About four years after choosing a rival brokerage over the nation’s largest independent broker-dealer, a billion-dollar enterprise moved to LPL Financial.

Elite Financial Network, a Huntington Beach, California-based office of supervisory jurisdiction with 30 financial advisors and $1 billion in client assets, left Advisor Group’s Securities America to rejoin LPL, the firms

LPL and its competitors are ramping up their transitional services to large teams in an effort to reduce the disruption of switching firms. Its

It’s “a totally different firm than I recall four years ago,” Cairo said, praising the technology, marketing and compliance services from LPL’s corporate office as offering growth potential without the possibility of surprise M&A announcements about the brokerage changing hands.

“What I didn't want to get caught up in is having to do this again because it's forced upon me,” Cairo said. “I don't need bumps in the road hitting my car unannounced.”

As is typical in an OSJ transition, a portion of the enterprise’s business is staying with Securities America.

“We wish Elite Financial Group the best in their transition,” Advisor Group spokesman Chris Clemens said in an emailed statement. “We look forward to continuing to help drive growth and success for the financial advisors formerly with Elite Financial Group who have chosen to remain with our firm.”

Many large practices and enterprises have been switching their brokerages recently in search of greater flexibility with respect to products and enhanced layers of support with services such as estate planning, legal and tax strategies, according to Nancy DiBattista, Commonwealth Financial Network’s senior vice president for transition and field development operations. She leads a new team out of the LPL rival’s headquarters called its Virtual Transition Support unit.

“We're seeing a lot of bigger practices making a move,” DiBattista said in an interview last month. “We've got a team that fully supports all of our advisors, and it's just a matter of a phone call.”

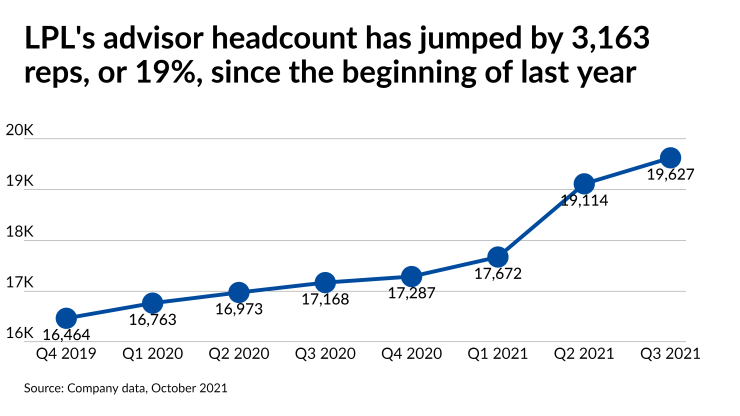

LPL’s mastery of such recruiting logistics has been paying dividends in the marketplace for talent. Out of 29 M&A and recruiting transitions

Elite’s move represents at least the second major enterprise to

“We are pleased to be their partner of choice as they continue to evolve their practice and deliver more value to clients,” LPL senior vice president of business development Ken Hullings said in a statement about Elite’s move. “We look forward to a long-lasting and successful relationship with Elite Financial Network.”

Cairo praised the leadership of LPL CEO Dan Arnold, who took over the role at the beginning of 2017. Elite formally affiliated with the firm on Dec. 15, according to FINRA BrokerCheck. As an advisor himself in addition to being the OSJ manager, Cairo looks forward to LPL’s staff handling accounting and compliance through its brokerage and corporate RIA teams. A 35-year industry veteran who will turn 61 years old next month, Cairo shut down Elite’s hybrid RIA two years ago to cut down on such tasks, he said.

“I just want to do what I do well, which is talk to clients, help them reach financial goals, speak to my advisors,” he said. “Life's good after that.”