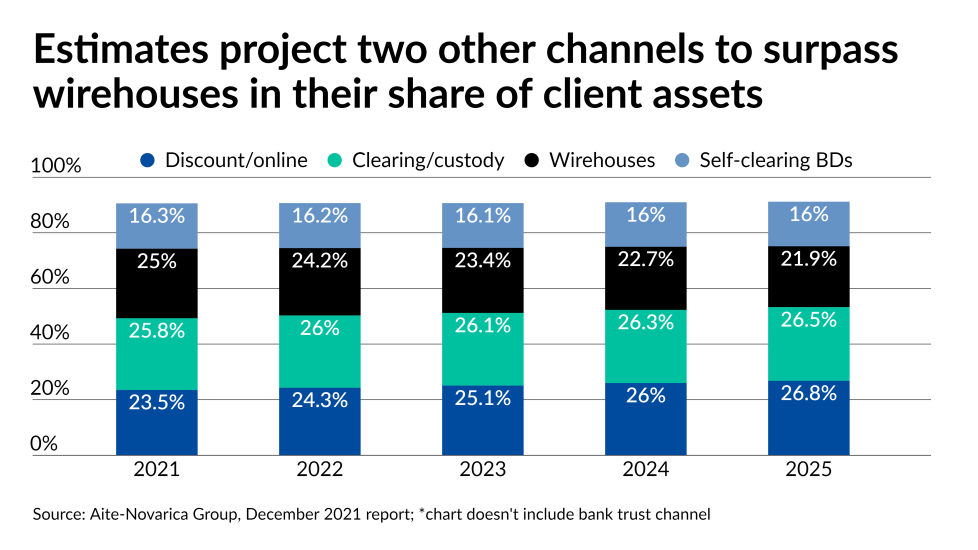

Wirehouses will give up the title of the wealth management channel with the most client assets by the end of this year and fall to third place by 2022, according to a new report.

Merrill Lynch, Morgan Stanley, UBS and Wells Fargo could stem the tide, however, with their investments in online brokerages, workplace retirement plans and remote advisor services for mass affluent households, consulting firm Aite-Novarica Group pointed out earlier this month in its latest

“You see clearly the uptake of online brokers gaining market share,” Pirker said. “You continue to see the wirehouses decreasing in market share by assets but increasing in profitability.”

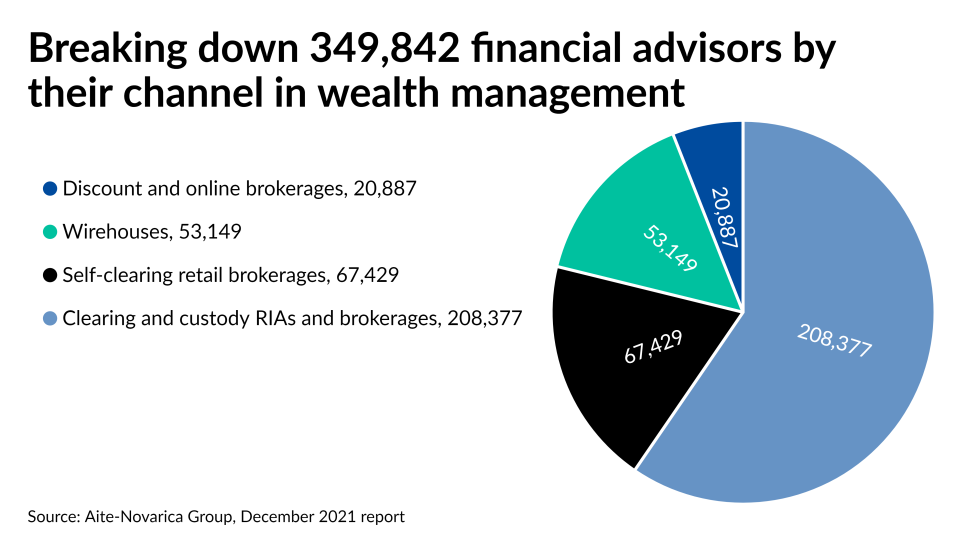

In its 10th year compiling the exhaustive study through public filings and asking firms directly for data, Aite-Novarica divided the industry into four channels: wirehouses; self-clearing brokerages (such as LPL Financial, Raymond James, Ameriprise and Edward Jones); independent RIAs and brokerages using external clearing and custody (for example, Focus Financial Partners, Hightower, Advisor Group and Cetera Financial Group); discount and online brokerages (Charles Schwab, Fidelity Investments, Robinhood and E-Trade) and bank trusts.

Just as in any measure of

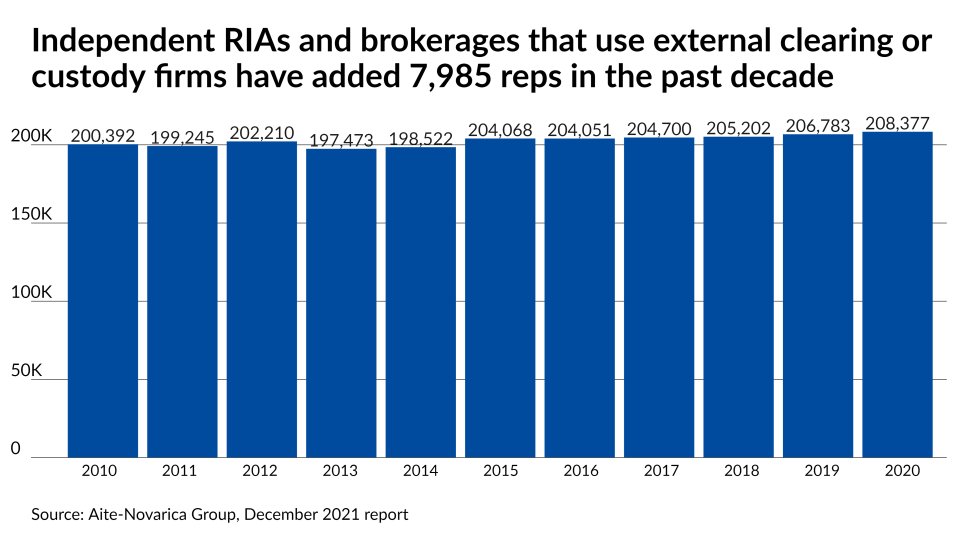

The growth in the number of reps and the amount of client assets would jump out of any report on the industry regardless of the various distinctions, though. The figures may surprise some observers in the way that they cast doubt on the industry’s conventional wisdom. For one, the wirehouses haven’t relinquished their position over the other channels in client assets, despite the increasing lure of independence that has depleted their advisor headcounts.

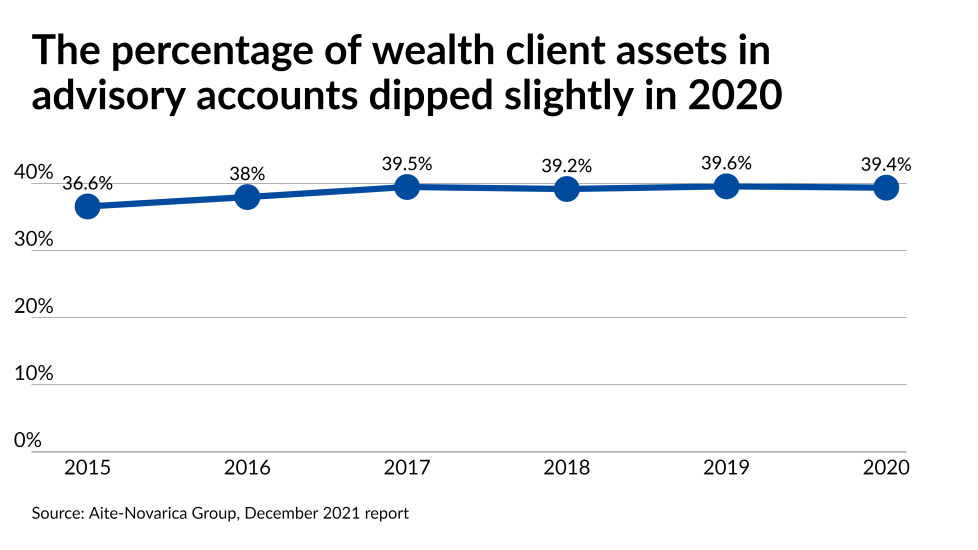

On another somewhat discordant note, the share of client assets in advisory accounts has remained roughly the same at 39% for the past four years. The common industry talking point would suggest that the share is at least at 50% or higher as firms gravitate toward recurring revenue and clients seek advisory services. After one evolution playing out over roughly the past 15 years with the rise of unified managed accounts, fractional shares and direct indexing are “changing fundamentally the way fee-based assets are being managed,” Pirker said.

“There are advisors who do business the way they've always done it,” he said. “The fee business largely has been an area of high net worth, but mass affluent was a bit harder.”

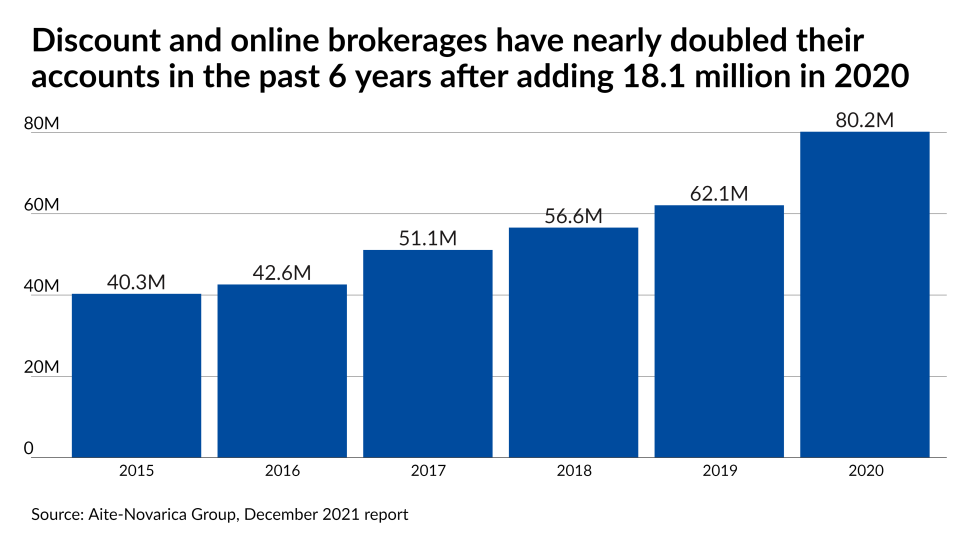

Regardless of the subtleties within this particular report, it follows others in reflecting the

“We definitely see every time there are these periods of uncertainty, RIAs are gaining market share because of that client experience,” Salvi said. “RIAs tend to provide an incredibly high-touch experience to their clients.”

The RIA consolidators and platforms who are supercharging the channel’s growth in many cases didn’t even exist 10 or 15 years ago. At publicly traded Focus, the firm has gone from zero assets at its founding by CEO Rudy Adolf, Chief Operating Officer Rajini Kodialam and Head of M&A Leonard Chang to more than $350 billion client assets across 82 partner firms. The firm aims to reach 125 partner firms and $4 billion in annual revenue by 2025,

“We had one conviction, and that is the fiduciary advice model,” Adolf said. “We’ve been proven right again and again over this 15-year journey.”

To see how RIAs stack up against the other channels of wealth management in terms of reps and client assets, scroll down our slideshow.

Note: All data are year-end 2020 figures from the Dec. 14