Analyzing the industry’s 20 largest funds is like looking through a time capsule. Returns for this group — comprised of mostly Vanguard and American Funds behemoths — reflect the growth and performance of the fund industry in the decade following the financial crisis.

With more than $4 trillion in combined assets under management, the 20 largest mutual funds and ETFs are nearly all actively managed and come from the same five providers; Vanguard, American Funds, BlackRock, State Street and Fidelity, Morningstar Direct data show. More than half posted double-digit returns over the last decade. It’s no surprise that these funds have benefited from steady post-crisis gains, says Greg McBride, senior analyst at Bankrate.

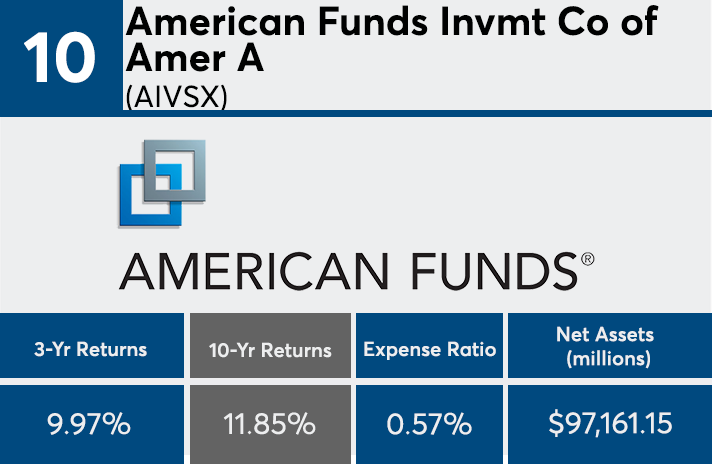

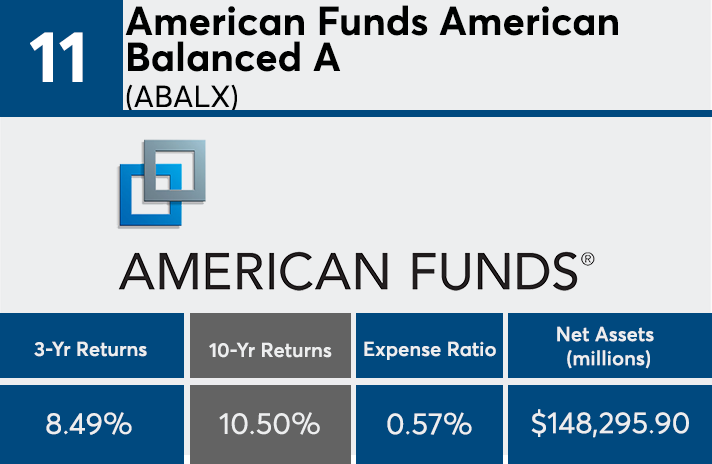

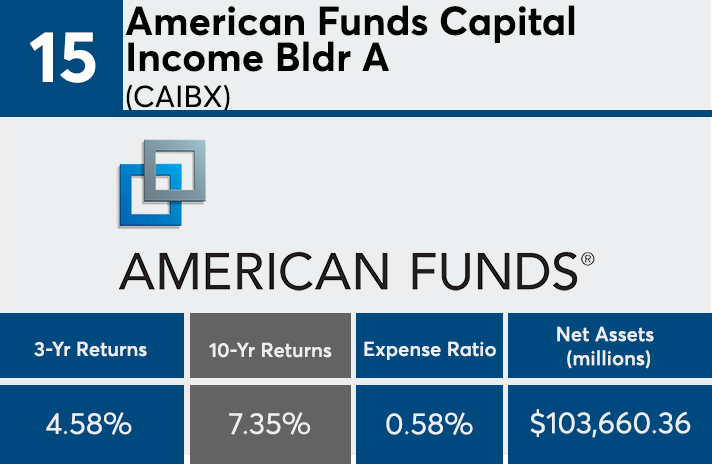

“The difficulty of actively managed funds to outperform index funds is revealed in these results,” he says. “Throughout a 10-year bull market, only one of the largest actively managed funds outperformed the S&P 500.”

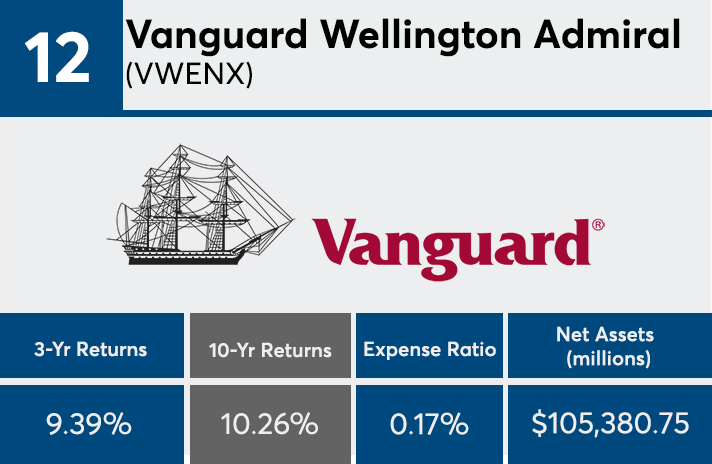

Although many underperformed the broader market, just over half of the funds posted double-digit gains. With an average return of 10.43%, these funds were outpaced by the Dow, which had a 10-year gain of 13.54% as measured by the SPDR Dow Jones Industrial Average ETF (DIA), and the S&P 500, which had a 10-year gain of 13.41%, as measured by the SPDR S&P 500 ETF (SPY), Morningstar data show. Nevertheless, Dan Culloton, director of equity manager research at Morningstar, says their returns over the long haul are nothing to frown at.

“It strikes me how much of these funds have double-digit returns,” Culloton says. “That speaks to the length and robustness of the bull market we’ve had since the near the bottom of the financial crisis.”

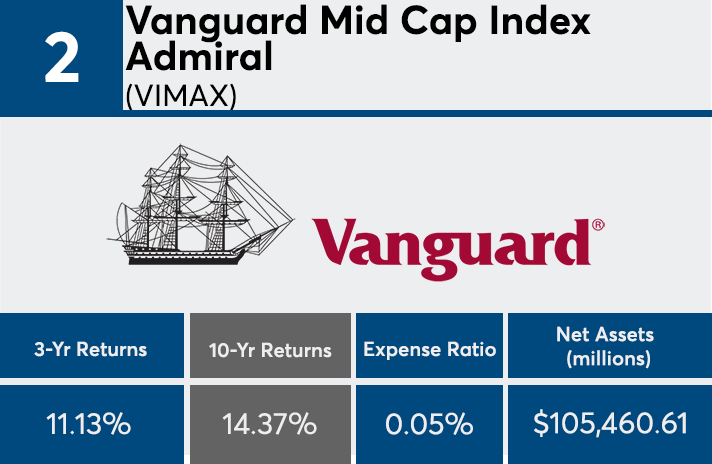

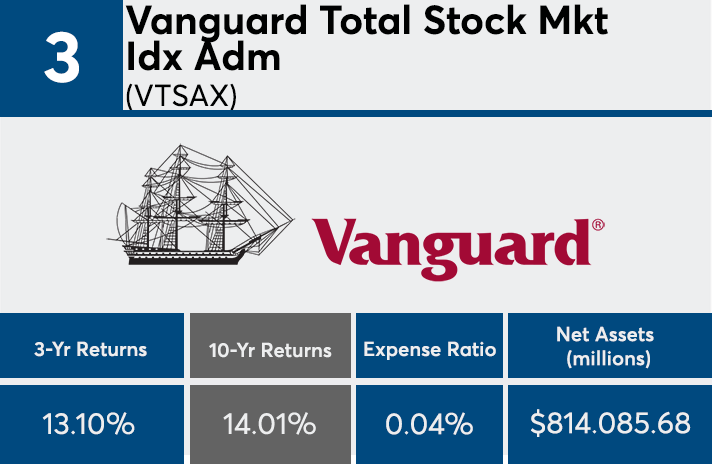

The average expense ratio among the largest funds is low. At an average of 0.35%, these funds are more than 10 basis points cheaper than the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. With $823.6 billion in AUM, the industry’s largest fund, the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), has an expense ratio of 0.04% and 10-year return of 14.01%, data show. If you ask McBride, their price has a lot to do with their stellar gains.

“How key are low expenses? The difference in expense ratio accounted for the performance gap between the market index and that of the third- and fourth-ranked actively managed funds,” McBride says. “It’s not how much you make; it’s how much you keep.”

Nearly every advisor has at least one client in any one of these funds. When considering how this list may look in the next 10 years — and how to talk to clients anticipating double-digit gains from these products again — Culloton says it's safest to expect the unexpected.

“If your fund is putting up very strong returns, thank God,” Culloton says. “Always realize the future is uncertain. The next 10-year period is unlikely to be like this past 10-year period, at least not without some hiccups or corrections, or even a bear market or recession. So, it’s important to adjust your expectations going forward, and maintain a balanced portfolio.”

Scroll through to see the 20 largest funds ranked by their 10-year returns through July. Funds with investment minimums over $100,000 were excluded, as were ETNs, leveraged and institutional funds. Assets and expense ratios for each fund, as well as three-year daily returns, are also listed. The data is based on each fund's primary share class.