day businesses, Armitage says. She points out that Ladenburg has a low stock value,

“At some point, you need that breath of fresh air and that succession play,” Armitage says. “While change is uncomfortable for most people, I think this will be good for both organizations. It's more in the execution phase, as to how do they realize those synergies.”

KEY INTEGRATION QUESTIONS

Even though the nine IBDs will retain their separate brands, the combined network can create better economies of scale by merging some units involving operations, customer service, accounting and payroll, according to Armitage. Each IBD may not need full C-suite rosters, she says.

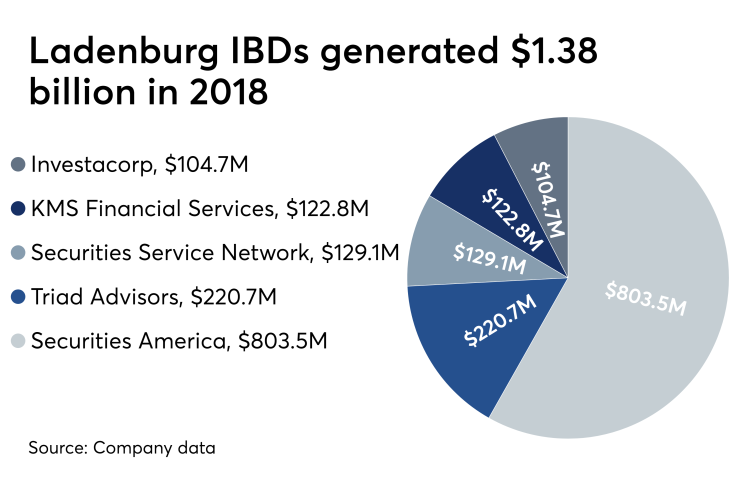

Describing Ladenburg as “a modestly profitable firm” that has benefited in recent years from rising interest rates and equities, Moody’s notes that the firm supports its 4,400 advisors with 1,500 employees. Advisor Group has 7,000 advisors and a little more than 1,000 employees.

The nine companies including Ladenburg IBDs Securities America and Triad Advisors and Advisor Group firms Royal Alliance Associates and SagePoint Financial have to remain apart “because, otherwise, that blows up the culture and everyone gets upset,” according to Michael Kitces.

“As long as there’s no repapering, that takes away 98% of the pain for the advisors,” says Kitces, who speaks at BD conferences and does business with them under his online payment firm AdvicePay. “I totally understand the purchase. Why did Ladenburg sell?”

At a July 8 meeting of Ladenburg’s board with its external counsel Sullivan & Cromwell and investment bank Jefferies, the members “discussed the company’s growth, performance, recent consolidation in the industry, and the risks of remaining independent, among others, as reasons for exploring a sale process,” according to the proxy for shareholders.

Consultant Larry Roth — a former CEO of Advisor Group and rival network Cetera Financial Group — declines to say if he advised either party during the process. But he says Ladenburg’s five IBDs generally have different management, technology budgets and operations.

“They didn't really have the scale to invest to the point that I think the management team and the advisors wanted them to invest,” he says. “Advisor Group has a back office that serves all the businesses...The Ladenburg firms will now be able to plug into Advisor Group's technology where it's helpful. And they're not going to do it, I'm sure, on a wholesale basis, but where it's helpful. And that won't be disruptive to the advisors.”

The

POST-DEAL COMPENSATION?

While the merger agreement

In addition, Ladenburg has provided the buyers with its standard loan agreement form, as well as listings of its outstanding loans and material litigation. Lampen and four other Ladenburg executives would get million-dollar “golden parachute” payouts if they’re let go after the merger.

Lampen stands

Representatives for Ladenburg and Advisor Group didn’t respond to requests for comment on whether the executives would leave after the close of the deal next year. The transaction is “proceeding smoothly,” Advisor Group CEO Jamie Price said in an emailed statement.

“No decisions have been made with respect to advisor retention bonuses, as at this point it is business as usual,” says Price. He’s slated to lead the nine IBDs, which he adds “will continue to enjoy industry-leading retention rates, in line with our proven commitment to supporting the growth of advisors’ businesses.”

HOW THE DEAL CAME TO BE

At the beginning of the year, Ladenburg’s board was examining its “share price, outlook and long-term prospects on a standalone basis,” the proxy states. After Party B suggested in February that management consider selling, the company tapped Jefferies to advise it.

The mystery suitor known as Party B is a “third party,” and the 18 firms who lost out to Advisor Group are “a mix of strategic and financial parties,” according to the document, which provides no further description. Ladenburg didn’t provide any more information about them after follow-up inquiries.

Regardless, Party B first approached Ladenburg about a potential deal earlier in the year, and, on March 26, it told management it was interested in paying as much of a 74% premium on Ladenburg’s stock price of $2.87 that day. The company asked for the potential bid in writing.

One week later, Party B let Ladenburg know that it was withdrawing from any discussions because it “did not then have the bandwidth to devote the necessary resources to pursue an acquisition,” the document says. Party B said it may be interested at a later date, though.

In late April, Ladenburg began a series of “new cost-savings initiatives to better position the company given the changing industry dynamics,” the proxy says. By its July meeting, the board decided to start the process of considering “strategic alternatives,” including a sale.

Of 19 parties who discussed a potential deal with Jefferies or management, 15 signed the necessary non-disclosure agreement to gain access to Ladenburg’s “virtual data room.” In addition to Party B and Advisor Group, two other suitors submitted written indications of interest.

The two others quoted prices as low as $2.30 per share and as high as $2.90 per share, while Party B informed Ladenburg that it might increase its bid above $2.50 in the second round. Advisor Group came in with the highest purchase price at $3.75.

In the second and decisive round of bidding in late October, Advisor Group counsel Eversheds Sutherland negotiated an exclusivity agreement. Advisor Group first reduced its bid to $3.25 per share before getting into the exclusive sale talks by increasing it to $3.50.

Just before a board meeting to approve the deal on Nov. 10, Advisor Group chopped the bid down again to $3.23 based on its due diligence, the proxy states. They were willing to allow Ladenburg to recover up to half of the lost price within two years after closing, though.

The board rejected the lower offer ahead of the Nov. 15 deadline on the exclusive talks. The following day, however, Advisor Group upped its offer back to $3.50 per share. Following the board’s approval, the buyers had their deal to create a nine-IBD network.

REVIEW FOR CREDIT DOWNGRADE

Moody’s set the value of the $1.3-billion purchase at a multiple of 13x to Ladenburg’s EBITDA, describing the price as “rich” in its Nov. 25 report on Advisor Group’s debt. The deal will delay Advisor Group’s deleveraging, especially given three interest rate cuts by the Fed this year.

“The changing macroeconomic environment will be an additional credit challenge during the acquisition integration,” according to Moody’s, which cites the importance of cash sweep revenue to IBDs amid the previously rising rates between December 2015 and July 2019.

Ladenburg’s 4,400 advisors with more than $90 billion in advisory AUM are credit benefits. But Ladenburg’s investment banking segment is “outside of Advisor Group’s traditional offerings” and boosts risk and earnings volatility with only moderate diversification effects, Moody’s says.

With a corporate family rating of “B2” on the higher end of risky issuers, Moody’s has

Advisor Group is “not surprised” by the review of its credit ratings, Price said in a statement. “Given our recent performance and an additional equity investment from Reverence Capital Partners, pro forma for the combination we expect leverage levels to actually be lower than they were at the close of our most recent financing on Aug. 1.”

LEVERAGE A CONCERN FOR ADVISORS?

At the end of the first quarter, Advisor Group had total debt of $1.6 billion and Ladenburg has $320 million in senior unsecured notes, according to Moody’s. Advisors should keep watch on how the combined firm approaches its “products, services and technology spend,” Roth, the consultant and former executive, says.

“Just pay attention to them, their actions and, to the extent that they make promises and they're difficult to keep, it could potentially be a function of their debt because they have to service that debt before they do other things,” Roth says. “But these firms are not going to fail because they're over-leveraged. The way the leverage works, that's not in the cards.”

The company’s credit rating — even if it does receive a downgrade — won’t pose an impact on recruiting and retaining advisors, according to Armitage. She’s interested to see whether the combined network could become a self-clearing firm like LPL Financial and Raymond James.

“It's all in the execution and the messaging for advisors,” Armitage says. “It’s an increasing bar that's not easy for them to continue to satisfy. You have to continue pushing the envelope for the excellence that you provide these advisors each and every day.”