My face was swollen from the pollen in the air, my legs were aching, it was hot and I still had 3 miles to go. This was the longest run of the year (18 miles) and my car seemed impossibly far away — and in that moment, my eventual objective of the Boston Marathon seemed even further than eight weeks out.

As a CFP and an avid runner, I see so many parallels between financial and athletic goals. I have run five marathons in the past six years, so I’m used to the routine of getting race-ready — I even achieved my ambition of qualifying for the Boston race, set for April 17. But even for experienced runners, it’s a daunting race.

Preparing is the real marathon. And running the race tests that preparation. It’s not so different from how many clients feel about retirement savings. Even if their income allows them to save, will they have the discipline to take advantage of the opportunity? What will they do when they reach the finish line — will retirement bring a sense of peace and fulfillment, or anxiety about what comes next? It’s our job to coach them.

For my clients, I try to emphasize the importance of preparation. Saving for retirement, financing a child’s college education, paying down a mortgage — they're all daunting, but an organized training regimen makes them achievable.

It is just as important for advisers to have a training regimen. We have the experience and training to help our clients, but we need an organized way to share that knowledge, and a step-by-step path for clients to achieve their goals. At Halpern Financial, our training regimen is our processes and technology. We document everything we do and that helps create a predictable, yet personalized standard of care. We use personalized deliverables to teach clients about the reasons behind our advice, and we provide online tools like Black Diamond and eMoney to help them track their progress. We also have in-person or phone meetings. These methods remind me of my own training regime. There is an overarching plan, and I can track my progress along the way.

Financial advisor Drew Boyer turned an accidental acceptance from a fire chief into a successful niche serving firefighters and police officers.

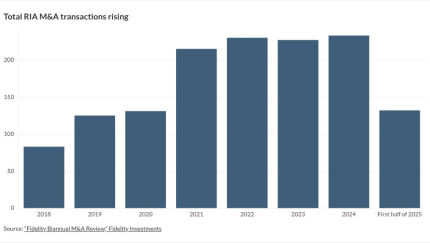

Private equity-backed M&A activity has steadily risen. Owners may do great in a sale, but what about advisors lower in the organization?

With unfounded rumors spreading that Osaic was about to buy its rival Cetera, a Texas-based headhunting firm started calling advisors to see if they wanted to move. Other industry recruiters say that crossed an ethical line.

Another important aspect of preparation is knowing that setbacks will occur. When I ran the Steamtown Marathon, everyone talked about the downhill first half where runners typically burn out their quads and either don’t finish or have trouble with the hills at the end. During the Baltimore Marathon, several potholes and hills meant I had to take extra care while running — and be mindful of my time. However, I had trained in all kinds of terrain, so even though it was tough, I felt prepared.

The same goes for times when a client has to dip into their emergency savings. It is not easy but having that safety net is invaluable. I often tell them to take advantage of the flush economic times in preparation for when cash flow might be tight. For example, we have some clients who have variable income because the majority of their compensation is from bonuses or commissions. We advise these clients to keep more than the traditional three months of expenses in cash reserves because we know some months will be better than others — and they can draw on those reserves during the tight months.

A runner shouldn’t approach the finish line without a post-race care plan — icing muscles, refueling, rehydrating — and a retiree shouldn’t clock out of the last day of work without having any idea of what to do the next morning. As an adviser I try to emphasize the importance of a distribution strategy, adjusting the asset allocation if needed, and managing the emotional part of retirement.

Unlike runners, there is no set finish line for our clients. It’s not as if they win the race by saving a certain amount within a certain time. But there are ways to help them keep going to the next goal. Runners will often ask ‘what is your PR (personal record)?’. To help my clients, I ask my own version. What is the number we are aiming for? College funding is one example where people often think of it backwards. They try to fit their budget to the cost of that dream college, rather than fitting the college to their budget. So I frame the conversation in terms of “What can you truly afford? Which colleges are financial safety schools for your budget?” This conversation can apply to various topics, but the bottom line is that we can help clients achieve sizable goals—we just have to help them plan for it in a realistic and systematic way.

For the average marathon runner, it’s not about how fast you get there. It’s about whether you feel strong and healthy by the time you reach your goal. So on that tough training run I just kept putting one foot in front of the other, with my eyes on the prize — feeling strong at Boston. And I hope that with the right training regimen I can help my clients feel that same sense of driven purpose to achieve their financial goals.