A retirement portfolio is like a ship in the open water. It is exposed to a variety of potentially hazardous conditions, and its survival is a function of how it is designed and how it is managed.

To build a sturdy portfolio that will get clients as far as they need to go, it’s particularly important to understand the required minimum distribution guidelines that apply to almost all retirement accounts. It’s also vital to see what hazards face these accounts, and how advisers can address them.

The biggest single hazard is being underfunded. Without sufficient capital, a portfolio simply can’t stay afloat for 25 to 30 years unless the retiree makes undersized annual withdrawals. That won’t work if the portfolio is the retiree’s primary source of retirement income. The portfolio will capsize long before the retiree does. The problem of underfunding is not solvable by the adviser at the point of retirement.

Another hazard is known as sequence-of-returns risk, meaning that the portfolio returns are inadequate. If the portfolio experiences large losses in the early years, or just poor performance overall, its longevity is seriously compromised.

To avoid this hazard, advisers must build a broadly diversified retirement portfolio that enlists a variety of asset classes that tend to have low correlation with one another. In this way, a sequence-of-returns spectrum is created among the various components of the portfolio, minimizing the probability that all of the asset classes will simultaneously experience a poor sequence of returns. It is hoped this will ensure that the portfolio performance is adequate to meet the income demands of the retiree.

Another hazard is that too much money is withdrawn by the retiree, primarily when the client relies on an overly aggressive withdrawal rate. Sometimes, this might result from ignorance; or it’s possible the retiree is simply unaware of what constitutes a reasonable withdrawal rate. It assuredly leads to premature insolvency. Interestingly, this is where the RMD factors in because the required minimum distribution is, in fact, a pre-determined schedule of annual withdrawal rates that require the retiree to withdraw a certain percentage of the portfolio’s value.

THE REQUIRED MINIMUM DISTRIBUTION

In the words of the IRS, “The RMD rules apply to all employer-sponsored retirement plans, including profit-sharing plans, 401(k) plans, 403(b) plans and 457(b) plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs and Simple IRAs. The RMD rules also apply to Roth 401(k) accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.”

The

Clearly, a lot of retirees have investment accounts that are impacted by the RMD rules. And here’s the amazing part: the mathematics of the RMD virtually guarantee that a portfolio cannot be liquidated within 45 years. The required minimum withdrawal may be inadequate to meet the needs of the retiree in the later years, but that is a different matter. On the other hand, the stipulated RMD may be more than the retiree needs to spend that year, so the excess above their needs can be reinvested into a taxable investment account — or simply stuffed in a mattress!

The

Then, in second year, the divisor is 26.5, which is equivalent to a withdrawal rate of 3.77%. The divisor continues to decline annually until the 46th year, when it reaches 1.9, and the effective withdrawal rate continues to rise until it is 52.63% in the 46th year.

One important attribute of the RMD needs to be highlighted: The stipulated annual withdrawal is a percentage of the portfolio’s value. This is quite different from a non-RMD withdrawal rate schedule that is blind to the portfolio’s fluctuating account value from year to year.

For example, if a retiree has a starting account value of $1 million and the first year’s withdrawal is scheduled to be 4% with a 3% COLA (annual cost of living adjustment) the annual withdrawals are known in advance — regardless of how returns experienced by the portfolio. In such a case, the first withdrawal will be $40,000 and the subsequent annual withdrawals will increase by 3% ($41,200 in the 2nd year, $42,436 in the 3rd year, and so on).

For a retirement account governed by the RMD, the annual withdrawals are a percentage of the portfolio’s value at the end of the prior year, so the withdrawal could actually decline in a subsequent year if the portfolio experienced a heavy market-based decline. This built-in sensitivity to the fluctuating account value of the portfolio is why a portfolio governed by the RMD guidelines cannot be liquidated for 45+ years.

Three tests were carried out using the RMD table for the period 1970 to 2016, assuming a $1 million portfolio value at the start but making different assumptions about the performance of the portfolio. One test assumed a fixed annual return of 5%, another assumed a 5% annual loss, another assumed a multi-asset portfolio that tracked the actual performance of seven indexes during the past 47 years.

See year-by-year details of these tests here:

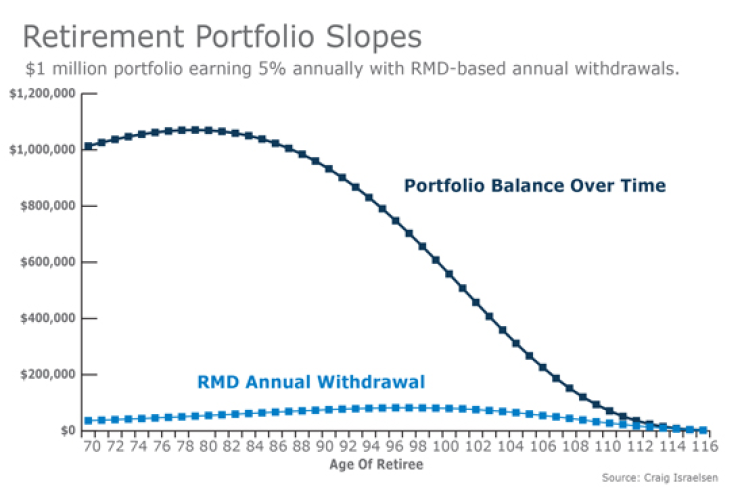

The performance of the portfolio with the fixed annual return of 5% is shown in the graph “Retirement Portfolio Slopes.” The numbers behind this plot reveal that a retirement portfolio that began with $1 million had $2,418 remaining when the retiree was 116 years old. A total of $2,527,806 was withdrawn over the entire 47-year period (since the annual RMD withdrawal is based on the account balance at the end of the prior year).

Let’s now assume a worst-case scenario in which the portfolio has a 5% loss each year. The portfolio still lasts for 47 years. The withdrawal made when the retiree was 116 years old was a whopping $9 and the ending account balance was $7. Nevertheless, the portfolio remained intact for 47 years.

A more realistic scenario is one in which the adviser builds a diversified portfolio for the retiree that consists of equal portions of large-cap U.S. stocks, small-cap U.S. stocks, non-U.S. stocks, real estate, commodities, U.S. bonds, and cash. (The indexes used in this analysis are shown in footnote of “Rolling Test.”)

The actual 47-year average annualized return for this portfolio in 1970-2016 was 9.75%. With this diversified investment portfolio, the retiree withdrew nearly $13 million if she lived to be 116 years old. By the end of her 90th year (a more likely age of death), the retiree withdrew slightly over $3 million and still had an account balance of over $4 million.

But, of course, this analysis considers only one particular sequence of returns that started in 1970 and ended in 2016. To get a more accurate picture of the survival characteristics of a retirement portfolio, we will need to study it over many different time periods, or rolling time frames.

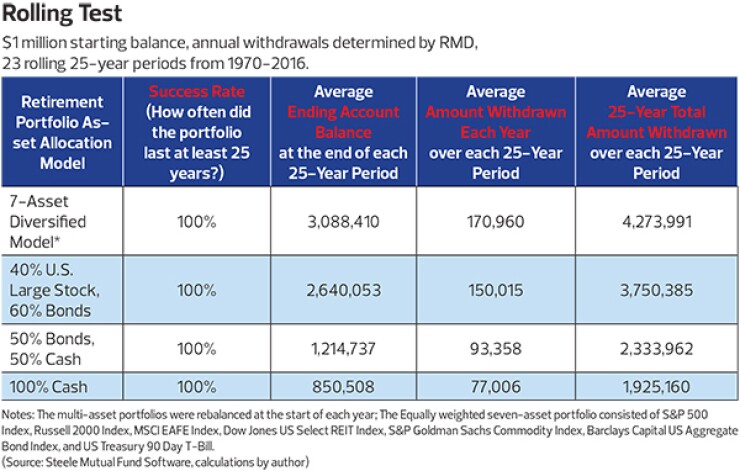

Furthermore, 47 years is a really long retirement period. More realistic is a 25-year retirement period from age 70 to age 95. Thus, the final analysis reported here will present the portfolio survival data over 23 rolling 25-year periods from 1970-2016. The first 25-year period was 1970-1994, the next was 1971-1995, and so on. The results are shown in “Rolling Test.”

LIVING TO AGE 95

If withdrawing only the amount specified by the RMD, the seven-asset diversified portfolio had a 100% success rate — meaning that it stayed intact for at least 25 years in all 23 rolling 25-year periods. The average ending account balance at the age of 95 was $3,088,410. The average amount withdrawn annually in each of the 23 rolling 25-year period was $170,960 and the average total amount withdrawn in each of the 23 rolling 25-year periods was $4,273,991.

Three increasingly more conservative asset allocation models were also historically tested: a 40% large cap U.S. stock/60% U.S. bonds model, a 50% bonds/50% cash model, and a 100% cash model.

We already know that any asset model employed will have a 100% success rate in surviving at least 25 years when using the RMD as the guide to annual withdrawals. Thus, when using RMD rules the asset allocation model does not affect portfolio survival, but rather the amount of money it provides the retiree each year. This suggests that the asset allocation of retirement portfolios need not be ultraconservative.

The annual portfolio withdrawal rate mandated by the mathematics of the RMD will naturally preserve the portfolio well beyond the anticipated lifespan of the retiree. Of course, if the retiree withdraws more than the RMD each year, the portfolio will not survive as long. But if the extra amount withdrawn is modest, it is still highly likely that the retirement portfolio will outlast the retiree, assuming a portfolio design that achieves a reasonable rate of return (something above 7%). Furthermore, if the RMD withdrawal is more than the retiree needs to spend that year, the excess above their needs can be re-invested into a taxable account—thus replenishing their retirement resources.

We observe that a more conservative 40% stock/60% bond retirement model had a lower average ending account balance (by nearly $450,000), a $20,000 lower average annual withdrawal (less money for the retiree each year), and an average total amount withdrawn over each 25-year period that was lower by over $520,000. The same pattern prevails as the portfolio becomes more conservative if using a 50% bond/50% cash model or a 100% cash model.

If your client withdraws only the amount stipulated by the RMD — and no more — then it is advisable to use an asset allocation model that is a prudent blend of equities (U.S. and non-U.S. stocks), diversifiers (real estate and commodities), and fixed income (bonds and cash). With the mathematics of the RMD as the safety net, build a portfolio designed for the long run because many retirees will have a long-run retirement.