Corporate bonds stole the fixed-income show in 2019, outpacing nearly all government debt funds.

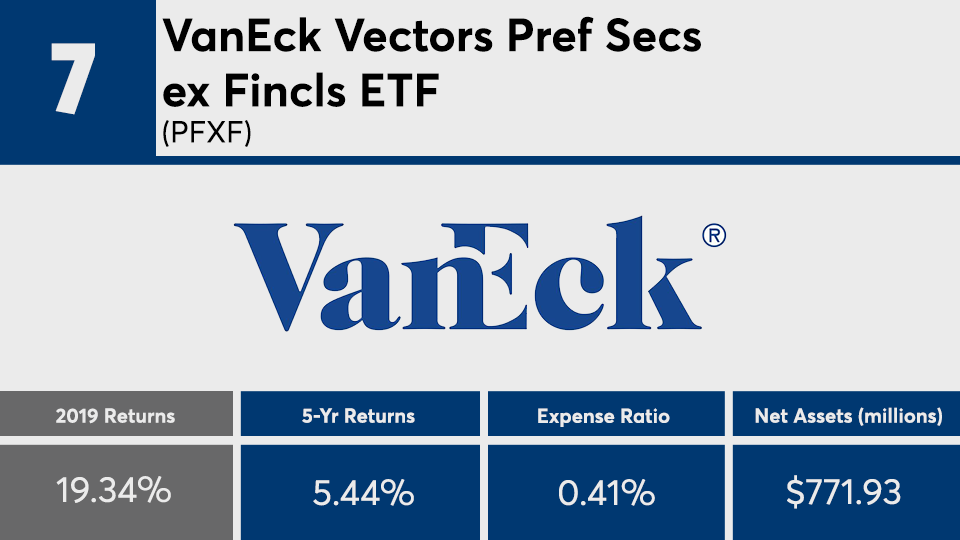

Riding the wave of market volatility and a tightening Fed, the 20 bond mutual funds and ETFs with the largest gains of the year posted returns nearly 10 basis points higher than the Bloomberg Barclays Aggregate Bond Index, data show. At 19.34%, their average return dwarfed the 8.46% gain posted by the bond market tracker, as measured by the iShares Core US Aggregate Bond ETF (AGG).

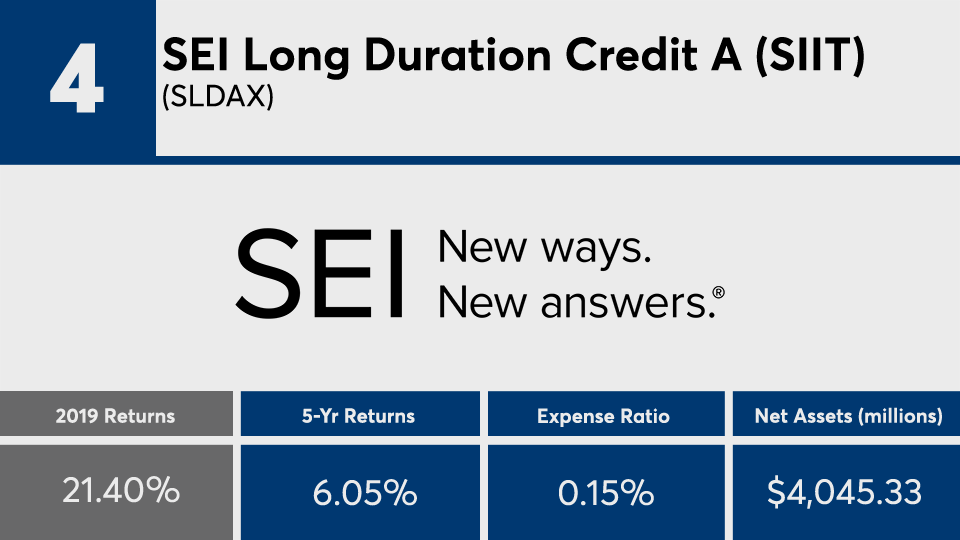

“The top-returning bond funds were those that benefit from falling interest rates, narrowing credit spreads or being lower on the capital structure,” says Greg McBride, senior analyst at Bankrate. “Long-term bonds see a bigger increase in price when rates fall, narrowing junk bond spreads.”

Just one of the year’s top-performers was comprised of government bonds, data show. Some preferred stock funds made their way to the list, however all of them met Morningstar’s fixed-income category threshold of 30% in bonds.

Fees were also lower than the broader fund industry. With an average net expense ratio of 0.33%, these bond funds were 15 basis points cheaper than the 48 basis points investors were charged, on average, for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The largest bond fund, the $248.6 billion Vanguard Total Bond Market Index Admiral Shares (VBTLX), had a 0.05% expense ratio and 8.71% return in 2019, data show. For comparison, the biggest overall fund, the $897.7 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), had a 0.04% expense ratio and a 30.8% return over the same period.

“The conditions that produced outperformance in 2019 will be difficult to replicate in 2020,” McBride warns advisors seeking similar results from the same strategies this year. “Long-term interest rates would need to fall to record lows and already razor thin credit spreads would need to further compress. Either is unlikely and both of those occurring is even more remote.”

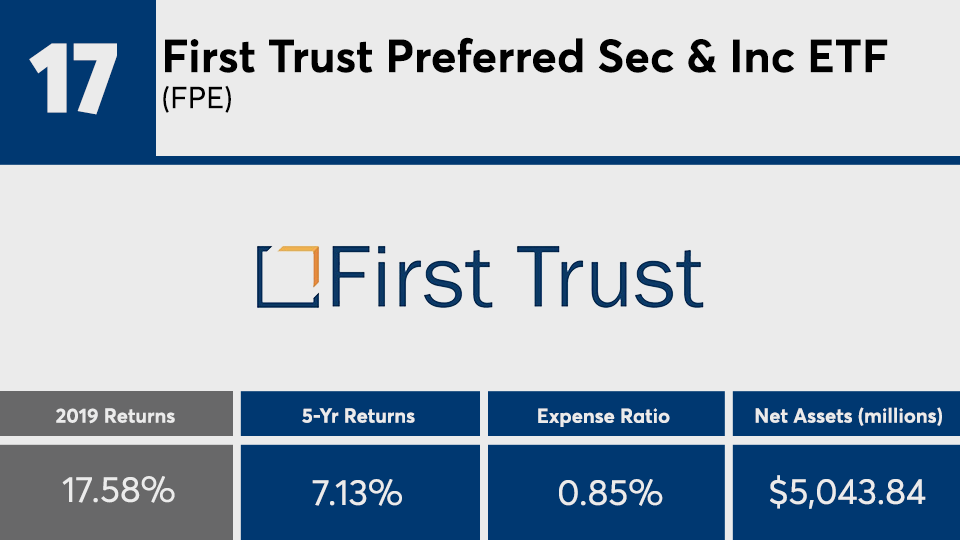

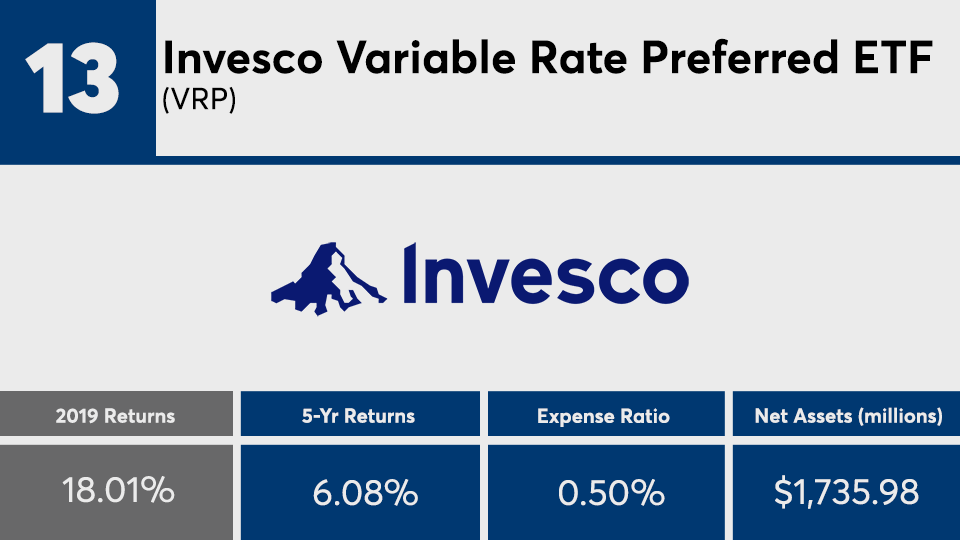

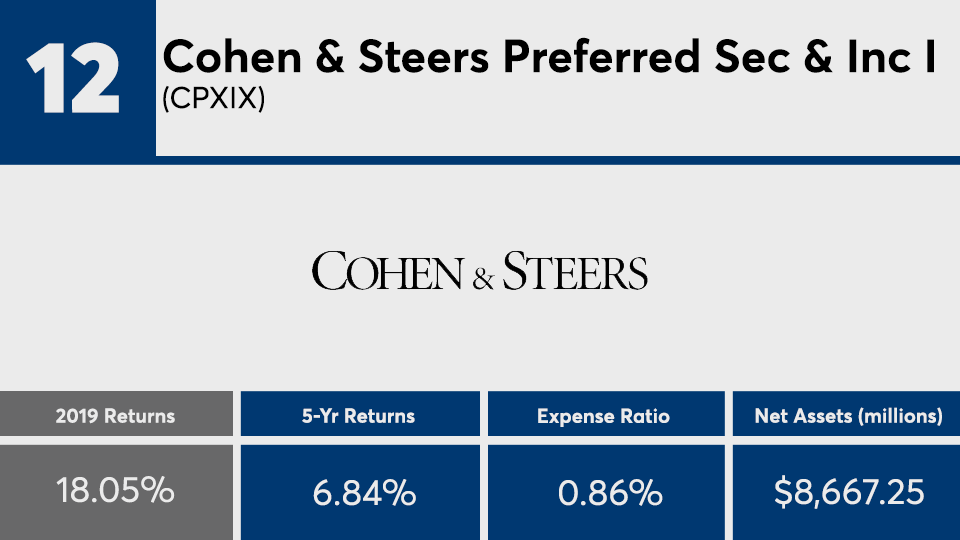

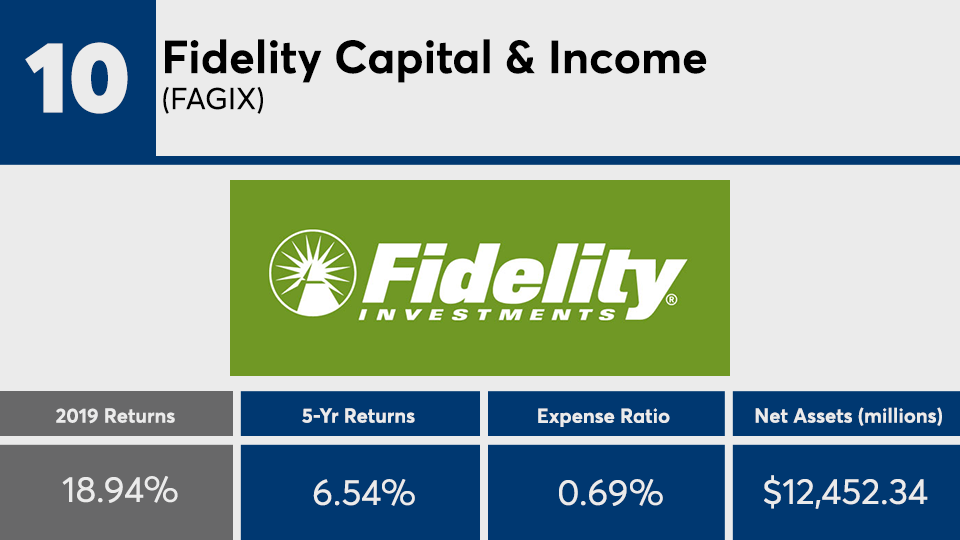

Scroll through to see the 20 fixed-income category mutual funds and ETFs with the largest gains as of 2019. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as three-year net flows and year-to-date returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.