The pandemic dealt a heavy blow to parts of the economy last year, and the fund industry reflected the damage.

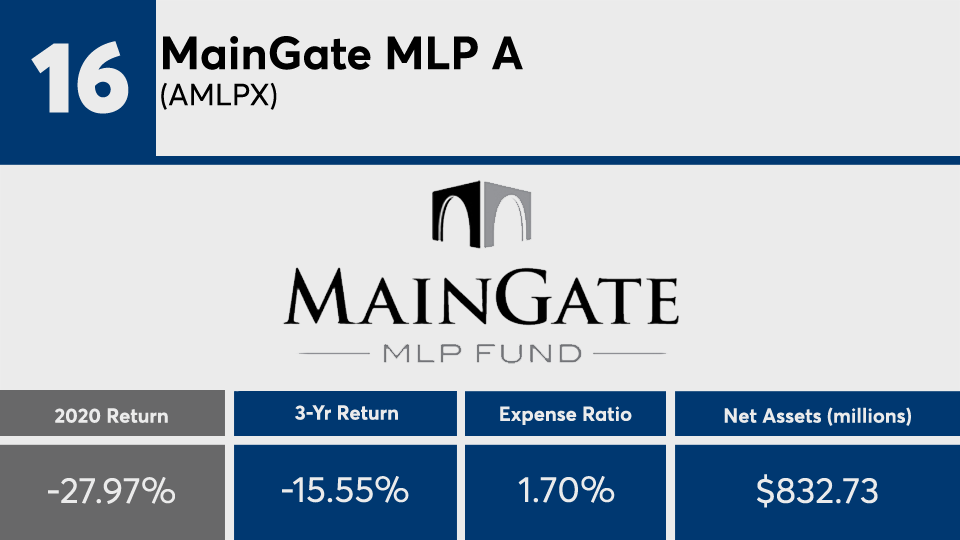

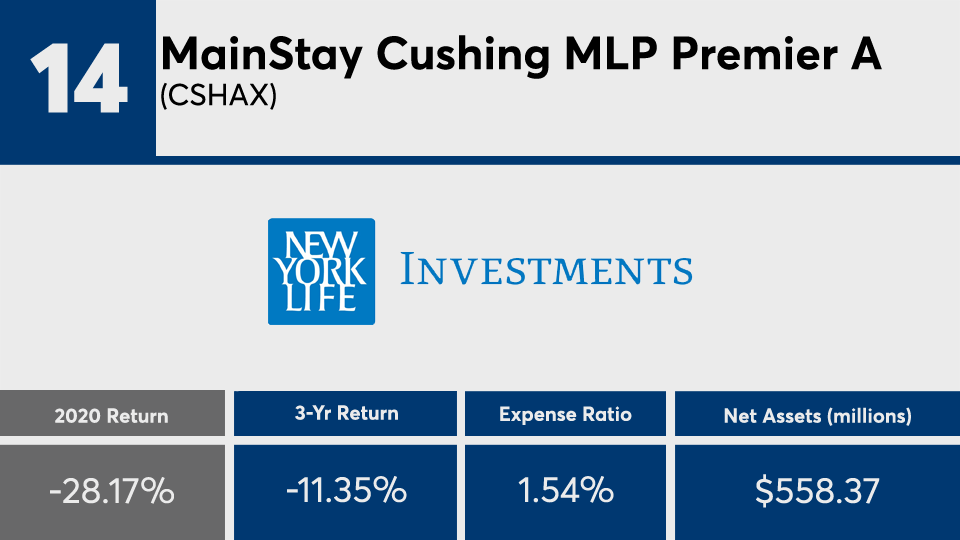

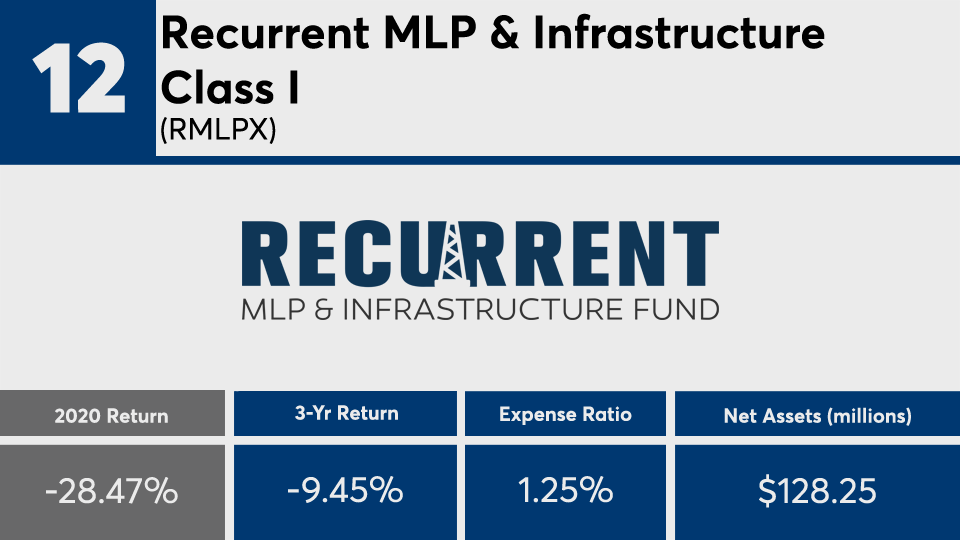

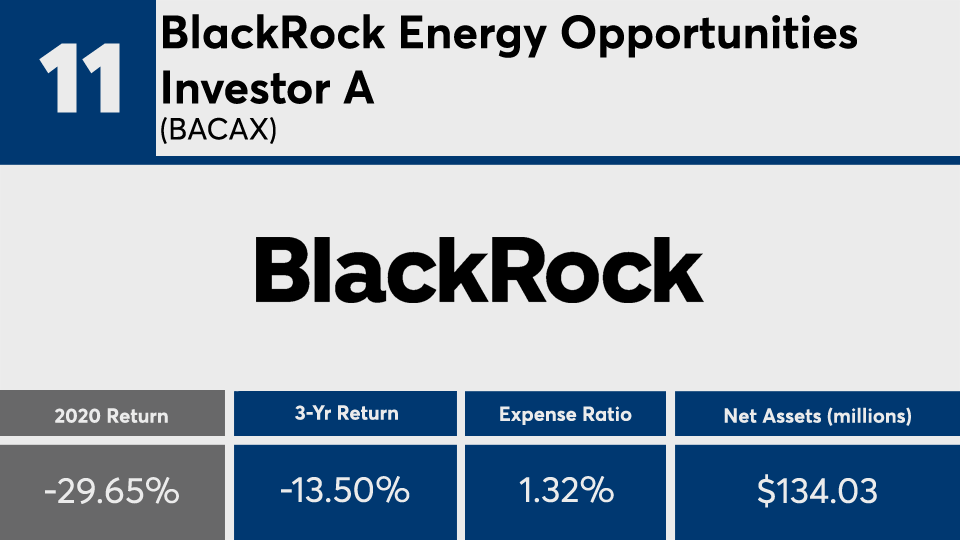

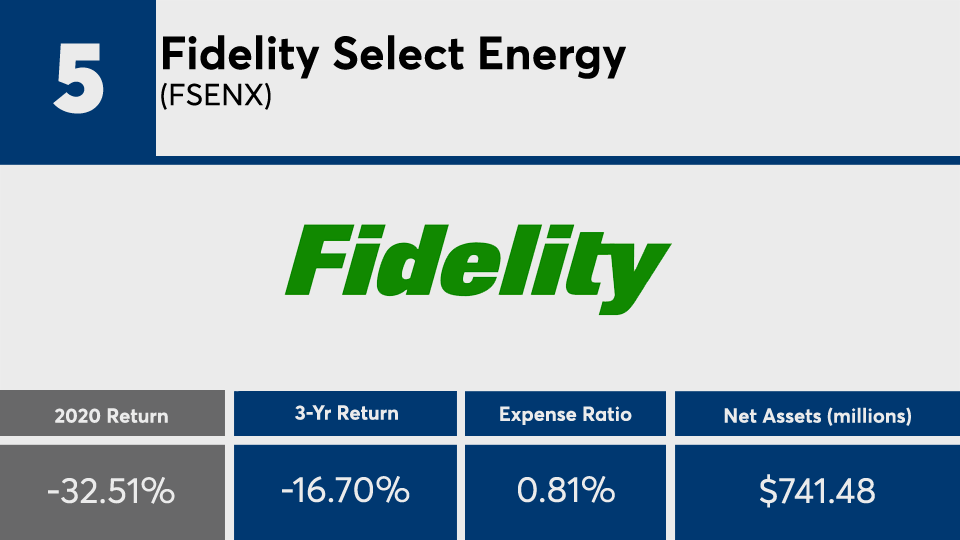

Analysis of the 20 worst-performing actively managed products of 2020 — with at least $100 million in assets — shows a more than 30% decline in those tracking sectors that suffered the most due to the coronavirus, Morningstar Direct data show. The lineup of mutual funds, almost of which weighted in energy and MLP sector holdings, also carried fees of as high as 170 basis points.

With the energy sector ranked among the worst-performers last year, with an overall 33% decline — and MLP’s down more than 29% — it’s no surprise that active fund managers tracking those categories had losses, says Amy Magnotta, co-head of discretionary portfolios at Brinker Capital Investments.

“The energy sector was already relatively weak entering 2020, and then declined further when oil prices collapsed during the initial months of the pandemic,” Magnotta says. “Stocks were unable to recover as quickly as other areas of the market as the demand outlook was weak.”

By comparison, index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) had gains last year of 18.4% and 9.62%, respectively, over the same period, data show. In bonds, the iShares Core U.S. Aggregate Bond ETF (AGG) recorded a 7.42% return in 2020, data show.

The active funds in this ranking came with fees as low as 0.25% to as high as 1.77%, data show. With an average net expense ratio of 121 basis points, funds here were more than twice the 0.45% investors paid for fund investing in 2019, according to

Although these funds have suffered over the near term, Magnotta says advisors with clients worried about their long-term standing can rest assured that short periods of underperformance are to be expected when considering an active approach.

“A financial advisor evaluating active managers for inclusion in client portfolios should seek out strategies that can consistently add value over a market cycle,” Magnotta says. “It is often helpful to evaluate this by reviewing rolling three-year and five-year performance versus a benchmark and peer group, and seeking out active strategies that have proven to add value over a majority of those rolling periods.”

Scroll through to see the 20 actively managed funds with the biggest losses of 2020. Funds with less than $100 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as three-, five- and 10-year returns through Jan. 22 are also listed for each. Minimum initial investments and loads are also listed when applicable. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.