The year 2022 was grim for most investors, with stocks dipping everywhere, except in

The S&P 500 posted a nearly 20% decline, its first negative return since 2018. Likewise, last year brought no joy for most equity index funds, popular vehicles synonymous with low-cost investing for the masses.

The happier news: Some index funds with double-digit declines last year are sitting pretty over 10 years. It's a testament to the power of ignoring potholes and sticking to the long term.

Index funds follow a particular gauge or benchmark, with the goal of replicating that standard's performance. They can passively track a plain vanilla, ready-made indicator, such as the S&P 500. Or they can follow a bespoke list, with a fund manager actively choosing a basket of stocks and a specific investing technique, such as shorting (betting that a stock's price will fall) or swaps (derivatives that involve trading one security's or index's cash flows for another).

Read more:

Index funds come as mutual funds and exchange-traded funds, the latter trading just like stocks. Those with a

Direct indexing usually costs more; after all, a fund manager has to get paid to try to select the winners. Still, Fidelity Investments said last June that it would allow

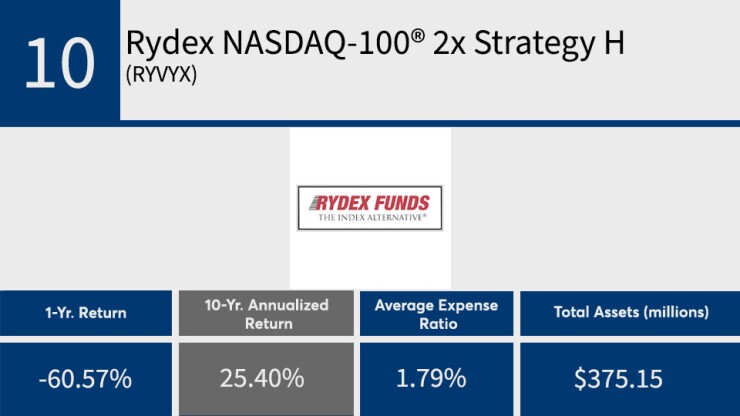

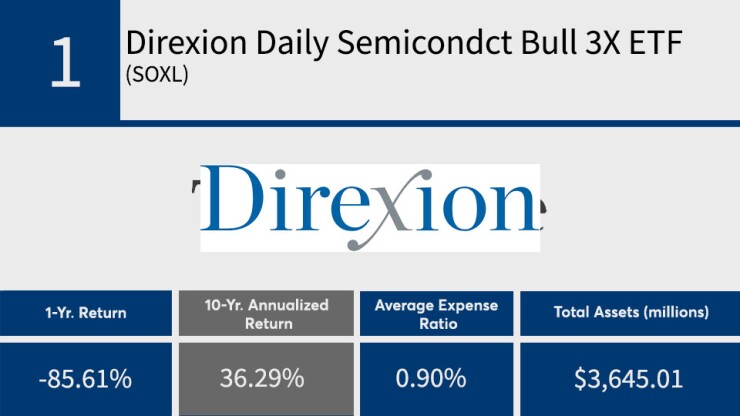

Scroll through the slideshow of the 20 top-performing U.S. equity index funds over 10 years. All data is from Morningstar and covers Jan. 1, 2013, through Dec. 31, 2022.