The largest independent broker-dealers at first glance can seem like a motley variety of businesses. But take a deeper look. Their outsize impact on wealth management adds up to tens of billions of dollars annually.

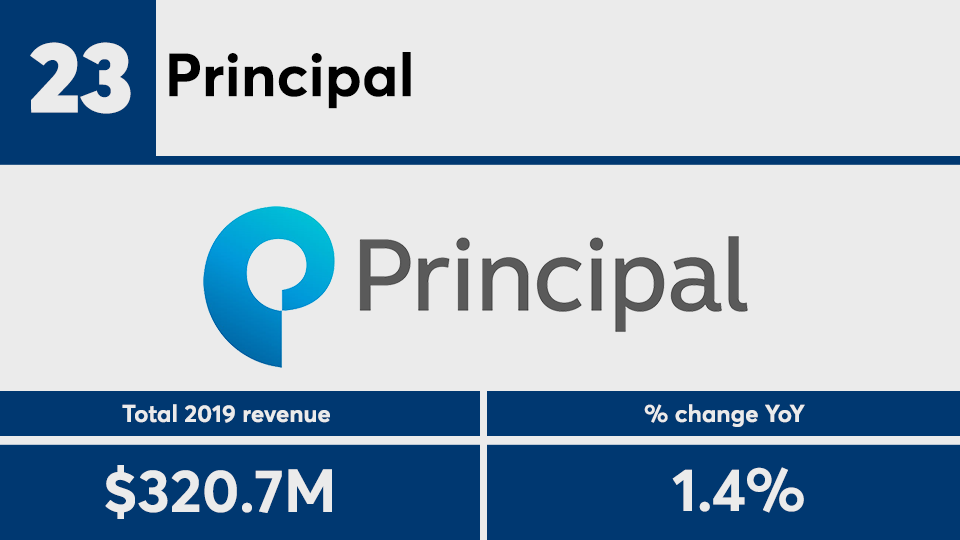

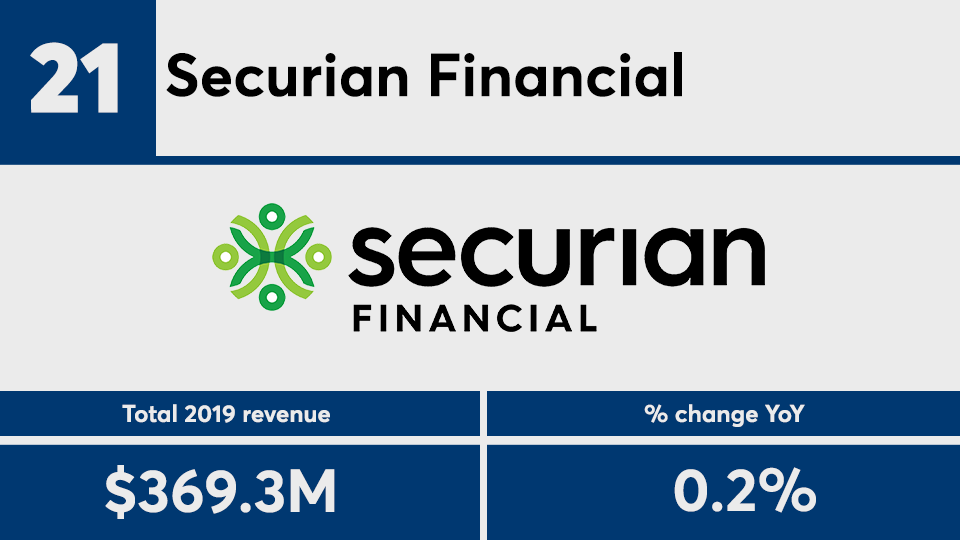

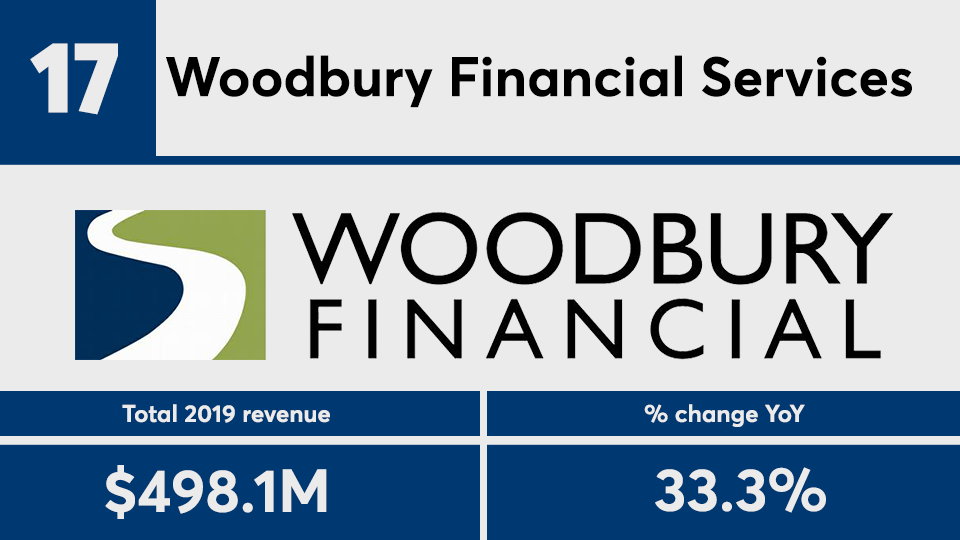

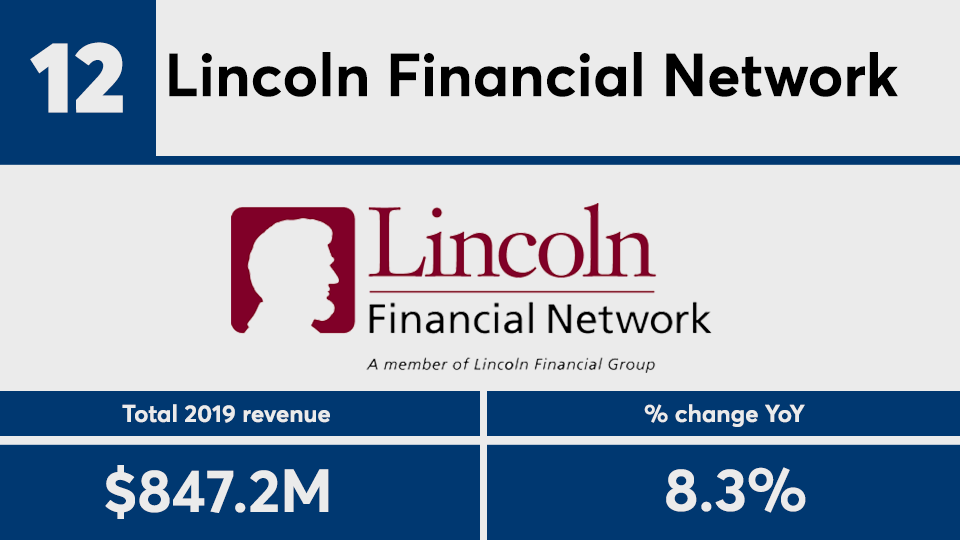

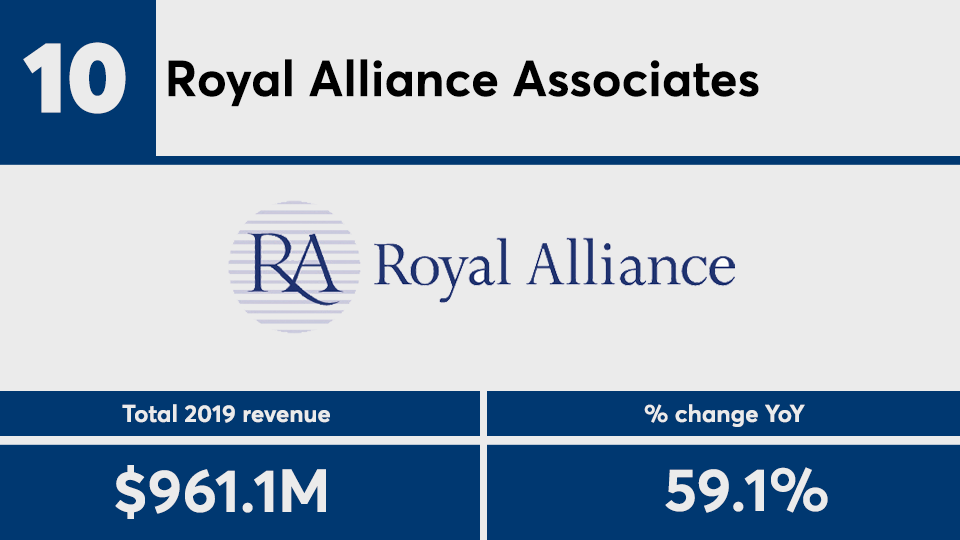

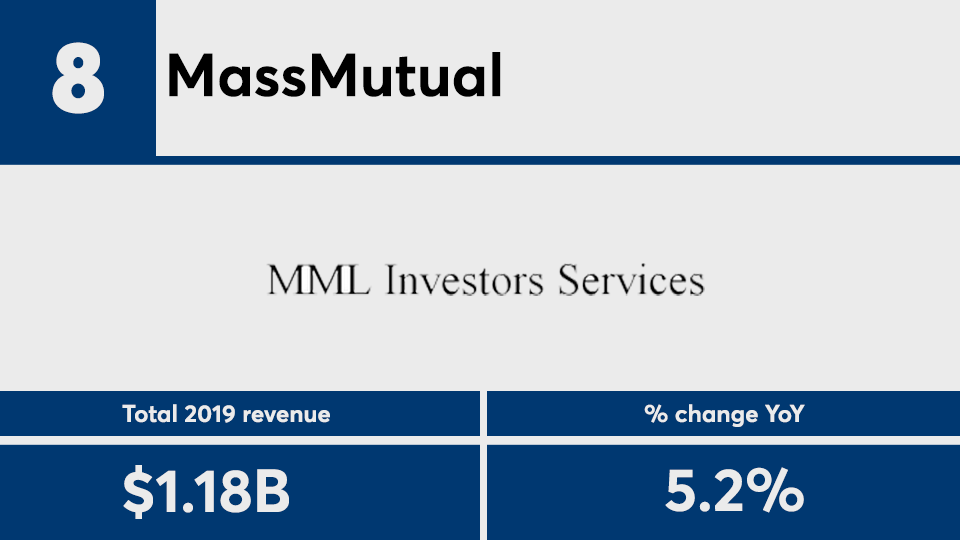

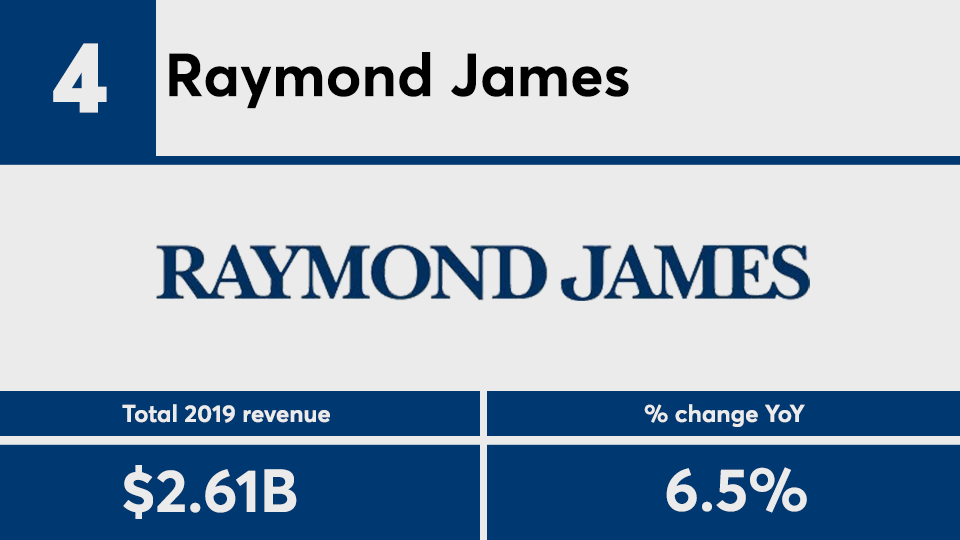

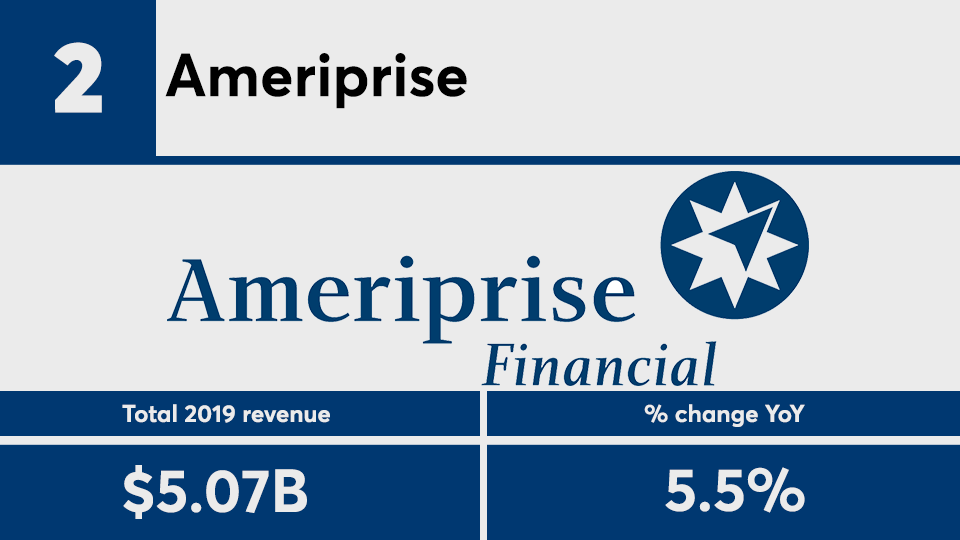

Among the top 25 largest firms participating in Financial Planning’s annual IBD Elite survey, the ranks include publicly traded giants, insurer affiliates, private equity-backed companies and private concerns. Within those general distinctions, the networks made up of independent subsidiaries run their business in different ways than firms who operate under a single brand.

For the first time in 2020, single entries reflect the full breadth of revenue across two IBD networks — Advisor Group and Cetera Financial Group — as well as a multibrand wealth management holding company called Atria Wealth Solutions. A fourth PE-financed firm, Kestra Financial, owns a smaller IBD but lists it separately.

The new format with no separate listing for networks places Advisor Group and Cetera among the top five firms in the sector. Their position on the main list also comes after Advisor Group

Even with Advisor Group growing under its $1.3 billion deal, the No. 1 firm kept the same position it has held for nearly 20 years. LPL Financial’s revenue surged 8% year-over-year in 2019 to $5.62 billion, or 18% of the entire sector’s $31.2 billion. LPL is also adapting some of the methods of its rivals, with

All but two of the 25 largest firms grew in 2019, but the economic turmoil

To view the top 25 firms by annual revenue in the IBD sector, scroll down the slideshow. For last year’s list,