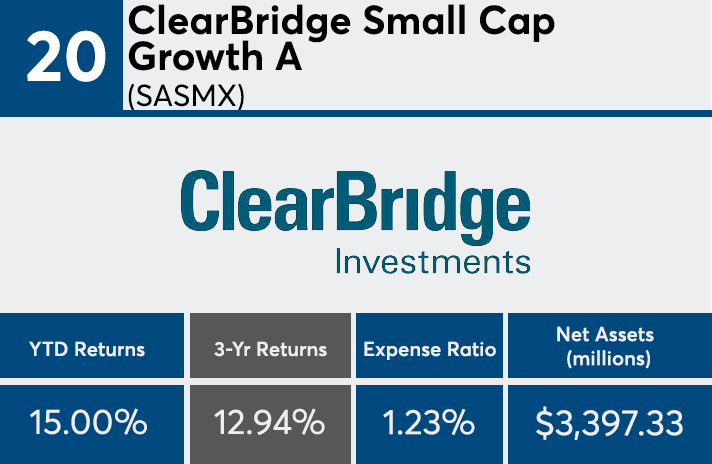

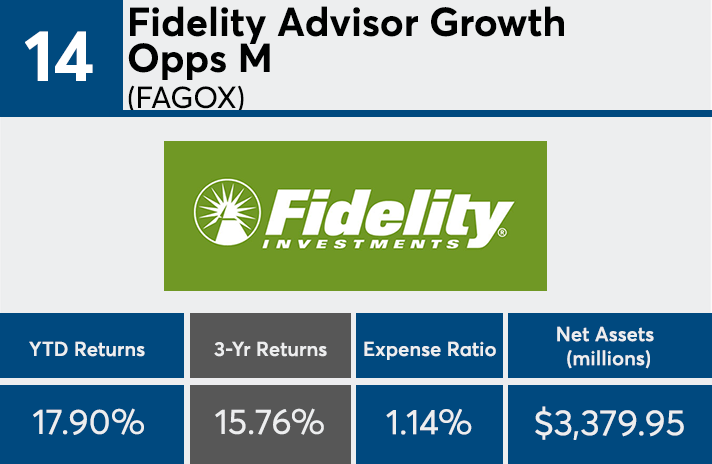

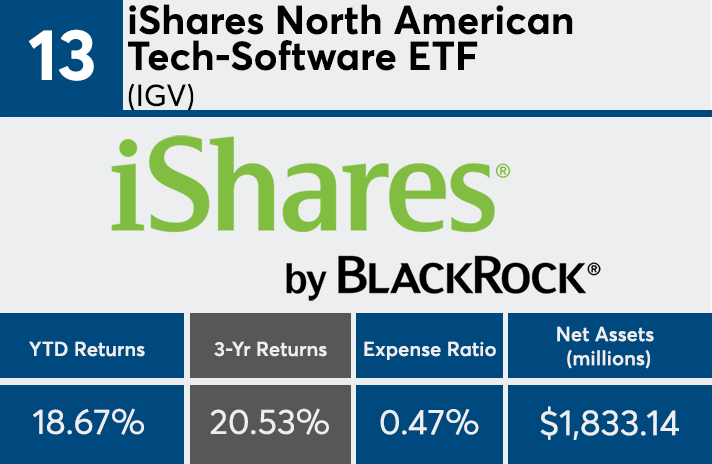

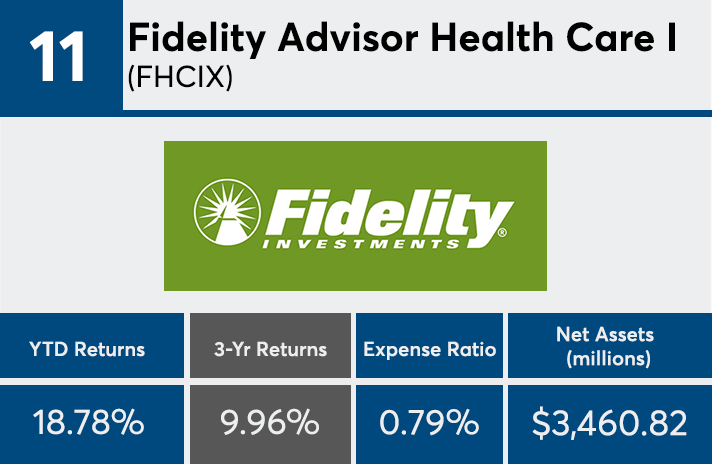

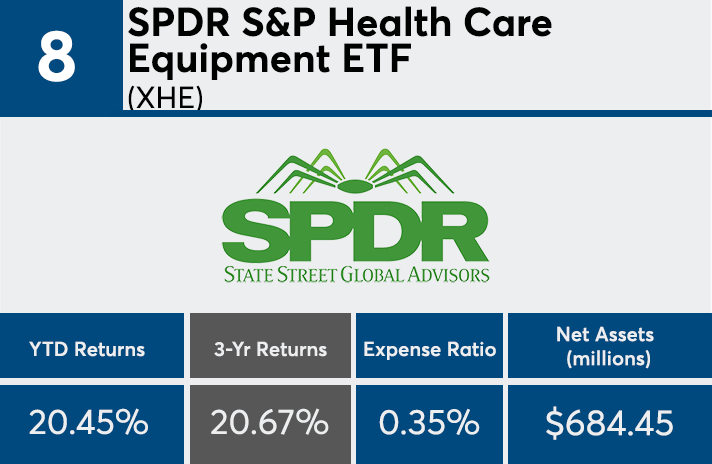

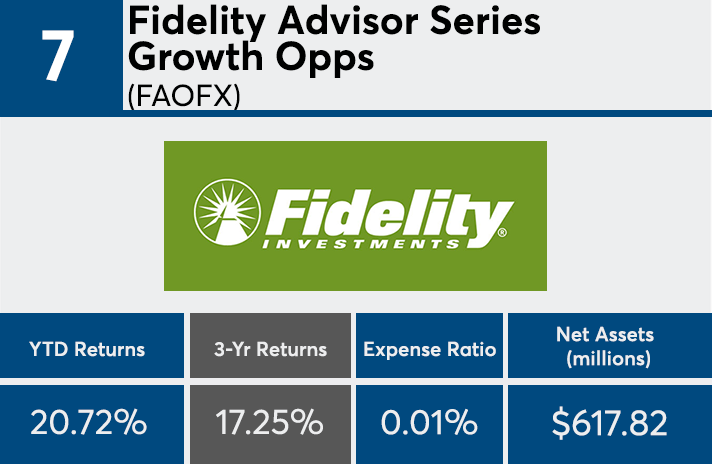

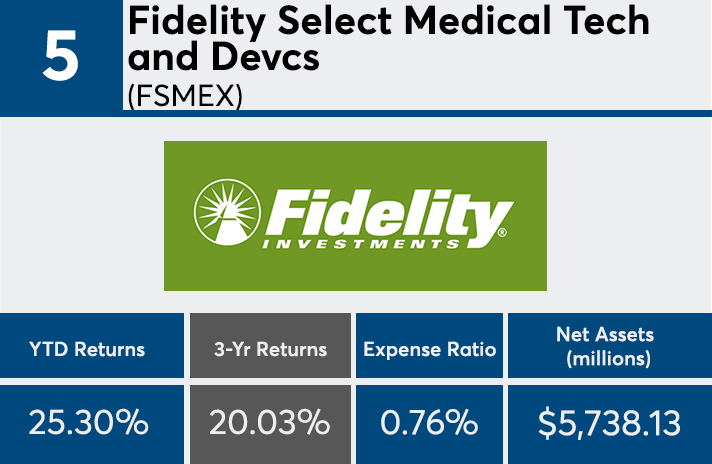

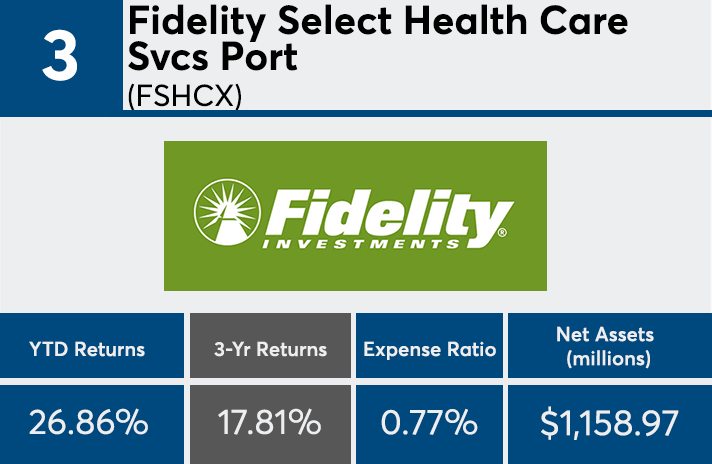

Among the year’s 20 top-performing mutual funds and ETFs, nearly all have seen double-digit returns over both three years and year to date, with many posting well above 20% over the last 12 months despite the volatility of the past few months.

Health category funds dominated the list, making up for six of the top 20, or a combined $30.6 billion in assets of the $53.9 billion total, Morningstar data show. Other categories that ranked among the top were small-cap growth, with $15.3 billion in assets; large-cap growth, with $4.9 billion in assets; and tech, with $3.1 billion in assets.

Political pressure on drug pricing has been one of the driving factors behind the third-quarter’s strong showing from health care stocks, says Tony Thomas, a manager research analyst at Morningstar. This was “epitomized by scrutiny over price hikes at Martin Shkreli’s Turing Pharmaceuticals,” Thomas says. “Some of that pressure has lightened under President Trump — despite some tweets to the contrary — and health care jumped to the fore of growth stocks in mid-2018.”

The strong performance has resulted in some staggering returns so far this year. The average YTD figures among the top-performing funds with more than $500 million in assets has been 20.43%, data show. Those same funds returned an average of 17.34% over three years.

“It’s important to remember that trailing returns have an end-point bias,” Thomas says. “A fund with a strong 2018 year-to-date, for example, could have posted more mediocre numbers in 2016 or 2017.”

Top returns this year came at a significantly higher cost than the average fund. Expense ratios among the top 20 ranged from as much as 202 basis points to as low as 0.01%, with an average net fee of 0.87%, data show. Last year, investors paid an average of 0.52%, according to a Morningstar fee study that reviewed the asset-weighted average expense ratio of roughly 25,000 U.S. mutual funds and ETFs. This was an 8% decline from 2016, the largest year-over-year decline Morningstar has recorded since it began tracking the data in 2000.

Thomas says advisors and investors should remember that a fund’s fee will have a direct impact on returns.

“It’s not always the case that you get what you pay for — i.e., that investors should pay top dollar for top performance,” Thomas says. “That also doesn’t mean that cheapest is always best. Sometimes, a good manager is worth his or her pay.”

Scroll through to see the 20 mutual funds and ETFs with the best YTD returns. Return figures are as of Nov. 30. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Three-year returns, assets and expense ratios for each fund are also listed. All data from Morningstar Direct.