The biggest mutual fund and ETF families are riding the crest of passive investment, especially in equities, benefitting from new investors entering the market and allowing them to keep their market share over time. This is according to a new analysis from FUSE Research, based on Morningstar fund data.

The well-known names on the list of top 10 and top 50 fund families have been stable over time for several reasons, said Alexander Ellwanger, a research analyst at Needham, Massachusetts-based FUSE. They have a diverse line of products, including active and passive funds, open-end funds and ETFs, that allow investors and their advisors to deal with fewer firms. Their massive scale allows them to offer competitive fees and less performance drag. They often have a large presence in 401(k)s, which are a major avenue for retirement savings. They spend money developing relationships with advisors. And they enjoy strong brand recognition, he said.

For advisors, the top fund families can offer advantages not found at smaller asset managers.

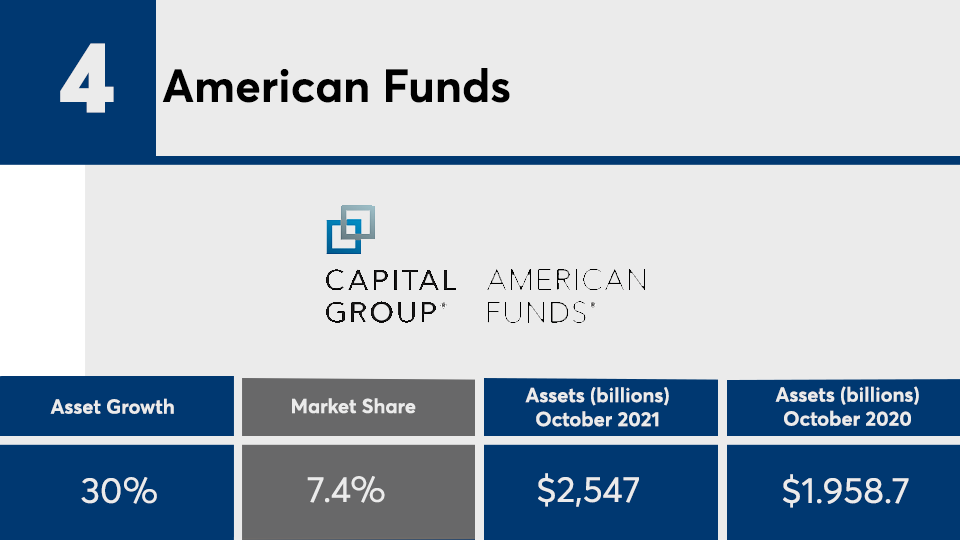

“Fidelity is noted for its commitment to research, Vanguard as being the low-cost provider, and American Funds for its unique devotion to high-conviction stock-picking resulting from a portfolio counseling system,” said A. Raymond Benton, a Denver advisor who manages $105 million with Lincoln Financial Advisors. Benton uses all of these families for client portfolios but focuses on American Funds, he said.

“Large funds generally are able to provide lower investor costs,” he said, noting that because the companies behind these funds don’t tend to be publicly traded, “they can devote themselves to managing assets rather than raising assets.”

Behind the dominance of these fund families is their strong position in passive mutual funds and ETFs, which have become increasingly popular as investors move out of actively managed funds and bet on the long-term bull market’s overall rise instead.

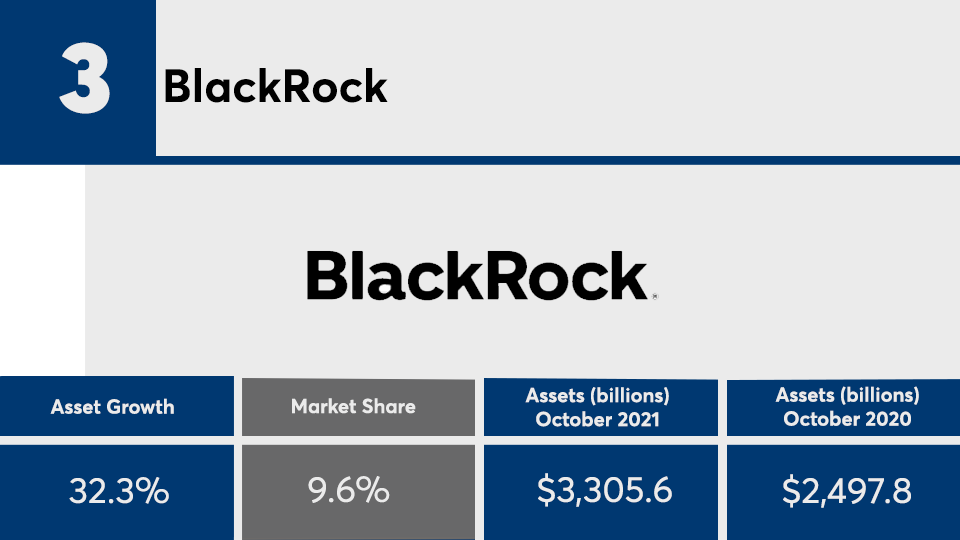

“What’s been driving their growth has been the flow into passives,” said Adam Sabban, a manager research analyst at Morningstar Research in Chicago, who covers equity strategies. Because firms like Vanguard, BlackRock, State Street and Fidelity are the largest providers of index funds and ETFs, which is where investors’ money has been concentrating, these firms are best positioned to take market share, particularly in equities, he said.

That trend will continue, Sabban said, with investors moving toward ETFs, which are easier to trade quickly.

“The bulk of assets are still in open-ended mutual funds, but the trend is really consistently edging in favor of ETFs,” he said. “They have certain advantages to their structures.”

The popularity of passive funds doesn’t mean that active management is dead. In particular, T. Rowe Price often scores highly in Morningstar analyses for its actively managed funds, Sabban said. And active funds are often the only alternative in some areas. “For more exotic asset classes, there may not be a passive alternative or it may be relatively illiquid,” he said.

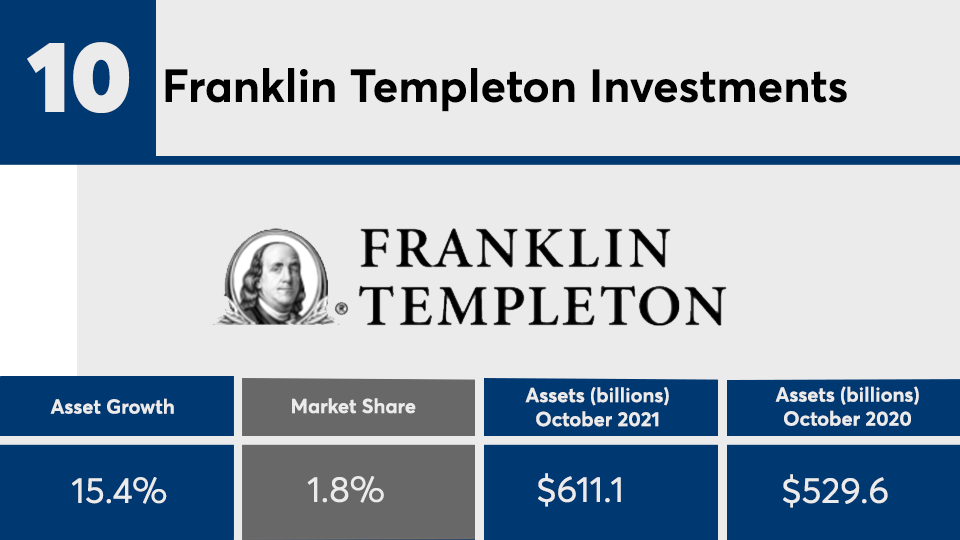

Scroll through to see which fund families ranked at the top by assets, as compiled by FUSE Research using Morningstar Research data. The analysis includes long-term open-end funds, variable product underlying funds, money market funds and exchange traded funds, but excludes closed-end funds. MetLife may be excluded due to the timing of their reporting to Morningstar.