When it comes to choosing mutual funds and ETFs, advisors and their clients, as well as retail and institutional investors, are increasingly making the same choices.

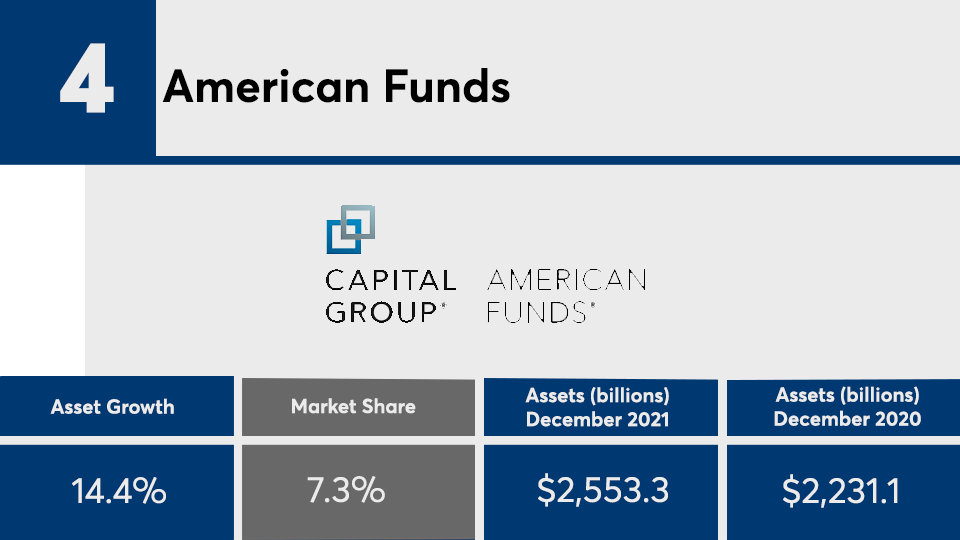

Fund flows data from Morningstar that FUSE Research Network analyzed shows that the same cast of 10 fund families were in the same top spots in December 2021

“The chart shows the majority of firms had strong asset growth in 2021 with solid market returns contributing to that growth,” said Alexander Ellwanger, a research analyst at FUSE in Needham, Massachusetts.

Mutual funds have long been king, but

Asad Gourani, an advisor whose AG Wealth Management is based in Ann Arbor, Michigan, said he picks funds for clients based on their objectives, not on the type of fund or the fund family. But when he goes looking for passive, globally-broad funds with low expense ratios, he often finds himself looking at funds from the largest families.

“Our main allocation currently is in ETFs rather than mutual funds given the simplicity and efficiency, and we currently rotate between Vanguard and iShares (by BlackRock) products given the expansive lineups of funds," Gourani said. "We could manually construct an exposure similar to an index we track while being able to take advantage of tax-loss harvesting opportunities as they come by."

Oversized?

Are the Vanguards and Fidelities getting too large to serve clients well?

“I don't see a problem with these companies becoming bigger and bigger, and see it as a net positive to investors as they are able to have many options for low-cost investing,” said advisor Erik Baskin at Baskin Financial Planning in Cheyenne, Wyoming. “These companies can't do it all, but they are a great option for the portfolios of most Americans.”

Index funds from the largest families, like Vanguard, Schwab and Fidelity, are actively traded, with low expense ratios, and they typically track the same benchmarks, Baskin said, meaning they make useful substitutes for one another when executing tax-loss harvesting. However, Baskin finds that the top funds aren’t as good at tightly targeted sectors like small caps or value stocks; he prefers Dimensional Fund Advisors or Avantis for those factors.

One problem with the biggest fund families is that they’ve been around a long time, meaning their funds – and the shares they hold – can have very low tax basis, said Mike Kurz, an advisor who runs OverShare Advice and Planning in Frisco, Texas.

“Active mutual fund structures as part of the large funds with tenure can often suffer from ugly embedded capital gains that can be magnified on the client’s tax bill when asset flows in these big funds turn negative and the managers are forced to liquidate old holdings with big profits,” Kurz said, comparing the effect to a client getting “stuck with the check after a dinner they didn’t get to eat.”

Scroll down to see which U.S. fund families ranked on top by assets at the end of 2021.