WASHINGTON — Financial advisors who want to steer clear of client complaints, lengthy examinations by regulators and tough home-office inspections have an overlooked tool at their disposal: documentation.

Simple note-keeping to verify that advisors met regularly with their clients, discussed their investment objectives and made them aware of any fees and risks, furthers all three goals, according to panelists from FINRA and two broker-dealers who spoke in a May 21 session at the regulator’s conference.

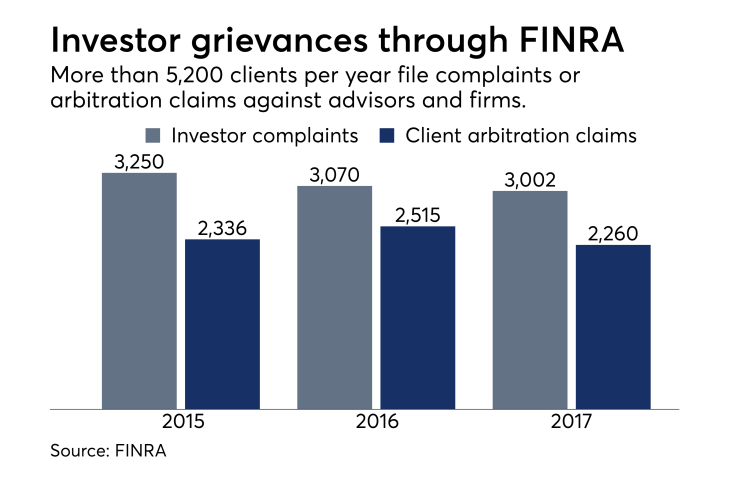

The stakes of documenting such interactions loom large given that FINRA

Registered representatives need to document their client interactions “to protect the firm, to protect the customer, to protect the rep,” Bill Bell, FINRA’s district director for its Philadelphia office, said at the conference.

“The more you document, the better it is for everyone involved,” Bell said. “Otherwise, what you run into is a ‘he-said, she-said.’”

Dan Stefek, the district director of the regulator’s Atlanta office, agreed.

“From the perspective of cause examinations where we investigate customer complaints, having good notes is often the best way for us to quickly move through those and really cut down on those types of investigations,” Stefek said. “We don’t really care how they’re kept, as much as they have that kind of detail.”

-

Firms are required to verify their procedures are reasonable, but they also must tailor their supervision to individual advisors, and sometimes that means crafting higher level of oversight for some people.

May 21 -

Integration, scalability and service model are key to selecting a vendor.

December 6 -

How often should CCOs pay a visit to branch offices?

April 23

Stocks and Puerto Rican bonds are the focus of many cases among clients, advisers and firms.

The methods of documenting talks with clients range from old-fashioned written notes to post-meeting review letters or emails to clients and electronic statements attached to client accounts within firms’ customer relationship management software.

Initial client questionnaires during the account opening process and forms ensuring clients and their advisors have discussed any complex products in full detail also provide important information, according to Mary Simonson, the chief risk officer of the 5,000-advisor IBD network Advisor Group.

The Phoenix-based firm is currently developing an online goal-planning tool for advisors and clients to fill out together in order to show how a particular product fits into their objectives. The interactive tool stems from the many changes undertaken by firms

Regardless of the method, however, advisors should leave out irrelevant details and make sure they aren’t just writing sparse information, she pointed out, recalling instances where she has “seen pages of notes that say nothing” and useless entries such as “met with them” or “had lunch.”

“We don’t really care what salad dressing you eat, we care about what you talked about, your investment objectives, your profile, any risks, any recommendation to either hold or not to hold, that has to be documented,” Simonson said. “Talk about that in your notes.”

Fee-based accounts also beg for good note-keeping, especially when there hasn’t been a lot of trading in them, according to Mark Cresap, the owner of an eponymous Philadelphia-area IBD with roughly 40 reps. Advisors need to document the investment strategy that explains the inactivity, Cresap says.

The documentation is especially handy when children question the performance of their parent’s account, the panelists said. Cresap told the story of a son who called his office “very unhappy” about the high-yield, blue-chip stocks in his mother’s account when equity markets were down.

All he had to do to appease the angry son was review the notes on his mother’s file over the phone, Cresap said.

“It was well-documented that this woman, who was older, fully understood equity risk and wanted to get high-yielding stocks with a possibility of dividend increases,” Cresap said.

“That was a situation where I have no doubt because of this guy’s tone during the phone call,” he continued, “that that would have morphed into a complaint if there weren’t notes on the system that were relevant and supported the investment objectives.”