Pretax profits for Raymond James' Private Client Group plunged 65% year-over-year, suffering under the fallout of a previously announced $150 million legal settlement, the firm said.

It was otherwise a strong quarter for the firm, which reported rising adviser headcount, record quarterly net revenue and assets under administration for the wealth management unit.

The year-over-year pretax profit drop to $29 million from $83 million was largely attributed to higher legal bills in the company’s announcement Tuesday.

The settlement with an SEC receiver resolved allegations that Raymond James had, through lax oversight, enabled

That also comes after Raymond James incurred tens of millions of regulatory penalties last year. FINRA fined the firm $17 million for

-

The firm is facing a lawsuit on behalf of investors who lost money in a $350 million Ponzi scheme.

June 1 -

The regulator says the firm had "widespread failures" in its anti-money laundering programs for both its employee and independent channels.

May 18 -

CEO Paul Reilly says the firm has hired new compliance professionals and is also working with outside attorneys in order to prepare for new regulations.

July 21

RECORD ASSETS

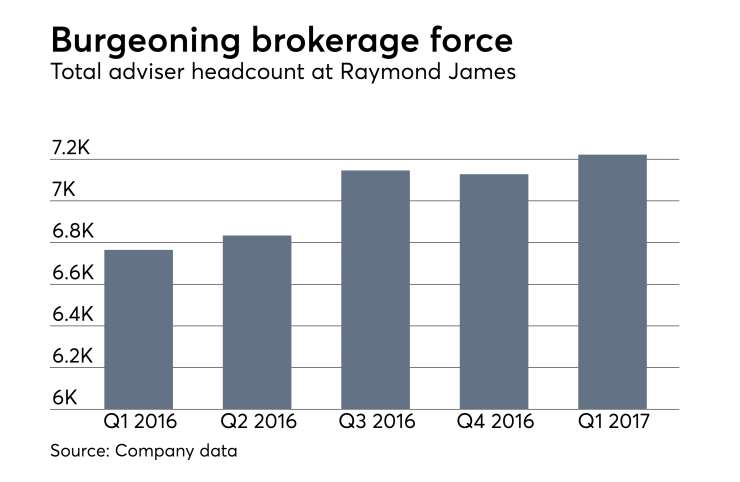

The St. Petersburg, Florida-based firm has kept up its recruiting momentum. Headcount climbed to 7,222 independent and employee advisers from 7,128 for the prior quarter. The firm's independent channel notched the strongest growth, with headcount ticking up 78.

The Private Client Group's assets grew to $611 billion from $485.6 billion for the year-ago period, a 26% increase. It was up 4% from the prior quarter.

The unit's fee-based assets also notched impressive growth, increasing to $260 billion from $196 billion, a 33% year-over-year increase.

CEO Paul Reilly credited the firm's recruiting efforts for the asset growth.

"The records we achieved for client assets under administration, financial assets under management and loan balances at RJ Bank should position us well for the second half of the fiscal year," he said in a statement.

Companywide, Raymond James' total revenues rose 23% to $1.6 billion, boosted by strong growth in securities commissions and fees as well as investment banking. Noninterest expenses, meanwhile, soared 25% to $1.4 billion. The fastest growing line item was "other," which mushroomed 265% to $163 million.