Falling oil prices, trade wars, tax overhaul and more are among the culprits for fixed-income’s less-than-stellar one-year results.

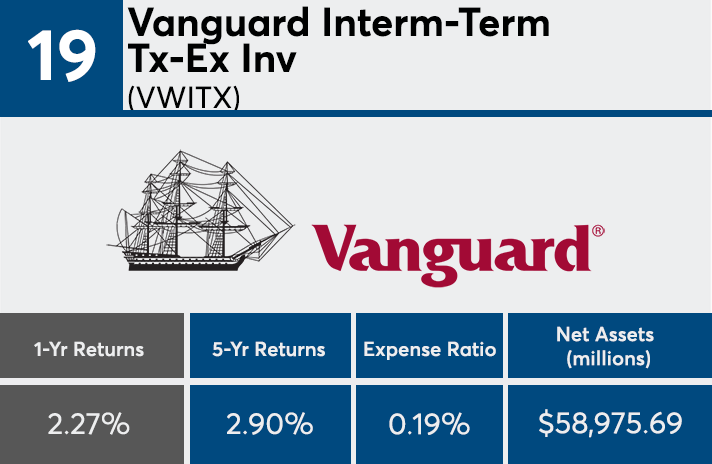

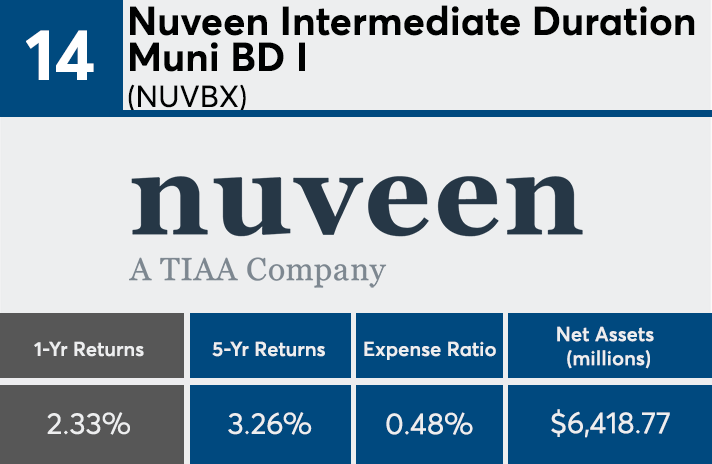

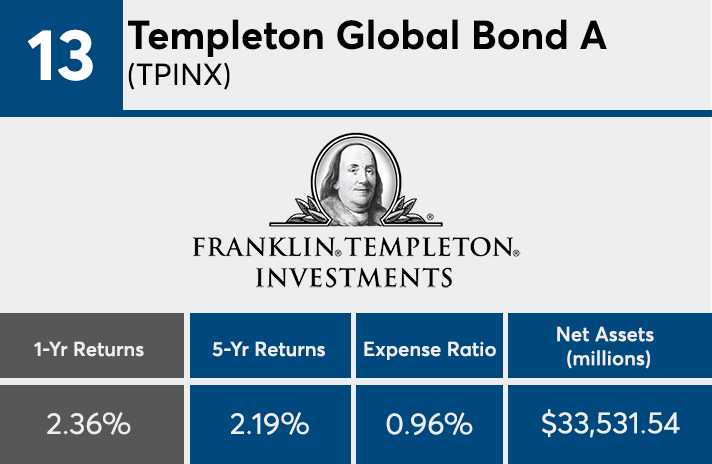

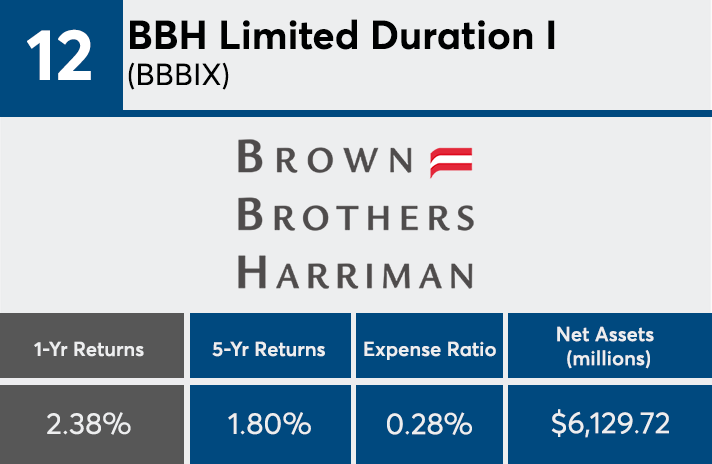

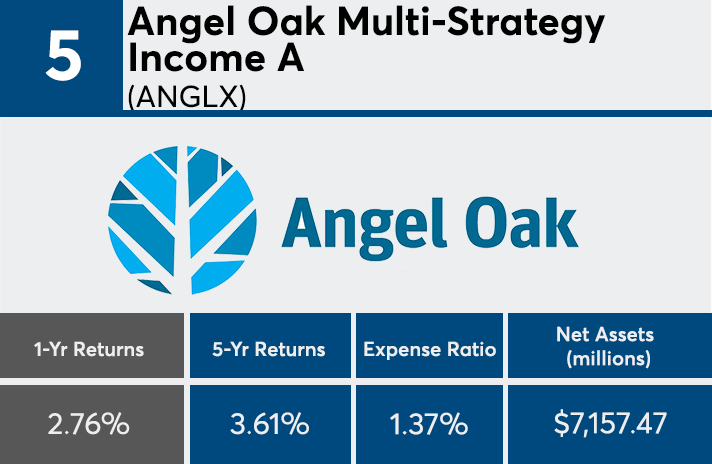

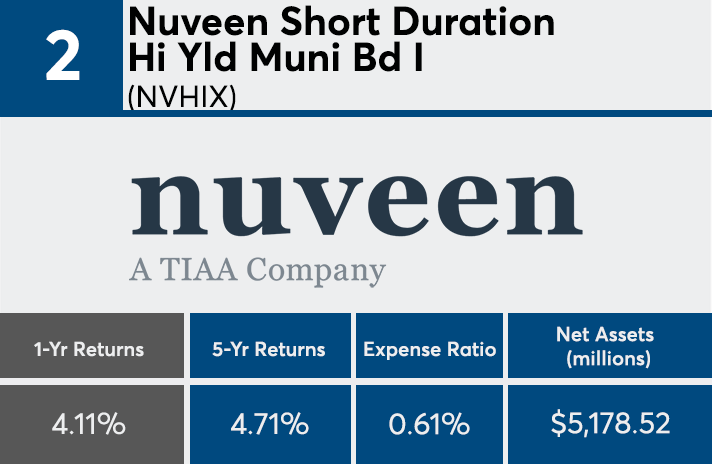

In the past year, the 20 top-performing bond funds with at least $5 billion in AUM posted an average annual return of less than 3%, according to Morningstar Direct data. For comparison, a similar screen of funds posted an average return of 9.95% in 2017, 13.17% in 2016 and 3.79% in 2015.

The most direct reason for the low figures the past year: multiple interest-rate hikes from the Fed last year — in March, June, September and December — helped flatten the yield curve, says Morningstar senior analyst Emory Zink.

Other concerns include the fading impact of fiscal stimulus and anxieties around the lending standards of the credit markets, which all fueled volatility in the U.S. bond markets, Zink says. “Stress periods can be illustrative, though. Actively managed funds are given an opportunity to prove their mettle.”

Overall, investment-grade credit faced a tough year, she says. Additional factors that contributed to stress in the bond market, she explains, include falling oil prices, trade hostilities between the U.S. and China and general market anxieties over whether the industry is nearing or actually at the end of the credit cycle.

The funds in this ranking, which hold a combined $273 billion in client assets, included government bonds, high-yield municipal bond, multi-strategy and global bond funds. The large presence of munis among the top-performers were helped by a municipal curve modestly steeper than that of the U.S. Treasury.

“The supply and demand dynamics supported the municipal market,” Zink explains. After the Republican-led tax overhaul, “there was a rush of issuance, and the expectation was that supply coming to market would be lower in 2018, which proved somewhat true. That, coupled with continued demand from traditional buyers — banks, insurance companies and corporate treasurys — supported fundamentals for the municipal markets.”

After the last year of general market turmoil, Zink says advisors must be more prepared than ever to remind their clients of the nuts and bolts of their portfolios and of their long-term strategies.

“Markets can change, and if you really do your homework on the specifics of the funds that you own — what are a fund’s strengths and weaknesses — then a stress period can provide an opportunity to test whether it behaved as you would expect given what you know,” she says. “If it doesn’t — then you may need to ask more questions about what role it’s playing in your portfolio.”

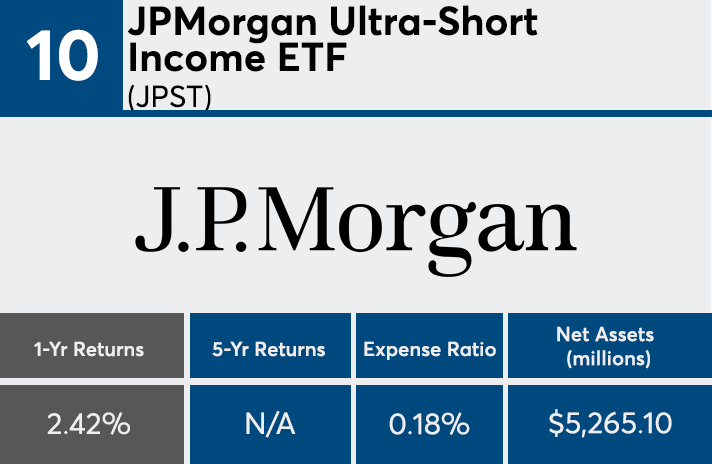

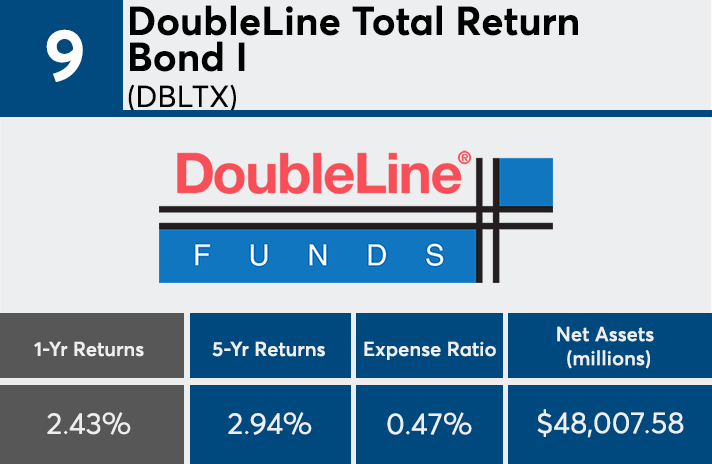

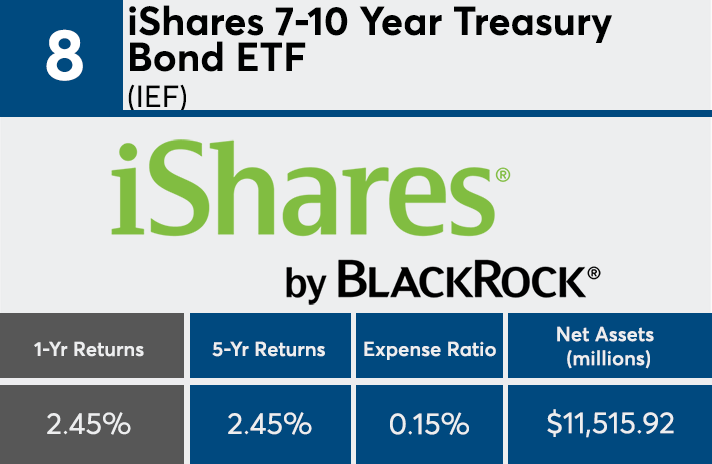

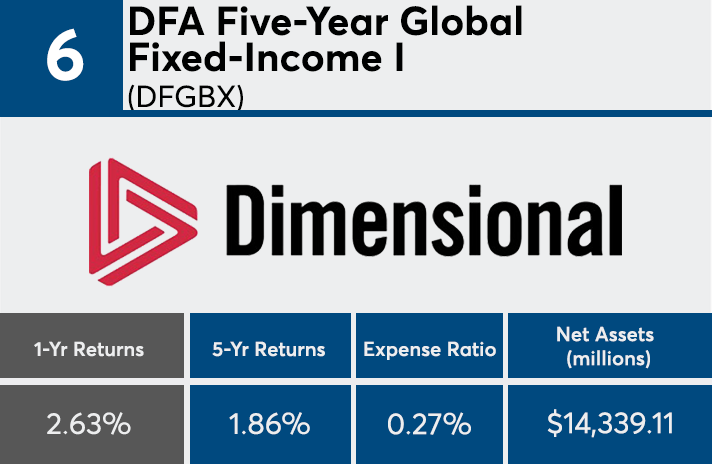

Scroll through to see the 20 fixed-income mutual funds and ETFs with the highest 1-year returns, as of Jan. 28. Institutional, leveraged and funds with investment minimums over $100,000 are excluded. Five-year returns, total assets and expense ratios for each fund are also listed. All data from Morningstar Direct.