The move to fee-based services from commissions amounts to a philosophical change in wealth management, where firms refer to a “secular shift” allowing them to be “agnostic” about products.

Many independent broker-dealers might then be said to be losing their religion.

Some firms embraced planning earlier than their peers, however, and they’re enjoying the benefits of that approach today.

Fee-based revenue

All told, commission-based revenue has increased more than 20% to $10.9 billion over the past decade, while fee-based revenue has more than tripled to a little more than $11 billion. Old-time religion is losing out to agnosticism amid the bull returns in equity markets and

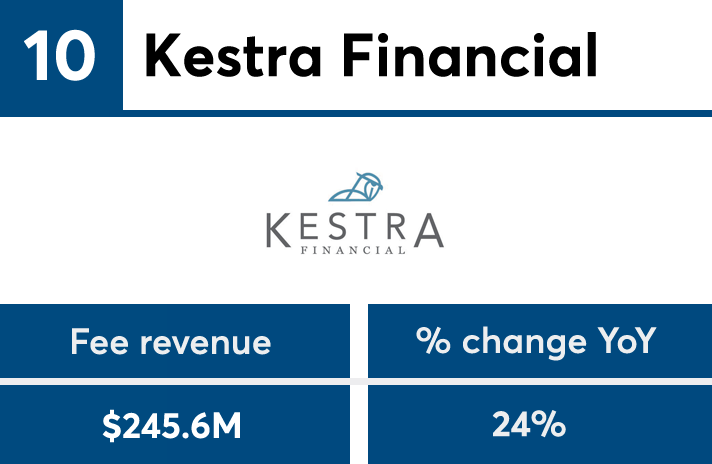

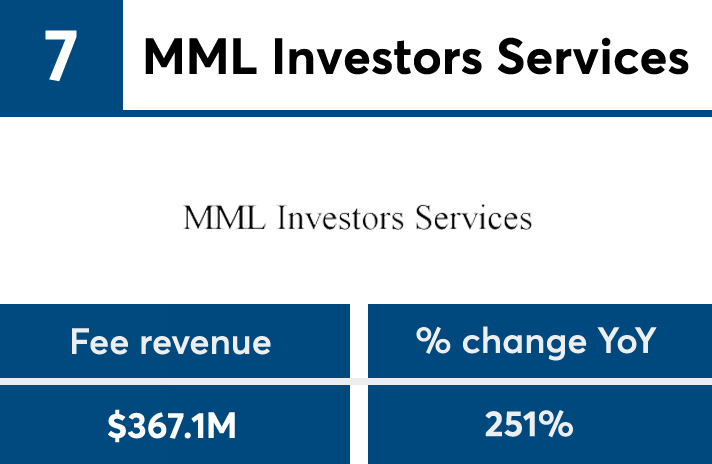

Despite the new milestone, the list of the top 10 firms according to fee-based revenue remained largely the same from the prior year. The only new members of the group were Kestra Financial and MassMutual’s MML Investors Services, which

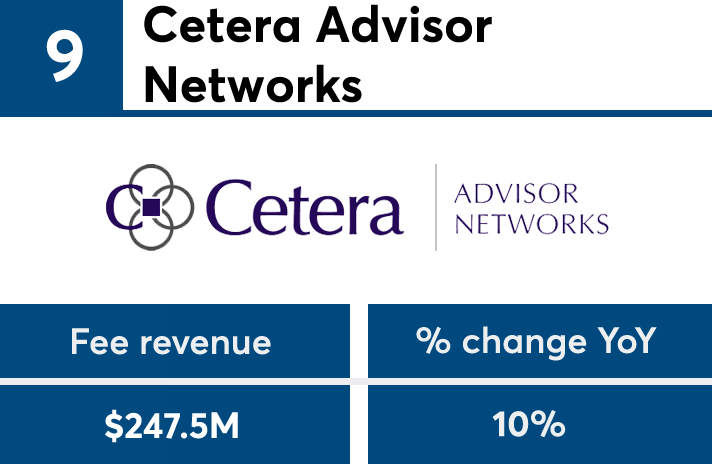

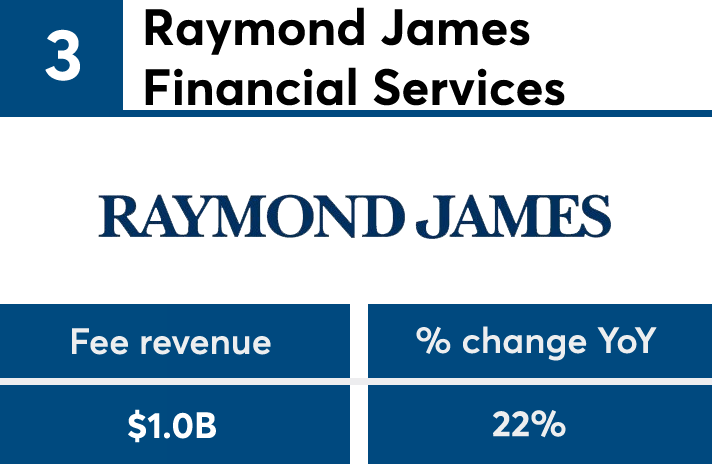

Each of the top 10 firms boosted their fee-based business by double-digit percentages, except for LPL Financial’s near-miss at 9% growth. LPL’s advisory revenue also stands out as a key area where the No. 1 IBD’s closest rival, Ameriprise, is giving it a tougher fight than it’s had for years over the designation of the largest firm in the space.

The No. 2 firm reduced its gap on LPL in overall revenue to $21.5 million in 2017, compared to a $32 million difference in the previous year.

Ameriprise’s fee-based revenue first jumped ahead of LPL’s in 2014,

To view the list of the top 10 IBDs ranked by fee-based revenue, scroll through the slideshow. All figures included for the top 10 firms' businesses include their full-year revenue for 2017.

For a ranking of the top 10 IBDs by fee-based mix of business,